Gains ownership and control over one of the largest, strategically located, prolific geologic environments for critical and precious metals in Quebec, Canada

Nuvau Minerals Inc. (TSXV: NMC,OTC:NMCPF) (the ‘Company’ or ‘Nuvau’) has achieved a significant milestone on the road toward a production restart at its flagship Matagami Property. The Company has completed the acquisition (the ‘Earn-In Transaction’), from Glencore Canada Corporation (‘Glencore Canada’), of interests in certain properties comprising the Matagami mining camp (collectively, the ‘Property’), located in the Abitibi region of central Québec, Canada, pursuant to a second amended and restated earn-in agreement dated January 28, 2026 among the Company, Nuvau Minerals Corp. (the Company’s wholly-owned subsidiary, ‘Nuvau Corp.’) and Glencore Canada (the ‘Earn-In Agreement’).

‘This landmark achievement marks a major step toward our goal of the restart of mining operations at the Matagami property,’ said Peter van Alphen, Nuvau’s CEO. ‘It reflects both our team’s unwavering commitment and the strong support behind our project. We are now eager to continue to build on our exploration momentum while advancing the technical and economic studies required to deliver a robust restart plan for our critical mineral assets.’

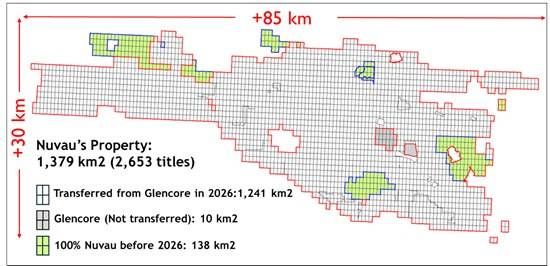

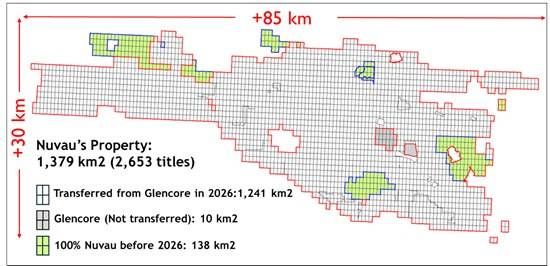

The Matagami mining camp is a 1,379-square-kilometre exploration and mining property, one of the largest in Canada, and is strategically located in a prolific geological environment for both critical and precious metals.

Figure 1: Position of Nuvau’s Matagami property in Canada and within the northern Abitibi advanced projects and operations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/285928_f65c88b214607901_001full.jpg

The Matagami Property

Located in the northern Abitibi, the Matagami Property is comprised of 2,389 titles, including 1,237 square kilometres of exploration claims and 4.5 square kilometres of mining rights property. This includes the past-producing:

- Bracemac-McLeod mine, which is still permitted and has key infrastructure in place

- Perseverance mine, with potential for shallow remnant and mineralization extension.

When combined with Nuvau’s existing 138 square kilometres of exploration claims, this land package is one of the largest mining and exploration properties in Eastern Canada.

Figure 2: Detailed map of the exploration claims and mining rights involved in the transaction.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/285928_f65c88b214607901_002full.jpg

The transaction excludes the property rights related to the Matagami Lake Processing Plant and the current Tailing Storage Facility, for which Nuvau has a 24-month right such rights from Glencore Canada.

Since entering into the earn-in agreement with Glencore in 2022, Nuvau has established a track record of success on the property, including the:

- Discovery of gold mineralization within the Bracemac Mine in July 2025;

- Discovery of gold anomalies in till in May 2025;

- Acquisition of the Thundermine property in 2024;

- Extension of mineralization at the past-producing McLeod Cu-Zn deposit in 2024;

- Discovery of the Renaissance Cu-Zn Volcanogenic Massive Sulfide (VMS) in 2023.

In addition, Nuvau demonstrated the economic potential of a near term production restart at the Matagami property with the Preliminary Economic Analysis (PEA) it published in 2023. The Company intends to update this PEA in 2026 to include additional geological and technical information as well as current commodity prices ahead of a Pre-Feasibility Study planned for 2027. The PEA leverages existing mine, processing and transportation infrastructure within the Matagami camp, all in close proximity to the town of Matagami at the heart of the northern Abitibi.

The Earn-In Transaction

In connection with the completion of the Earn-In Transaction:

- Nuvau Corp. incurred an aggregate of $30,000,000 in exploration, development and related expenditures on the Property on or before March 25, 2025.

- Glencore retained a 2% net smelter returns (‘NSR’) royalty on the Property, subject to an aggregate maximum NSR royalty of 3.5% inclusive of existing royalties on any mining claim, pursuant to a royalty agreement entered into between Glencore Canada and Nuvau Corp.

As per the terms of the Earn-In Agreement, within 60 days of the closing of the Earn-In Transaction, Nuvau Corp. will also be required to pay Glencore Canada (i) $5,000,000 in cash, and (ii) an additional $5,000,000 payable in cash, common shares of the Company (‘Common Shares‘), or a combination thereof at Nuvau Corp.’s election, subject to required stock exchange and other regulatory approvals and provided that any share issuance does not result in Glencore having beneficial ownership of more than 9.9% of the Company’s issued and outstanding Common Shares immediately following issuance.

For a period of 24 months following the closing of the Earn-In Transaction, Nuvau will also retain the right to acquire certain excluded property (including the Matagami Lake Processing Plant and Tailings Storage Facility) from Glencore Canada for a payment of $5,000,000 (payable in cash, Common Shares, or a combination thereof), subject to the satisfaction of certain conditions and regulatory requirements, all as more particularly described in the Earn-In Agreement.

For more information regarding the Earn-In Transaction, please refer to the Earn-In Agreement, a copy of which has been filed and is available on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile.

About Nuvau

Nuvau Minerals (TSXV: NMC,OTC:NMCPF) is a Canadian mining and exploration company advancing its assets through the exploration and development stage. The Company’s principal asset is the past-producing Matagami mining district in the Abitibi region of Québec.

Nuvau controls a 1,379 square kilometre land package and benefits from access to permitted mining infrastructure, including an option on a 3,000 tpd concentrator, through an earn-in agreement with Glencore Canada. Its strategy combines near-term resource development and a potential mine restart with district-scale exploration targeting zinc-copper VMS deposits and newly recognized gold potential in the camp.

Backed by Québec investors, Nuvau is executing a multi-year exploration and resource growth program to advance the camp toward a renewed production decision while generating new discoveries.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Bastien Fresia P. Geo. (Qc), Director of Technical Services and a ‘qualified person’ for the purposes of National Instrument 43-101.

Further Information

Peter van Alphen

President and CEO, Nuvau Minerals Inc.

416-525-6063

pvanalphen@nuvauminerals.com

Cautionary Statements

This news release contains forward-looking statements and forward-looking information (collectively, ‘forward-looking statements‘) within the meaning of applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements are often identified by terms such as ‘may’, ‘should’, ‘anticipate’, ‘will’, ‘estimates’, ‘believes’, ‘intends’, ‘expects’ and similar expressions which are intended to identify forward-looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning: the completion and timing of any remaining post-closing filings and registrations with governmental authorities; the timing and form of payments contemplated by the Earn-In Agreement (including any election to satisfy a portion of such payments in Common Shares), and if applicable, the receipt of any required stock exchange and other regulatory approvals; the potential future acquisition of the excluded property and satisfaction of applicable conditions related thereto; and the timing and ability of the Company to advance the Property to production decision and the overall potential of the Property. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management, in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances. Readers are cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of the Company. Factors that could cause actual results to differ materially from such forward-looking statements are set out in the Company’s public disclosure record available on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile. Readers are further cautioned not to place undue reliance on any forward-looking statements, as such information, although considered reasonable by the management of the Company at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

The forward-looking statements contained in this news release are made as of the date of this news release, and are expressly qualified by the foregoing cautionary statement. Except as expressly required by securities law, the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285928