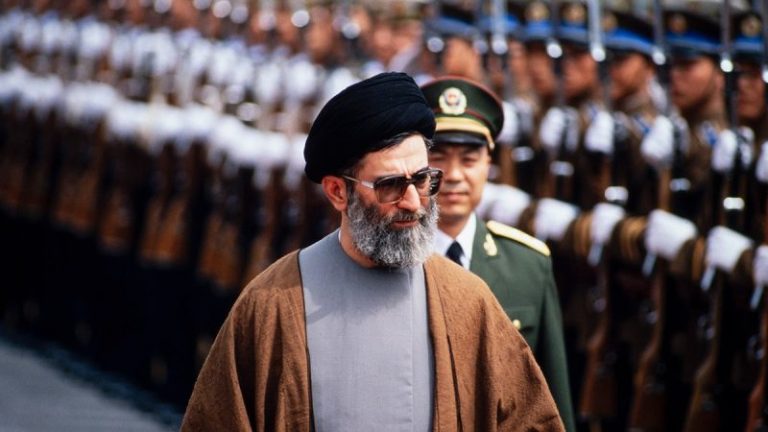

New York City’s socialist Mayor Zohran Mamdani is facing blowback from conservatives on social media over his post condemning the U.S. attack on Iran that led to the killing of Iran’s supreme leader, Ayatollah Ali Khamenei.

On Saturday, as a joint strike on Iran by the United States and Israel was developing, Mamdani blasted the Trump administration’s decision in a post on X that has been viewed roughly 20 million times.

‘Today’s military strikes on Iran — carried out by the United States and Israel — mark a catastrophic escalation in an illegal war of aggression,’ Mamdani wrote.

‘Bombing cities. Killing civilians. Opening a new theater of war. Americans do not want this. They do not want another war in pursuit of regime change.’

Mamdani said Americans prefer ‘relief from the affordability crisis’ before speaking directly to Iranians in New York City.

‘You are part of the fabric of this city — you are our neighbors, small business owners, students, artists, workers, and community leaders,’ Mamdani said. ‘You will be safe here.’

The post was quickly slammed by conservatives on social media making the case that Mamdani’s response appeared sympathetic to Iran’s brutal regime and pointing to his lack of public reaction to the Iranian protesters killed in recent years.

‘Comrade Mayor is rooting for the Ayatollah,’ GOP Sen. Ted Cruz posted on X. ‘They can chant together.’

‘Do u say anything pro American ?’ Fox News host Brian Kilmeade posted on X. ‘do u know any Iranians – ? they hate @fr_Khamenei they celebrate his death, you should be celebrating his death ! hes killed thousands of American’s and just killed 30k Iranians, did u even say a word about that? You are an embarrassment !! Please quit.’

‘I don’t feel safe in New York listening to someone like you, Mamdani, who sympathizes with the regime that killed more than 30,000 unarmed Iranians in less than 24 hours,’ Iranian American journalist Masih Alinejad posted on X.

‘We Iranians do not allow you to lecture us about war while you had nothing to say when the Islamic Republic shot schoolgirls and blinded more than 10,000 innocent people in the streets. You were busy celebrating the hijab while women of my beloved country Iran were jailed and raped by Islamic Security forces for removing it.

‘And NOW you find your voice to defend the regime? No. I will not let you claim the moral high ground. The people of Iran want to be free. Where were you when they needed solidarity?’

‘How is it that you can’t differentiate between good and evil?’ Billionaire hedge fund manager Bill Ackman posted on X. ‘Why is this so hard for you?’

‘It takes a particular kind of audacity, or ignorance, for a city mayor to appoint himself the conscience of American foreign policy while his constituents step over garbage on their way to work,’ GOP Rep. Nancy Mace posted on X. ‘History will not remember his bravery. It will not remember him at all.’

‘Iranian New Yorkers are thrilled today and see right through you,’ Republican New York City Councilwoman Vickie Paladino posted on X.

‘When Kuwait, Saudi Arabia, Qatar, Turkey, UAE, Bahrain all support today’s operation eliminating world’s #1 sponsor of terror, but New York City’s Mayor @ZohranMamdani is shilling for Iran,’ Republican New York City Councilwoman Inna Vernikov posted on X.

Fox News Digital reached out to Mamdani’s office for comment.

Shortly after Mamdani’s post, it was announced by President Trump and Israeli officials that the military operation resulted in Khamenei’s death.

Israeli leaders confirmed Khamenei’s compound and offices were reduced to rubble early Saturday after a targeted strike in downtown Tehran.

‘Khamenei was the contemporary Middle East’s longest-serving autocrat. He did not get to be that way by being a gambler. Khamenei was an ideologue, but one who ruthlessly pursued the preservation and protection of his ideology, often taking two steps forward and one step back,’ Behnam Ben Taleblu, senior director of FDD’s Iran program, told Fox News Digital.