Saga Metals Corp. (‘SAGA’ or the ‘Company’) (TSXV: SAGA,OTC:SAGMF) (OTCQB: SAGMF) (FSE: 20H), a North American exploration company focused on critical mineral discovery, is pleased to confirm the full mobilization of SAGA’s exploration team, drilling crews and additional equipment for the continuation of the major diamond drill program targeting a maiden Mineral Resource Estimate (‘MRE’) at the 100% owned Radar Titanium-Vanadium-Iron (Ti-V-Fe) Project in southeastern Labrador, Canada.

Personnel are expected to arrive in Cartwright, Labrador, on January 16th, and drilling will commence shortly thereafter.

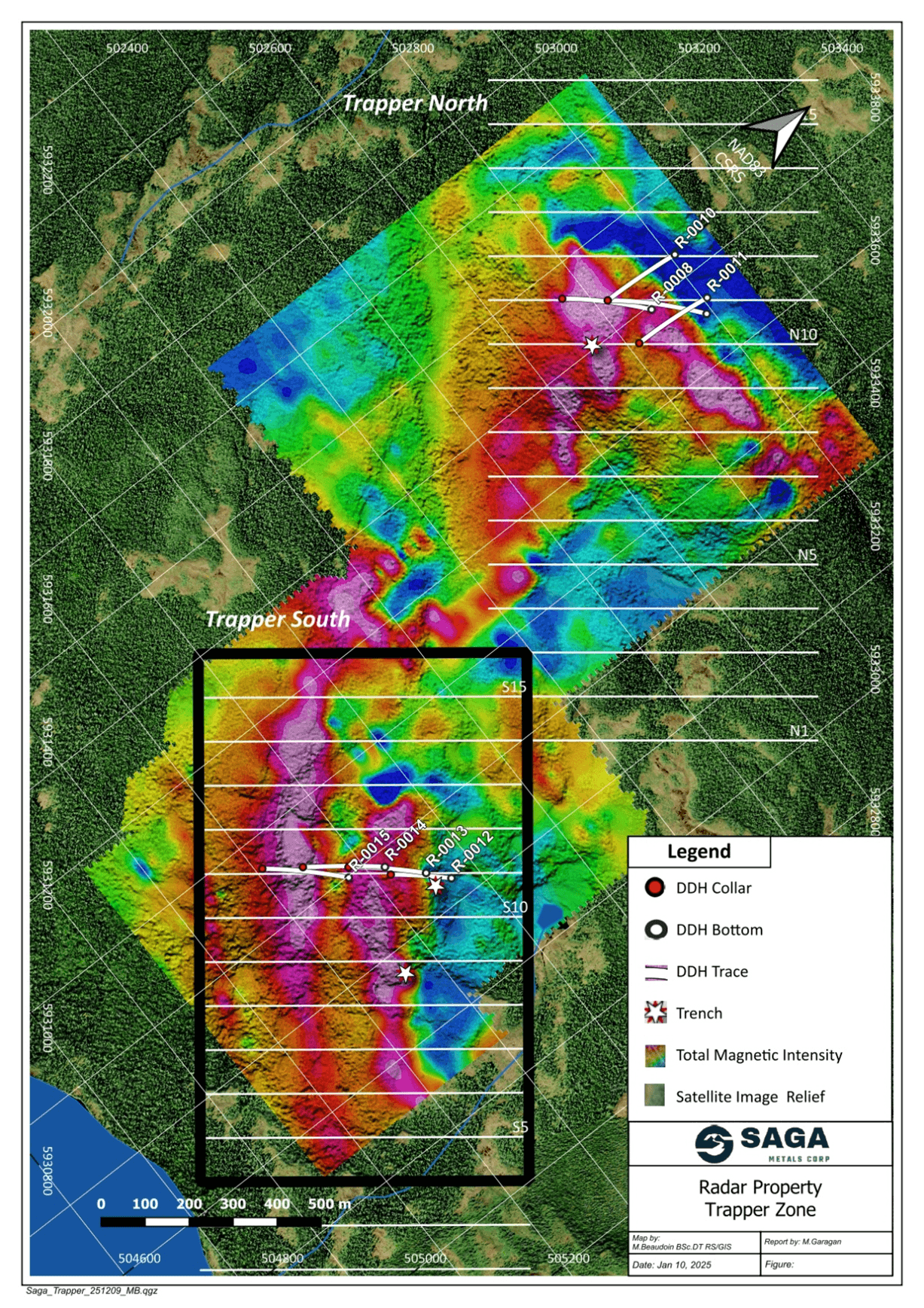

Mineral Resource Estimate Drill Program Highlights To-Date:

- 2 of 8 diamond drill holes assayed (2025 Trapper Zone); full-hole assays from surface:

- R-0008: 269.36 m @ 36.21% Fe₂O₃, 6.57% TiO₂, 0.244% V₂O₅

- R-0009: 296.47 m @ 39.75% Fe₂O₃, 7.46% TiO₂, 0.25% V₂O₅

- TiO₂ strength:

- 46.2% of samples > 7% TiO₂ (majority are 2 m samples)

- 23.2% of samples > 10% TiO₂ (majority are 2 m samples)

- V₂O₅ strength:

- 57.7% of samples > 0.2% V₂O₅ (majority are 2 m samples)

- 30.6% of samples > 0.3% V₂O₅ (majority are 2 m samples)

- Highest TiO₂ to date: 13.30% TiO₂ 2 m assay (core 1800528)

- Exceptional intercepts including: 87.20 m @ 50.67% Fe₂O₃ + 10.15% TiO₂ + 0.339% V₂O₅

- Step-change Trapper North vs. Hawkeye: best full-hole metrics up Fe₂O₃ +124%, TiO₂ +105.9%, V₂O₅ +36.9%

- Significant increase in overall oxide concentration from Trapper vs Hawkeye.

- Next drill assays: additional drill hole assays expected to be released next week.

Kicking off the 2026 Phase of MRE Drilling

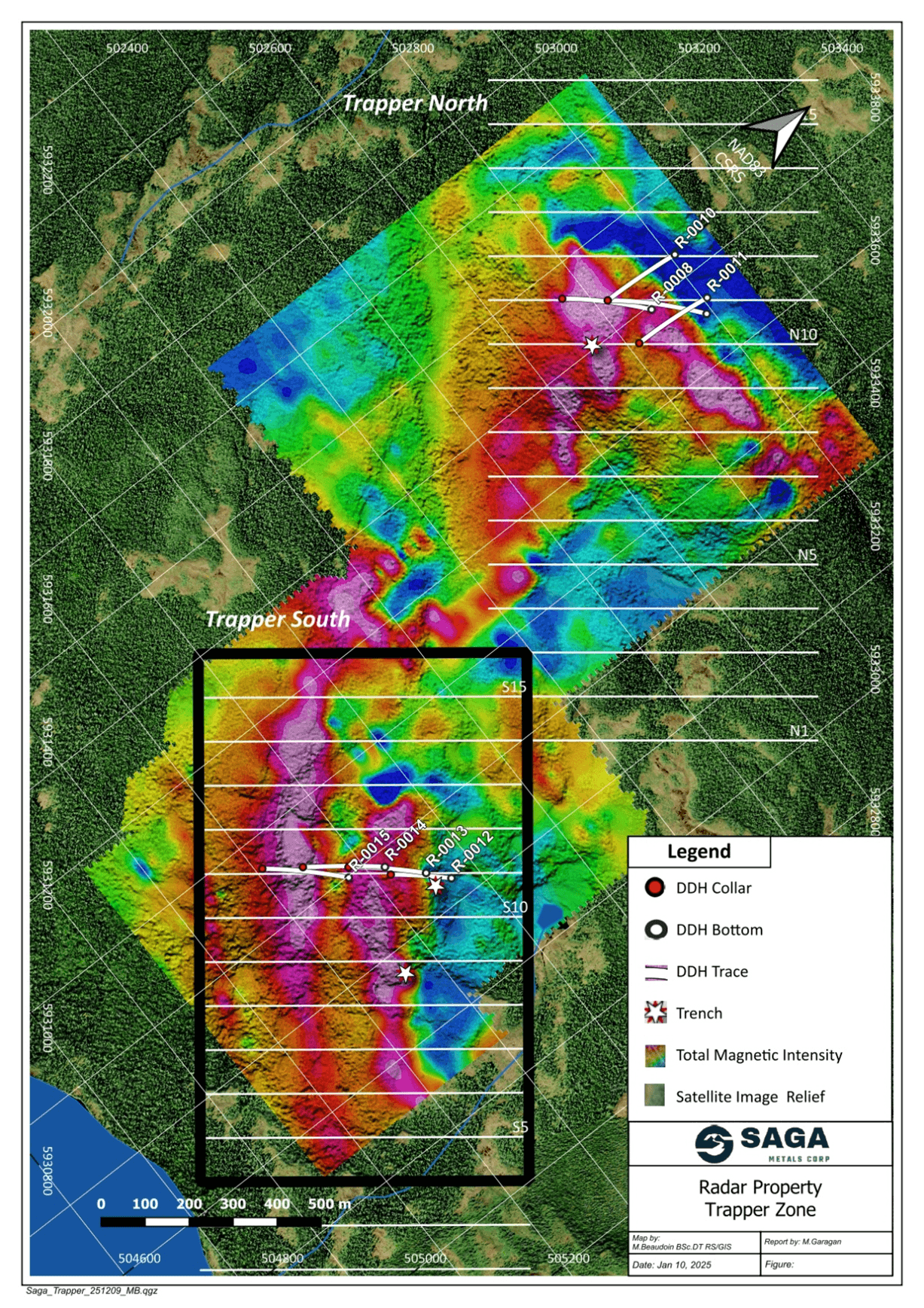

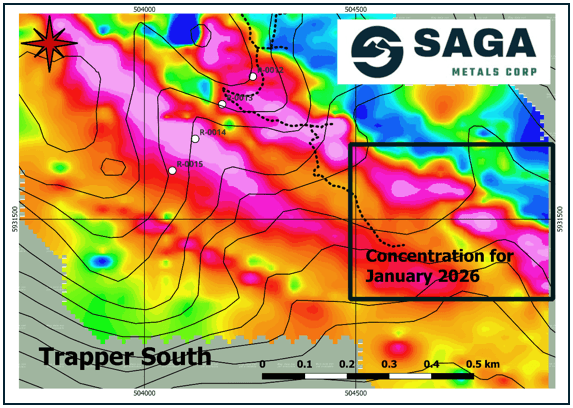

The initial focus for the 2026 Radar Project drill program will be in the southern section of the Trapper Zone, also known as ‘Trapper South.’ SAGA’s geological team and Gladiator’s drill crews will take advantage of the extensive trail network created in the summer of 2025, allowing for an easy traverse for snowmobiles and the excavator used to move the drill. Drilling will begin at the southeastern extent of Trapper South, targeting approximately 30 holes (7,500 m). The program will then advance hole by hole back toward Trapper North, positioning the team to complete the remainder of the MRE drill campaign by spring.

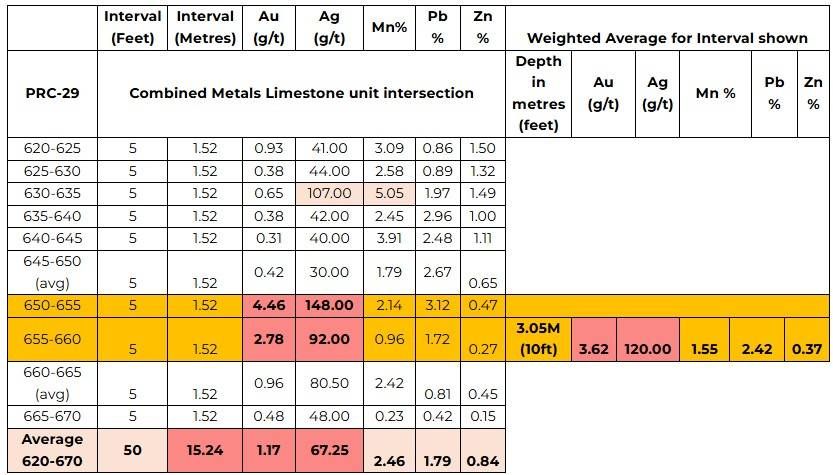

Figure 1: Location of the initial kick off to 2026’s phase of drilling at the Trapper Zone, showing the total magnetic intensity (‘TMI’) of the 2025 Trapper Zone ground magnetic survey as well as the grid for the MRE drill program to be completed in 2026.

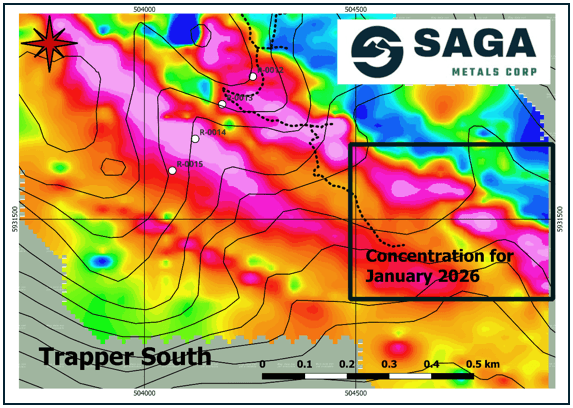

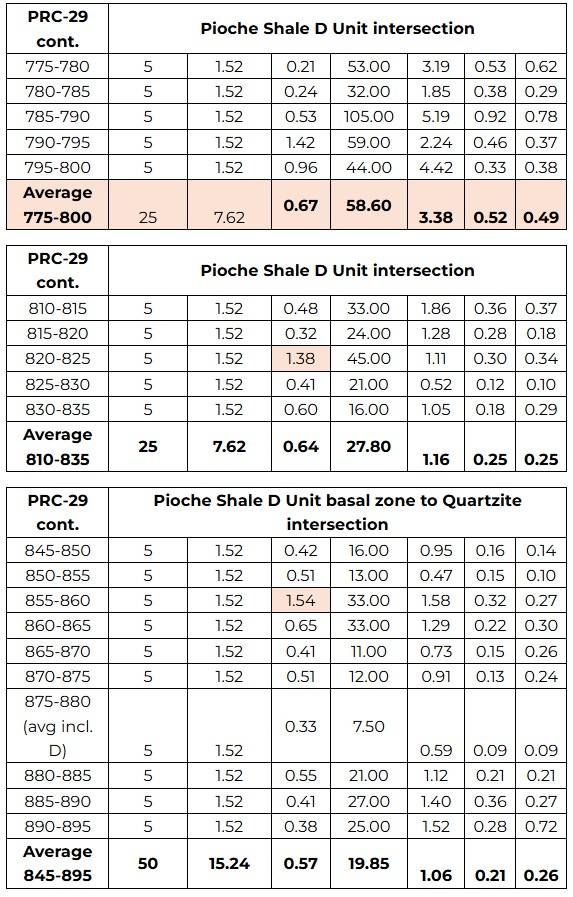

As seen in Figure 2 below, SAGA will concentrate January drilling on the southeastern-most portion of the Trapper South anomalies. The program will continue to execute the MRE strategy, with drill holes spaced 100 metres apart along 38° azimuth section lines and drilled at a 45° dip. This includes continuing drill holes along the white grid lines shown in Figure 1 above, known as cross-sections. Planned hole depths will average with a minimum of ~150 metres of vertical depth coverage to support confidence in the mineral resource model.

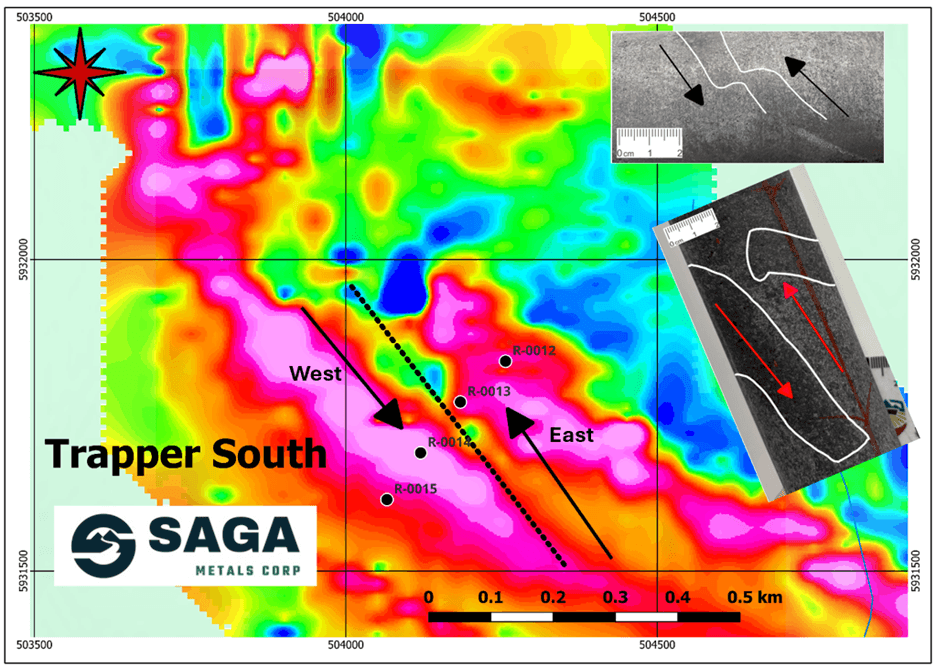

Figure 2: Trapper South depicting the TMI of the 2025 Trapper Zone ground magnetic survey, as well as cross-section S-11 completed in Q4 2025, and the initial area of concentration for the 2026 drill program.

Leveraging observations from the 2025 Phase 1 program and initial assay results, the team can now apply robust geochemical correlations and structural tracking across all incoming core, informed by a detailed review of the first eight drill holes. Special attention will remain on structural measurements and the proper orientated core measurements so the team can continue to model the ore body in three dimensions.

Trapper South Summary

Drilling commencing in January 2026 will build on the successful drilling completed in Trapper South in December of 2025. All four drill holes (R-0012, R-0013, R-0014, and R-0015) completed on cross-section S-11 in Trapper South intersected significant oxide layering, including:

- R-0012 – intersected the eastern side of the main oxide layering with a cumulative 59.88 m of rhythmic oxide layering and 13.67 m of intercumulus oxides.

- R-0013 intersected a cumulative 174.87 m of oxide comprised of 135.87 m of rhythmic oxide layering and 39 m of intercumulus oxides.

- R-0014: cumulated intersections of 69.54 meters of oxide layering.

- R-0015: cumulated intersections of 146 meters of tightly banded rhythmic oxide layering sequences.

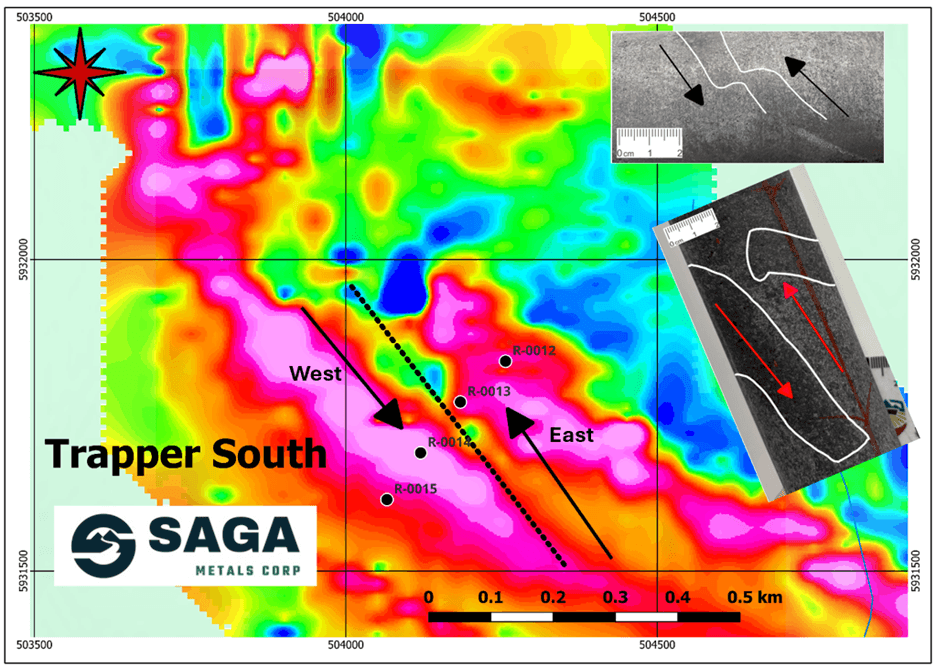

The initial cross-section (S-11) of Trapper South has provided vital structural information for the southern half of the property and insights into the regional structural geometry. Analysis suggests that the two anomalies (East and West) were initially connected but have since been separated by a combination of folding and faulting, specifically a left-lateral strike-slip reverse fault.

Figure 3: Outlines a left-lateral, strike-slip reverse fault. The hanging wall (East anomaly) is offset primarily relative to the (West) Footwall. The map shows analogs of the geometric pattern observed in the core in both R-0015 and R-0014. Similar offsets were also viewed in both R-0013 and R-0012.

Drilling on Section S-11 has defined structural geometry, enabling more efficient future drilling. Hole R-0014 proved particularly informative, confirming multiple instances of the reverse faults in the core. This has enhanced the team’s understanding of the structural geometry of the Trapper South anomaly, the genesis of the Dykes River intrusion, and the historical connectivity between the two limbs.

On the surface in Trapper South, the first-pass cross-section (Section S-11) across the width of the anomalies has defined two linear trends and discrete sets of oxide layering sequences:

- Western anomaly: Striking 1.4 km with a width of approximately 150 m.

- Eastern anomaly: Striking 700 m with a width of approximately 150 m.

Michael Garagan, CGO & Director of Saga Metals, commented,

‘We are incredibly eager to remobilize our crew back to the Radar Ti-V-Fe Project in Labrador as we kick off the 2026 phase of our maiden Mineral Resource Estimate drill program at the Trapper Zone. Building on the outstanding success of the 2025 drilling—highlighted by exceptional intercepts such as 269.36 m @ 6.57% TiO₂ and 296.47 m @ 7.46% TiO₂ in Trapper North, along with numerous high-grade samples exceeding 10% TiO₂ and strong vanadium values—this return to the field represents a pivotal moment. The recent assays confirm the district-scale potential of this large layered mafic intrusion, with oxide layering validated over significant strike lengths and structural insights from Trapper South enhancing our targeting efficiency. We are ready to advance in Trapper South, complete the planned ~7,500 meters of drilling, and move to Trapper North in an effort to deliver the data needed for our first resource estimate, positioning Radar as a strategic North American source of critical titanium, vanadium, and iron for defense, aerospace, and clean energy applications.’

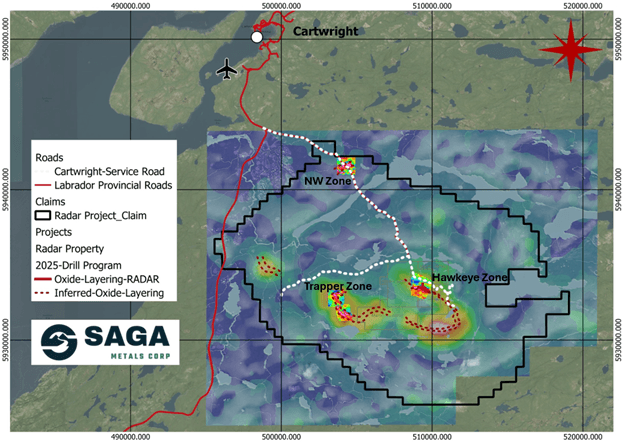

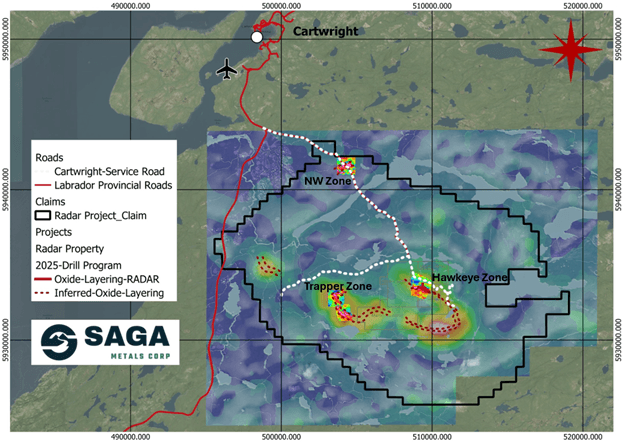

About the Radar Ti-V-Fe Property

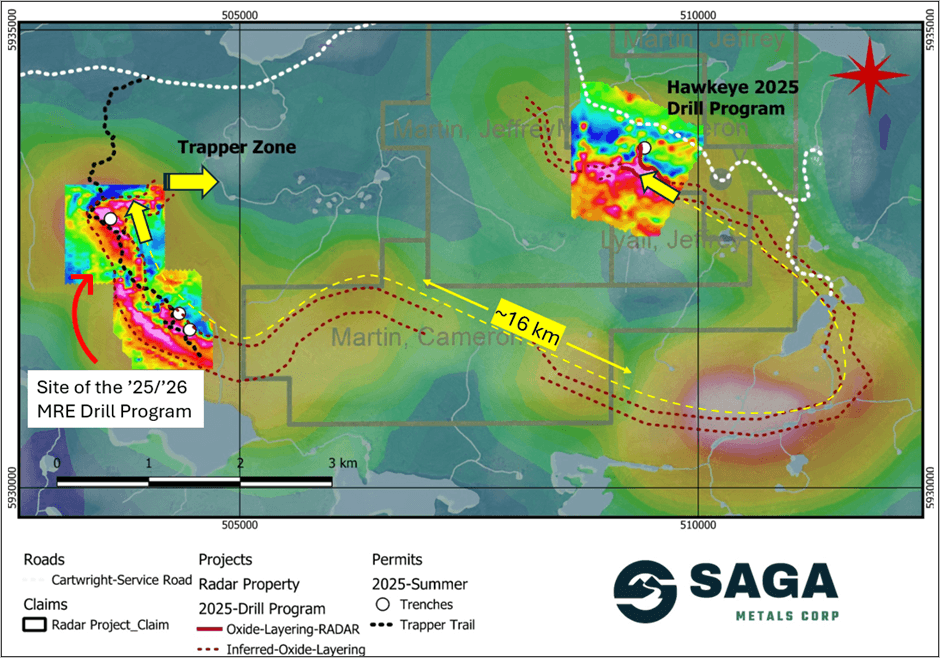

The Radar Property spans 24,175 hectares and hosts the entire Dykes River intrusive complex (~160 km²), a unique position among Western explorers. Geological mapping, geophysics, and trenching have already confirmed oxide layering across more than 20 km of strike length, with mineralization open for expansion.

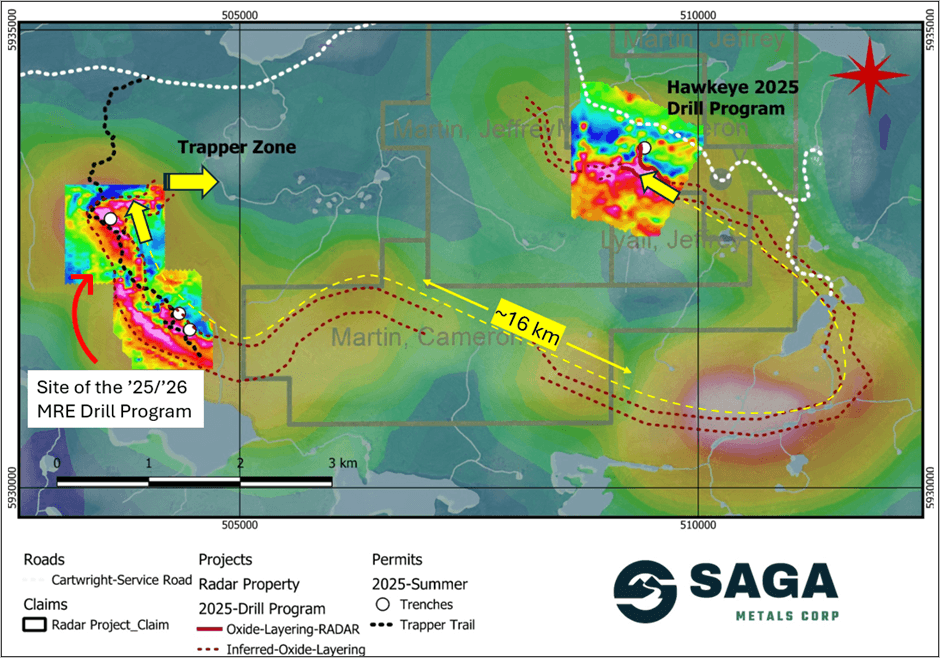

Figure 4: Radar Property map, depicting magnetic anomalies, oxide layering and the site of the 2025 drill programs. The Property is well serviced by road access and is conveniently located near the town of Cartwright, Labrador. A compilation of historical aeromagnetic anomalies is overlaid by ground-based geophysics, as shown.

Vanadiferous titanomagnetite (‘VTM’) mineralization at Radar is comparable to global Fe–Ti–V systems such as Panzhihua (China), Bushveld (South Africa), and Tellnes (Norway), positioning the Project as a potential strategic future supplier of titanium, vanadium, and iron to North American markets.

Figure 5: Radar Project’s prospective oxide layering zone validated over ~16 km strike length through Fall 2025 drilling, as shown on a compilation of historical airborne geophysics as well as ground-based geophysics in the Hawkeye and Trapper zones completed by SAGA in the 2024/2025 field programs. SAGA has demonstrated the reliability of the regional airborne magnetic surveys after ground-truthing and drilling in the 2024 and 2025 field programs.

Corporate Update

The Company has entered into a debt settlement agreement with an arm’s length creditor to settle outstanding indebtedness in the amount of $178,750 (the ‘Debt’) through the issuance of 275,000 common shares (the ‘Shares’) at a deemed price of $0.65 per Share (the ‘Debt Settlement’). The Debt accrued from the purchase of two vehicles used for exploration on the Company’s properties.

The board of directors determined that the Debt Settlement is in the best interests of the Company as it will preserve cash for exploration activities and strengthen the Company’s balance sheet. The Debt Settlement remains subject to TSX Venture Exchange (the ‘TSXV’) approval. The Shares will be subject to a hold period of four months and one day from issuance in accordance with applicable securities laws and TSXV policies.

Qualified Person

Paul J. McGuigan, P. Geo., is an Independent Qualified Person as defined under National Instrument 43-101 and has reviewed and approved the technical information disclosed in this news release.

Technical Information

Samples were cut by Company personnel at SAGA’s core facility in Cartwright, Labrador. Diamond drill core was sawed and then sampled intervals. The drill hole core diameter utilized was NQ.

Core samples have been prepared and analyzed at the Impact Global Solutions (IGS) laboratory facility in Montreal, Quebec. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects, and pulps are kept and stored in a secure storage facility for future assay verification. The Company utilizes a rigorous, industry-standard QA/QC program.

About Saga Metals Corp.

Saga Metals Corp. is a North American mining company focused on the exploration and discovery of a diversified suite of critical minerals that support the North American transition to supply security. The Radar Ti-V-Fe Project comprises 24,175 hectares and entirely encloses the Dykes River intrusive complex, mapped at 160 km² on the surface near Cartwright, Labrador. Exploration to date, including 4,250 m of drilling, has confirmed a large, mineralized layered mafic intrusion hosting vanadiferous titanomagnetite (VTM) and ilmenite mineralization with strong grades of titanium and vanadium.

The Double Mer Uranium Project, also in Labrador, covers 25,600 hectares and features uranium radiometrics that highlight an 18km east-west trend, with a confirmed 14km section producing samples as high as 0.428% U3O8. Uranium uranophane was identified in several areas of highest radiometric response (2024 Double Mer Technical Report).

Additionally, SAGA owns the Legacy Lithium Property in Quebec’s Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Metals.

With a portfolio spanning key commodities critical to the clean energy future, SAGA is strategically positioned to play an essential role in critical mineral security.

On Behalf of the Board of Directors

Mike Stier, Chief Executive Officer

For more information, contact:

Rob Guzman, Investor Relations

Saga Metals Corp.

Tel: +1 (844) 724-2638

Email: rob@sagametals.com

www.sagametals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as ‘will’, ‘may’, ‘should’, ‘anticipates’, ‘expects’, ‘believes’, and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to the Company’s Radar Project. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company’s expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, inherent risks and uncertainties involved in the mineral exploration and development industry, particularly given the early-stage nature of the Company’s assets, and the risks detailed in the Company’s continuous disclosure filings with securities regulations from time to time, available under its SEDAR+ profile at www.sedarplus.ca. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4b8ca841-86ab-478c-8485-1d7c82d96a10

https://www.globenewswire.com/NewsRoom/AttachmentNg/a2630189-91d0-48ee-b96e-0a4207f78500

https://www.globenewswire.com/NewsRoom/AttachmentNg/9f68b615-7ca5-484a-a08d-a4c79d736a7f

https://www.globenewswire.com/NewsRoom/AttachmentNg/07dd968b-dcb4-4194-a388-9167673503f2

https://www.globenewswire.com/NewsRoom/AttachmentNg/a55d092e-0073-48be-b7ef-c57948732303

![]()

![]()