(TheNewswire)

|

|||||||||

Vancouver, British Columbia TheNewswire – June 2, 2025: Allied Critical Metals Inc. (CSE: ACM | FSE:0VJ0) (‘ Allied’ or the ‘ Company’ ), which is focused on its 100% owned past producing Borralha and Vila Verde (Vale das Gatas) tungsten projects in northern Portugal, is pleased to announce the commencement of a fully-funded exploration program that will include up to 5,000 metres of core drilling at the Company’s flagship Borralha Tungsten Project (the ‘ Property’ or ‘ Borralha’ ), located in northern Portugal.

Roy Bonnell, CEO and Director commented, ‘The launch of this 5,000-metre drilling campaign marks a major milestone for Allied and the continued advancement of the Borralha Project. Our experienced geological team in Portugal expects the results to meaningfully expand the current resource base, paving the way for a more robust and valuable project. All newly defined tonnage will be incorporated into an updated Preliminary Economic Assessment (PEA), scheduled for release this fall. In parallel, advanced metallurgical optimization test work will be conducted at Wardell Armstrong’s laboratories in the UK, focusing on enhancing metal recoveries and concentrate grades. These efforts are aimed at further improving the economic performance of the project and delivering a higher-quality concentrate to meet the demanding standards of end-users.’

The Borralha project is an advanced-stage brownfield tungsten project located in northern Portugal. Historically mined between 1904 and 1985, it produced over 10,280 tonnes of high-grade wolframite concentrate averaging 66% WO₃ (as described in the Company’s Technical Report, referenced below). The Borralha project is now positioned for near-term, low-cost production with modern exploration confirming significant remaining mineralization.

Key highlights include:

Current NI 43-101 Resources (as of March 2024):

-

Indicated: 4.98 million tonnes at 0.22% WO₃, 762 g/t Cu, and 4.8 g/t Ag.

-

Inferred: 7.01 million tonnes at 0.20% WO₃, 642 g/t Cu, and 4.4 g/t Ag.

The Company has completed its maiden mineral resource estimate for the Property described in its technical report entitled, ‘Technical Report on the Borralha Property, Parish of Salto, District of Vila Real, Portugal’ dated effective July 31, 2024 (the ‘ Technical Report’ ), which is available under the Company’s profile on SEDAR+ at www.sedarplus.ca .

Recent Exploration : Drilling from 2023–2024 returned strong intercepts, including up to 10m at 1.75% WO₃ and multiple longer intervals averaging over 0.2% WO₃, as reported in the Technical Report.

Proposed 2025 RC Drilling Program:

Click Image To View Full Size

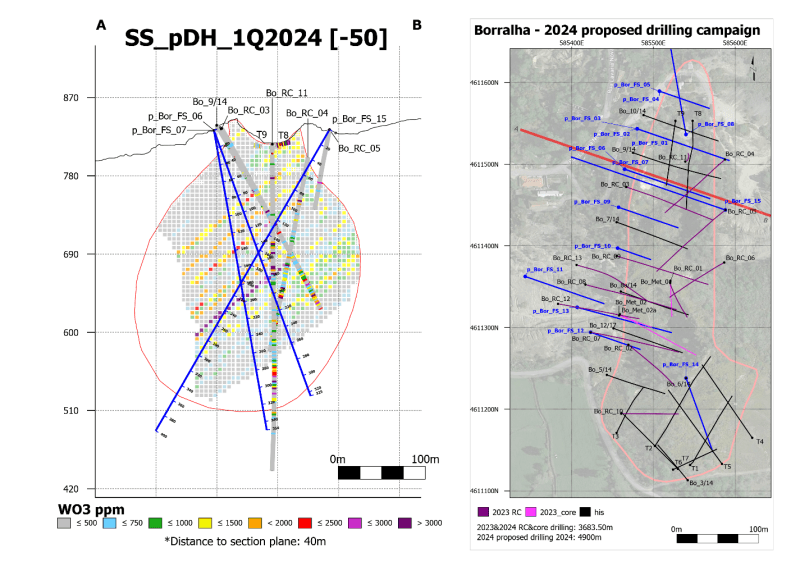

The following figure shows the plan of the proposed 2025 RC drilling program and an example of the proposed sectional drilling.

Figure 1: Proposed 2025 RC Drilling Program and Example of Proposed Sectional Drilling

Permitting: The project holds a Mining Rights Concession License and is undergoing environmental assessment to transition to full-scale mining. Current permitting allows bulk sampling of up to 150,000 tonnes per annum.

Infrastructure: Located near the major Portuguese cities of Braga and Porto, it benefits from excellent infrastructure including roads, power, water, and skilled labor.

Strategic Positioning: Borralha represents one of the few near-term, non-Chinese tungsten production opportunities globally, strategically aligning with the West’s increasing demand for critical raw materials amid heightened supply chain vulnerabilities. With Borralha and other national assets, Portugal is poised to emerge as one of Europe’s leading suppliers of tungsten , reinforcing its role in supporting the continent’s industrial resilience and green transition.

This project forms the cornerstone of Allied’s strategy to become a leading Western supplier of tungsten, a metal critical to defense, EVs, semiconductors, and industrial manufacturing.

Qualified Person

Doug Blanchflower, P.Geo. is a Consulting Geologist with Minorex Consulting and has reviewed and approved the scientific and technical information in this news release and is a Registered Professional Geoscientist in good standing with the Association of Professional Engineers and Geoscientists of British Columbia (No. 19086), and is independent from ACM and its mineral properties and is a qualified person for the purposes of National Instrument 43-101—Standards of Disclosure for Mineral Projects . Mr. Blanchflower is independent of the Company and its mineral properties.

On behalf of the Board of Directors

‘Roy Bonnell’

Roy Bonnell

CEO and Director

For further information or investor relations inquiries, please contact:

Dave Burwell

Vice President, Corporate Development

Email: daveb@alliedcritical.com

Tel: 403-410-7907

Toll Free: 1-888-221-0915

ABOUT ALLIED CRITICAL METALS

Allied Critical Metals Inc. (ACM:CSE | FSE:0VJ0) is a Canadian-based mining company focused on the expansion and revitalization of its 100% owned past producing Borralha Tungsten Project and the Vila Verde Tungsten Project in northern Portugal. Tungsten has been designated a critical metal by the United States and other western countries, as they are aggressively seeking friendly sources of this unique metal. Currently, China and Russia represent approximately 90% of the total global supply and reserves. The Tungsten market is estimated to be valued at approximately U.S.$5 to $6 billion and it is used in a variety of industries such as defense, automotive, manufacturing, electronics, and energy.

Please also visit our website at www.alliedcritical.com.

Also visit us at:

LinkedIn:

X: https://x.com/@alliedcritical/

Facebook:

Instagram: https://www.instagram.com/alliedcriticalmetals/

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains ‘forward-looking statements’, including with respect to the use of proceeds. Wherever possible, words such as ‘may’, ‘would’, ‘could’, ‘should’, ‘will’, ‘anticipate’, ‘believe’, ‘plan’, ‘expect’, ‘intend’, ‘estimate’, ‘potential for’ and similar expressions have been used to identify these forward-looking statements. These forward-looking statements reflect the current expectations of the Company’s management for future growth, results of operations, performance and business prospects and opportunities and involve significant known and unknown risks, uncertainties and assumptions, including, without limitation, those listed in the Company’s Listing Statement and other filings made by the Company with the Canadian securities regulatory authorities (which may be viewed under the Company’s profile at www.sedarplus.ca ). Examples of forward-looking statements in this news release include, but are not limited to, statements regarding the proposed timeline and terms of the investor awareness campaign, anticipated benefits to Company from running the investor awareness campaign, and the performance of the investor relations services providers of the marketing services as contemplated in the marketing agreements, or at all. Should one or more of these risks or uncertainties materialize or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements may vary materially from those expressed or implied by the forward-looking statements contained in this news release. These factors should be considered carefully, and prospective investors should not place undue reliance on the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and reference should also be made to the Company’s Listing Statement dated April 23, 2025 , and the documents incorporated by reference therein, filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors. The Company disclaims any intention or obligation to revise forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law.

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this press release and has neither approved now disapproved the contents of this press release.

Copyright (c) 2025 TheNewswire – All rights reserved.

News Provided by TheNewsWire via QuoteMedia