Rzolv Technologies Inc. (TSXV: RZL) (the ‘Company’ or ‘RZOLV’) today announced the results of independent metallurgical testing conducted by SGS Canada Inc. (‘SGS’) evaluating the performance of RZOLV’s proprietary, non-cyanide gold leaching formula on gravity concentrate material.

The test program was carried out at SGS’ Burnaby, British Columbia metallurgy laboratory and compared gold recovery achieved using RZOLV against conventional sodium cyanide under controlled bottle-roll leaching conditions.

against conventional sodium cyanide under controlled bottle-roll leaching conditions.

The material tested consisted of both oxidized and sulfide-based gravity concentrates sourced from 2 separate gold projects located in Alaska. The material was prepared to a particle size of 80% passing 2 mm. The objective of the test work was to evaluate the technical performance of RZOLV relative to cyanide on high-grade gravity concentrate material, particularly in contexts where cyanide use may be constrained or less effective.

relative to cyanide on high-grade gravity concentrate material, particularly in contexts where cyanide use may be constrained or less effective.

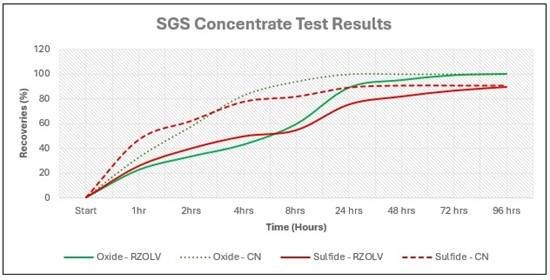

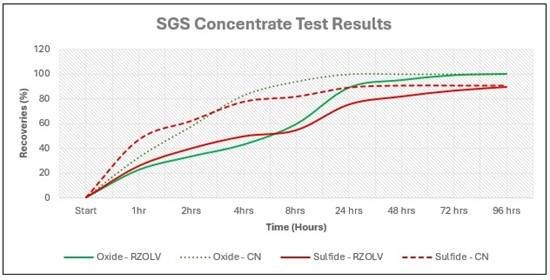

Under the specific laboratory test parameters evaluated by SGS, RZOLV achieved gold recoveries of 98.7% on oxide-based gravity concentrates and 89.4% on sulfide-based gravity concentrates over a 96-hour leach retention time. Under the same laboratory conditions, a reference solution containing 2,000 ppm sodium cyanide achieved gold recoveries of 99.9% and 90.7%, respectively.

achieved gold recoveries of 98.7% on oxide-based gravity concentrates and 89.4% on sulfide-based gravity concentrates over a 96-hour leach retention time. Under the same laboratory conditions, a reference solution containing 2,000 ppm sodium cyanide achieved gold recoveries of 99.9% and 90.7%, respectively.

The Company notes that results are specific to the material tested and the conditions applied. Further test work is ongoing to evaluate performance across a broader range of ore types, mineralogical characteristics, and operating conditions.

RZOLV continues to focus on third-party validation and disciplined test programs as it advances the evaluation of its technology for potential commercial applications.

continues to focus on third-party validation and disciplined test programs as it advances the evaluation of its technology for potential commercial applications.

Chart 1: Bottle Roll Leaching Recovery Results – (SGS)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11597/280071_rzolv.jpg

Figure 1: Bottle Roll Leaching Recovery Results – (SGS)

| Test |

Reagent |

Cal Head (g/t Au) |

Residue (g/t Au) |

Recoveries (%) |

| 1hr |

2hrs |

4hrs |

8hrs |

24 hrs |

48 hrs |

72 hrs |

96 hrs |

| Oxide Cons |

RZOLV |

339.0 |

4.280 |

21.6 |

32.2 |

41.5 |

57.7 |

86.3 |

97.9 |

– |

98.7 |

| CN |

357.9 |

0.0 |

32.3 |

57.3 |

82.4 |

93.5 |

99.7 |

99.9 |

99.9 |

99.9 |

| Sulphide Cons |

RZOLV |

421.0 |

44.8 |

25.4 |

39.6 |

49.4 |

54.4 |

75.1 |

81.6 |

86.4 |

89.4 |

| CN |

433.2 |

40.4 |

46.8 |

62.0 |

77.6 |

82.2 |

89.1 |

90.7 |

90.7 |

90.7 |

* Note: Results shown are derived from laboratory-scale bottle-roll testing under controlled conditions.

CEO Commentary

Duane Nelson, President and CEO of Rzolv Technologies Inc., stated: ‘We are very pleased with the independent metallurgical testing conducted by SGS. Under the test conditions evaluated, RZOLV’s non-cyanide solution demonstrated gold recoveries and leach kinetics comparable to those achieved using cyanide-based reference methods commonly applied prior to smelter treatment, under the specific laboratory conditions evaluated.

These results represent a meaningful technical milestone for the industry and support RZOLV’s potential to provide a cost-effective alternative to the current cyanide, and smelter-based methods used today for the treatment of gold-bearing concentrates.’

The metallurgical results reported herein are laboratory-scale only and are not intended to support, nor should they be construed as supporting, any mineral resource, reserve, or production estimates.

Key Test Highlights – Independent SGS Metallurgical Results

-

Independent third-party validation by SGS – All metallurgical test work was conducted by SGS Canada Inc. at its Burnaby, BC laboratory under controlled conditions, providing independent confirmation of performance using industry-standard methods

-

Excellent gold recoveries on gravity concentrates – RZOLV achieved 98.7% gold recovery on oxide gravity concentrates and 89.4% recovery on sulfide gravity concentrates over a 96-hour leach cycle, demonstrating strong dissolution performance on high-grade materials

achieved 98.7% gold recovery on oxide gravity concentrates and 89.4% recovery on sulfide gravity concentrates over a 96-hour leach cycle, demonstrating strong dissolution performance on high-grade materials

-

Performance comparable to cyanide under identical conditions – Under the same laboratory parameters, RZOLV delivered gold recoveries and leach kinetics that were directly comparable to a 2,000-ppm sodium cyanide reference solution, confirming technical parity without the use of cyanide

delivered gold recoveries and leach kinetics that were directly comparable to a 2,000-ppm sodium cyanide reference solution, confirming technical parity without the use of cyanide

-

Demonstrated effectiveness on both oxide and sulfide concentrates – The ability to achieve high recoveries across two distinct concentrate types suggests broad applicability to gravity and flotation concentrate streams where cyanide or smelting may be constrained or uneconomic

-

Potential alternative to smelter-based concentrate treatment – Management believes these results support RZOLV ’s potential to provide a cost-effective, non-cyanide alternative to smelter treatment for certain gold concentrates – a market segment historically limited by high costs, logistics, and ESG constraints

’s potential to provide a cost-effective, non-cyanide alternative to smelter treatment for certain gold concentrates – a market segment historically limited by high costs, logistics, and ESG constraints

-

Material sourced from real operating jurisdictions – Test material originated from two separate gold projects in Alaska, reinforcing that the results are based on representative, real-world concentrate material rather than synthetic or idealized samples

-

Strong technical foundation for scale-up and further optimization – While results are specific to the material and conditions tested, the Company has emphasized disciplined test programs and ongoing evaluation across a broader range of mineralogies and operating parameters as it advances toward commercial deployment

Stock Options

The Company also announces a grant of 1,660,000 incentive stock options (the ‘Options‘) to certain directors, officers, employees, and consultants to the Company.

Each Option is exercisable to acquire one common share of the Company (a ‘Share‘) at a price of $0.50 per Share, for a period of five years from the date of grant. Following this stock option grant, the Company has a total of 5,490,333 stock options outstanding representing approximately 8.86% of the outstanding common shares of the Company. This stock option grant is subject to acceptance by the TSX Venture Exchange (the ‘Exchange’).

About SGS

SGS is the world’s leading Testing, Inspection and Certification company. We operate a network of over 2,500 laboratories and business facilities across 115 countries, supported by a team of 99,500 dedicated professionals. With over 145 years of service excellence, we combine the precision and accuracy that define Swiss companies to help organizations achieve the highest standards of quality, compliance and sustainability.

We offer comprehensive testing, inspection, certification and consulting services to help mining businesses optimize processes, ensure regulatory compliance and enhance sustainability. We support your mining operations at every stage – from exploration, resource development, feasibility studies, planning and construction, through to operation, production, transportation and site rehabilitation.

About Rzolv Technologies Inc.

Rzolv Technologies Inc. is a next-generation clean-technology company redefining how gold is recovered in a world demanding safer, smarter, and more sustainable mining. The Company develops innovative, non-cyanide hydrometallurgical solutions designed to unlock gold that conventional chemistry leaves behind-while materially reducing environmental risk and regulatory friction.

Its flagship technology, RZOLV , is a proprietary, water-based gold-dissolution system engineered to deliver performance comparable to traditional cyanide leaching, without the toxicity, permitting constraints, or long-term liabilities associated with legacy reagents. By operating within a broader and more controllable chemical window, RZOLV

, is a proprietary, water-based gold-dissolution system engineered to deliver performance comparable to traditional cyanide leaching, without the toxicity, permitting constraints, or long-term liabilities associated with legacy reagents. By operating within a broader and more controllable chemical window, RZOLV enables gold recovery from complex ores, concentrates, and previously stranded materials-creating new economic value where existing methods fail.

enables gold recovery from complex ores, concentrates, and previously stranded materials-creating new economic value where existing methods fail.

RZOLV is not simply replacing cyanide; it is expanding the addressable gold-recovery market by aligning metallurgical performance with modern ESG expectations, regulatory realities, and the mining industry’s urgent need for safer chemistry.

Cautionary Note

Neither the TSXV nor its Regulation Services Provider (as that term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

The metallurgical testing and analytical work referenced in this release were conducted by an independent laboratory using industry-standard methods. The technical information contained herein has been reviewed by Company management with relevant metallurgical and process engineering experience.

For further information, please contact:

Duane Nelson

Email: duane@rzolv.com

Phone: (604) 512-8118

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute ‘forward-looking statements.’ Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words ‘expects,’ ‘plans,’ ‘anticipates,’ ‘believes,’ ‘intends,’ ‘estimates,’ ‘projects,’ ‘potential’ and similar expressions, or that events or conditions ‘will,’ ‘would,’ ‘may,’ ‘could’ or ‘should’ occur.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements include, but are not limited to, statements regarding the potential commercial application of RZOLV , future metallurgical performance, scale-up outcomes, permitting considerations, and market adoption.

, future metallurgical performance, scale-up outcomes, permitting considerations, and market adoption.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280071

against conventional sodium cyanide under controlled bottle-roll leaching conditions.

against conventional sodium cyanide under controlled bottle-roll leaching conditions.