NEWYou can now listen to Fox News articles!

Colorado police responded to a terror attack at a pro-Israel event in Boulder Sunday, leaving multiple people injured.

It was the latest incident being investigated by federal authorities as domestic terrorism.

The U.S. has seen an increase in antisemitic attacks and violent pro-Palestinian protests amid the war between Israel and Hamas.

But the incidents of domestic terrorism aren’t limited to antisemitism. Extremists who hold anti-American sentiment have attempted attacks on vehicles, military bases and more.

Here is a breakdown of the domestic terrorism incidents in the U.S. in 2025:

Terror in Boulder, Colorado

Boulder, Colorado, Police Chief Stephen Redfearn said his department received reports early Sunday afternoon of a man with a weapon and people being set on fire on Pearl Street. A male suspect with minor injuries was taken into police custody at the scene, Redfearn said.

Suspect Mohamed Sabry Soliman is now facing murder, assault and other charges following what the FBI called a ‘targeted terror attack’ in Boulder, Colorado.

The violence against a pro-Israel group advocating for Hamas to release Israeli hostages left eight people, ages 52 to 88, with injuries, including one in critical condition, according to the FBI. Police responded to the area after receiving reports of a man with a weapon setting people on fire.

‘Run for Their Lives,’ was the organization hosting the event. The group organizes run and walk events calling for the immediate release of all hostages being held captive by Hamas in the Gaza Strip.

Soliman was charged with murder in the first degree — deliberation with intent; murder in the first degree — extreme indifference; crimes against at-risk adults/elderly; 1st degree assault — non-family; 1st degree assault — heat of passion; criminal attempt to commit class one and class two felonies; and use of explosives or incendiary devices during felony.

Soliman was also in the United States illegally, Fox News has learned. Soliman is an Egyptian national who came into the country two years ago and overstayed his visa.

Boulder Police Department confirmed Monday that no victims have died.

Soliman was booked into the Boulder County, Colorado, jail Sunday evening and remains held on a $10 million bond.

Shooting outside Capital Jewish Museum in Washington

On Wednesday, May 21,Yaron Lischinsky and Sarah Milgrim, two staffers of the Embassy of Israel to the U.S. — a couple set to be engaged — were shot and killed as they left the museum’s event focused on finding humanitarian solutions for Gaza.

Lischinsky was born in Israel and grew up in Germany. His father is Jewish, and his mother is Christian. Milgrim was an American employee of the embassy.

Authorities took Elias Rodriguez, a 31-year-old man from Chicago, into custody. Upon being taken into custody, Rodriguez began shouting, ‘Free, free Palestine!’

The FBI is investigating the incident as a possible hate crime and investigating any ties to terrorism.

Steven Jensen, the assistant director in charge of the FBI Washington field office, said in a news conference that the federal law enforcement entity is working alongside the Metropolitan Police Department (MPD) to ‘look into ties to potential terrorism or motivation based on a bias-based crime or a hate crime.’

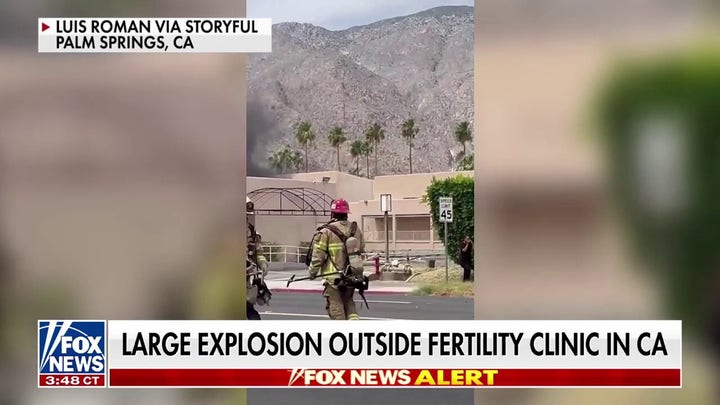

Palm Springs fertility clinic bombing

On May 17, a bombing took place at a fertility clinic in Palm Springs, California. The bombing killed the suspect and injured four others.

Authorities identified the perpetrator of the incident as a 26-year-old suspect motivated by a fringe ideology known as ‘pro-mortalism.’

‘Pro-mortalism,’ a radical offshoot of anti-natalism, views human reproduction as inherently immoral and embraces death as a moral corrective.

According to federal and local law enforcement, the suspect targeted the American Reproductive Centers facility specifically to destroy human embryos stored on-site.

Surveillance footage and online postings suggest he parked in the rear of the building to remain unnoticed, ingested drugs and then detonated an explosive device — killing himself in the process.

The FBI has classified the bombing as an act of domestic terrorism, citing the ideological motivation behind the violence.

Officials have said that it is the first high-profile case linked to the pro-mortalist ideology and are now monitoring it as a potential emerging threat. Authorities have urged families and communities to remain vigilant for signs of ideological extremism, especially among those who may feel disenfranchised.

Attempted mass shooting at Michigan military base

In May, a former Michigan Army National Guard member, Ammar Abdulmajid-Mohamed Said, 19, was arrested for allegedly planning a mass shooting near the U.S. Army’s Tank-Automotive & Armaments Command (TACOM) center at the Detroit Arsenal in Warren, Michigan.

Said planned to carry out the attack on behalf of ISIS.

Said allegedly ‘launched his drone in support of the attack plan’ and told an undercover FBI agent in the lead-up to the foiled plot he recommended that ‘everyone have about seven magazines because you don’t want to be in there and run out of ammo,’ according to officials.

Said is now facing charges of attempting to provide material support to a foreign terrorist organization and distributing information related to a destructive device. He faces a maximum penalty of 20 years per count if convicted.

The FBI disrupted the attempted attack, with FBI Director Kash Patel telling Fox News Digital that any individual targeting the U.S. military or conspiring with foreign terrorist organizations will be ‘prosecuted to the fullest extent of the law.’

‘Let this be a warning: Anyone who targets our military or conspires with foreign terrorist organizations will be found, stopped and prosecuted to the fullest extent of the law,’ Patel told Fox News Digital. ‘I commend the men and women of the Joint Terrorism Task Force and our law enforcement partners for their continued dedication to protecting the American people.’

Tesla attacks

Since January, there have been a number of instances of vandalism, arson and targeted shootings against Tesla vehicles, dealerships, and charging stations across the nation.

Tesla vehicles and dealerships have been targeted nationwide amid Elon Musk’s involvement with the Trump administration’s Department of Government Efficiency (DOGE), which has been focused on slashing wasteful spending and fraud within the federal government. Musk is the co-founder and CEO of Tesla.

The FBI launched a task force to crack down on violent Tesla attacks.

The FBI’s task force was created in conjunction with the Bureau of Alcohol, Tobacco and Firearms (ATF) and will coordinate investigative activity.

A threat tag has been created at the FBI to streamline reports and a command post at FBI headquarters has been created. It consists of a joint FBI/ATF task force to mitigate that threat stream.

The FBI is treating the attacks as ‘domestic terrorism.’ Attorney General Pam Bondi called the attacks on Tesla ‘domestic terrorism,’ and the Department of Justice announced charges against suspects in Tesla arson cases.

Musk spoke out against the ‘deranged’ attacks, suggesting that ‘there’s some kind of mental illness thing going on here, because this doesn’t make any sense.’ The billionaire even alluded to ‘larger forces’ potentially behind the attacks that have sprung up across the nation.

This post appeared first on FOX NEWS