(TheNewswire)

|

|||||||||

|

|

|

|

|

|||||

Vancouver, British Columbia TheNewswire – January 9th, 2025 Prismo Metals Inc. (‘Prismo’ or the ‘Company’) (CSE: PRIZ,OTC:PMOMF) (OTCQB: PMOMF) is pleased to announce that it has entered into an agreement with Infinitum Copper Corp. (TSXV: INFI) (‘Infinitum’) whereby Prismo will increase its interest in the Hot Breccia copper project, located in the heart of Arizona’s prolific copper belt, from 75% to 95%. In addition, Prismo has obtained an irrevocable option to acquire Infinitum’s remaining 5% interest, providing a clear path to 100% interest in the project.

Alain Lambert, CEO of Prismo commented: ‘The absence of a clear mechanism to secure full ownership at Hot Breccia had previously limited our ability to fund drilling and pursue potential third-party partnerships. The transaction announced today totally removes that constraint and materially improves the strategic flexibility of the project.’

He added: ‘Prismo remains firmly committed to advancing Hot Breccia. The recent extension of certain milestone obligations under the option agreement with Walnut Mines LLC (the ‘Option Agreement‘), the owner of the Hot Breccia claims, together with the deal announced today, provides the Company with additional flexibility as we evaluate a range of strategic alternatives. Each of these pathways is intended to position Prismo to commence drilling on what we consider to be one of the most compelling copper exploration opportunities in Arizona and the broader United States.‘

Dr. Linus Keating, manager of Walnut Mines LLC, enthusiastically commented: ‘Walnut Mines is solidly in favor of any action that moves Hot Breccia closer to a serious drill program. We are hopeful that this transaction will accomplish that goal in 2026. In our opinion, this property remains one of the best copper exploration opportunities in North America.’

Under the terms of the transaction, Prismo will pay Infinitum CA $185,000 to acquire a 20% additional interest in the Hot Breccia project and assume all of Infinitum’s remaining obligations under the Option Agreement to issue shares to Walnut, which is currently evaluated at approximately CA $54,000 through the issuance of Prismo common shares at a deemed issue price of $0.11 per share, subject to adjustments at closing. Prismo has also agreed to pay 5% of any consideration received in connection with a transaction in which Prismo assigns its interest in Hot Breccia to a third-party. The cash payment will be funded through a third party as an advance to the Company and will not utilize its working capital which is earmarked for the advancement of the Silver King project. Closing of the transaction is expected to take place on or around January 16th.

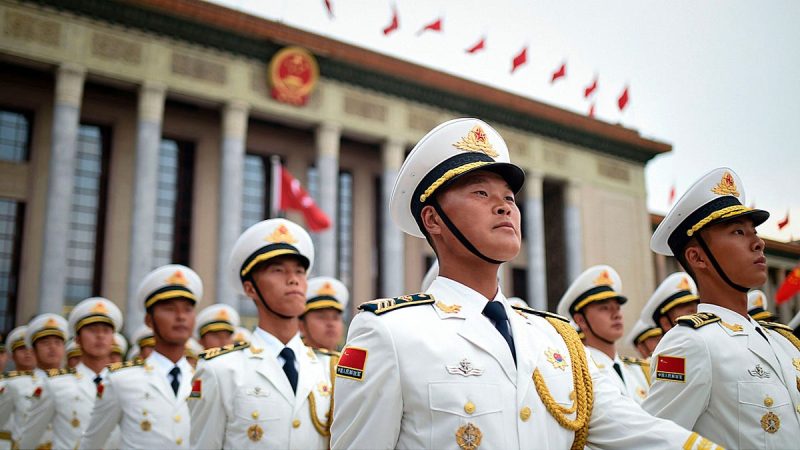

Prismo‘s Hot Breccia project lies at the heart of the Arizona Copper Belt, which hosts several globally significant porphyry copper deposits. Examples of these significant deposits are Freeport McMoRan’s Miami-Inspiration mining complex, BHP’s San Manuel mine, Rio Tinto and BHP’s Resolution deposit and others (see Figure 1).

Figure 1. Location of the Hot Breccia Project in the Arizona Copper Belt.

Historical drilling carried out in the mid to late 1970‘s by a Rio Tinto subsidiary intersected high-grade copper mineralization at depths ranging from 640 to 830 meters below surface. Several holes targeted an area with a coincident magnetic high, believed to be caused by magnetite skarn that was cut in the drill holes and that occurs in xenoliths in cross cutting dikes exposed at the surface. Prismo believes those intercepts may represent the periphery of the upper portion of a large mineralized system.

Support for the Company‘s mineralization model at the project comes from several sources, including the results of historical drilling, geophysical surveys, distribution of dikes with xenoliths of Cu-bearing skarn, the 2023 ZTEM survey as well as the results of an AI study. The anomalous target area identified in Prismo‘s modelling measures 1,100 meters by 1,150 meters.

Dr. Craig Gibson, Chief Exploration Officer of Prismo stated: ‘The copper exploration target at Hot Breccia has geophysical, geochemical and geological features characteristic of many porphyry copper deposits. The project area has a regional setting similar to BHP-Rio Tinto’s Resolution copper deposit located 40 kilometers to the northwest of Hot Breccia and which is considered to be one of the greatest copper discoveries in the history of North American mining.‘ He added: ‘The drill program is intended to drill through the entire prospective Paleozoic carbonate stratigraphy into the postulated porphyry body/breccia zone. The exploration team will take advantage of geological information provided by each hole during drilling to refine targeting of subsequent holes.‘

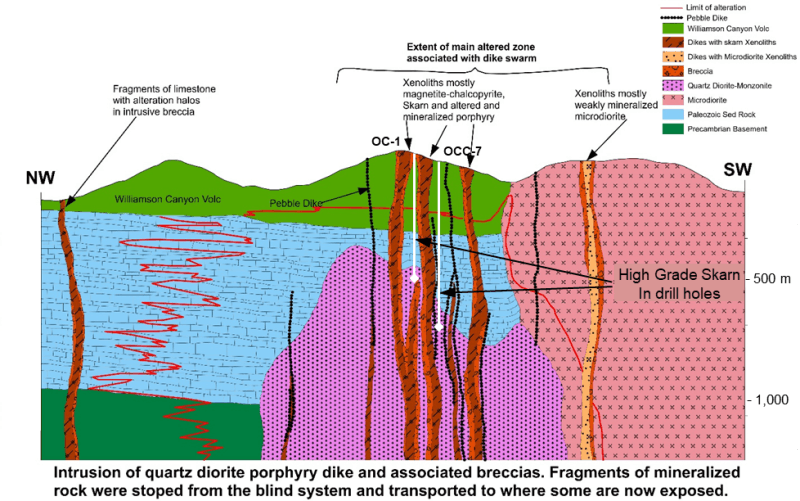

Historical drill holes cut high grade skarn mineralization including 23 meters with 0.54% Cu at 640 meters depth (hole OC-1), 18 m with 1.4% Cu and 4.65% Zn at 830 meters depth (hole OCC-7), and 7.6 m with 1.73% Cu and 0.11% Zn at 703 meters and 4.6 meters with 1.4% Cu and 0.88% Zn at 716 meters (OCC-8). Mineralization occurs within a several hundred-meter-thick altered zone hosted in favorable Paleozoic carbonate rocks that underly a sequence of Cretaceous andesitic volcanic rocks. These carbonates are the same rocks that host the high-grade copper mineralization at Freeport‘s nearby Christmas mine. The historical drilling intersected a blind mineralized intrusion associated with the skarn mineralization, providing an immediate drill target that is believed to be the source of the mineralization at Hot Breccia (Figure 2). Several magnetic highs in the region surrounding the proposed intrusion may also indicated buried skarn mineralization and provide additional exploration targets.

Click Image To View Full Size

Figure 2. Schematic cross section at Hot Breccia showing updated interpretation after Barrett (1974).

Notes:

-

(1)Barrett, Larry Frank (1972): Igneous Intrusions and Associated Mineralization in the Saddle Mountain Mining District Pinal County, Arizona. Unpublished Master’s Thesis, University of Utah.

-

(2)Barrett, Larry Frank (1974): Diamond drill hole OC-1, O’Carroll Canyon, Pinal County, Arizona, unpublished internal report, Bear Creek Mining.

About Hot Breccia

The Hot Breccia property consists of 1,420 hectares in 227 contiguous mining claims located in the world class Arizona Copper Belt between several very well understood world-class copper mines including Morenci, Ray and Resolution (Figure 1). Hot Breccia shows many features in common with these neighboring systems, most prominently a swarm of porphyry dikes and series of breccia pipes containing numerous fragments of well copper-mineralized rocks mixed with fragments of volcanic and sedimentary derived from considerable depth. Prismo performed a ZTEM survey last year that identified a very large conductive anomaly directly beneath the breccia outcrops.

Sampling at the project has shown the presence of copper mineralization associated with dacite dikes that transported fragments of strongly mineralized carbonate rocks to the surface from depths believed to be 400-1,000 meters. Drilling deep holes is necessary to tap into the source of these mineralized fragments found at surface.

Assay results from historical drill holes are unverified as the core has been destroyed, but information has been gathered from memos, photos and drill logs that contain some, but not all, of the assay results and descriptions. Technical information from adjacent or nearby properties does not mean nor does it imply that Prismo will obtain similar results from its own properties.

Data on previous drilling and geophysics is historical in nature and has not been verified, is not compliant with NI 43-101 standards and should not be relied upon; the Company is using the information only as a guide to aid in exploration planning.

Qualified Person

Dr. Craig Gibson, PhD., CPG., a Qualified Person as defined by NI 43-01 and Chief Exploration Officer and a director of the Company, has reviewed and approved the technical disclosure in this news release.

About Prismo Metals Inc.

Prismo (CSE: PRIZ,OTC:PMOMF) is a mining exploration company focused on advancing its Hot Breccia copper project in Arizona and its Palos Verdes silver project in Mexico.

Please follow @PrismoMetals on , , , Instagram, and

Prismo Metals Inc.

1100 – 1111 Melville St., Vancouver, British Columbia V6E 3V6 Phone: (416) 361-0737

Contact:

Alain Lambert, Chief Executive Officer alain.lambert@prismometals.com

Gordon Aldcorn, President gordon.aldcorn@prismometals.com

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as ‘intends‘ or ‘anticipates‘, or variations of such words and phrases or statements that certain actions, events or results ‘may’, ‘could‘, ‘should‘, ‘would‘ or ‘occur‘. This information and these statements, referred to herein as ‘forward‐looking statements’, are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management’s expectations and intentions with respect to, among other things: the timing, costs and anticipated results of drilling at Hot Breccia; the ability of Prismo to fund drilling and pursue potential third-party partnerships; the Company’s strategic flexibility with respect to the Hot Breccia project going forward; the number of shares issuable by Prismo to Walnut pursuant to the transaction described in this news release; and the Company’s expectations regarding mineralization and other qualities of the Hot Breccia project.

These forward‐looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: delays in obtaining or failure to obtain appropriate funding to finance the exploration program at Hot Breccia; the risk that the Company will not enter into a third-party partnership with respect to the Hot Breccia project; the risk that mineralization will not be as anticipated at the project; the risk that the Company will not be able to take advantage of geological information to refine drill targeting; metal prices; market uncertainty; and other risks and uncertainties application to exploration activities and the Company’s business as set forth in the Company’s disclosure documents available for viewing under the Company’s profile on SEDAR+ at www.sedarplus.ca.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that: the ability to raise capital to fund the drilling campaign at Hot Breccia and the timing of such drilling campaign; the ability of the Company to enter into a third-party partnership on the project; that the project will have the anticipated mineralization and other qualities; and the Company will be able to take advantage of geological information to refine drill targeting.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

Copyright (c) 2026 TheNewswire – All rights reserved.

News Provided by TheNewsWire via QuoteMedia