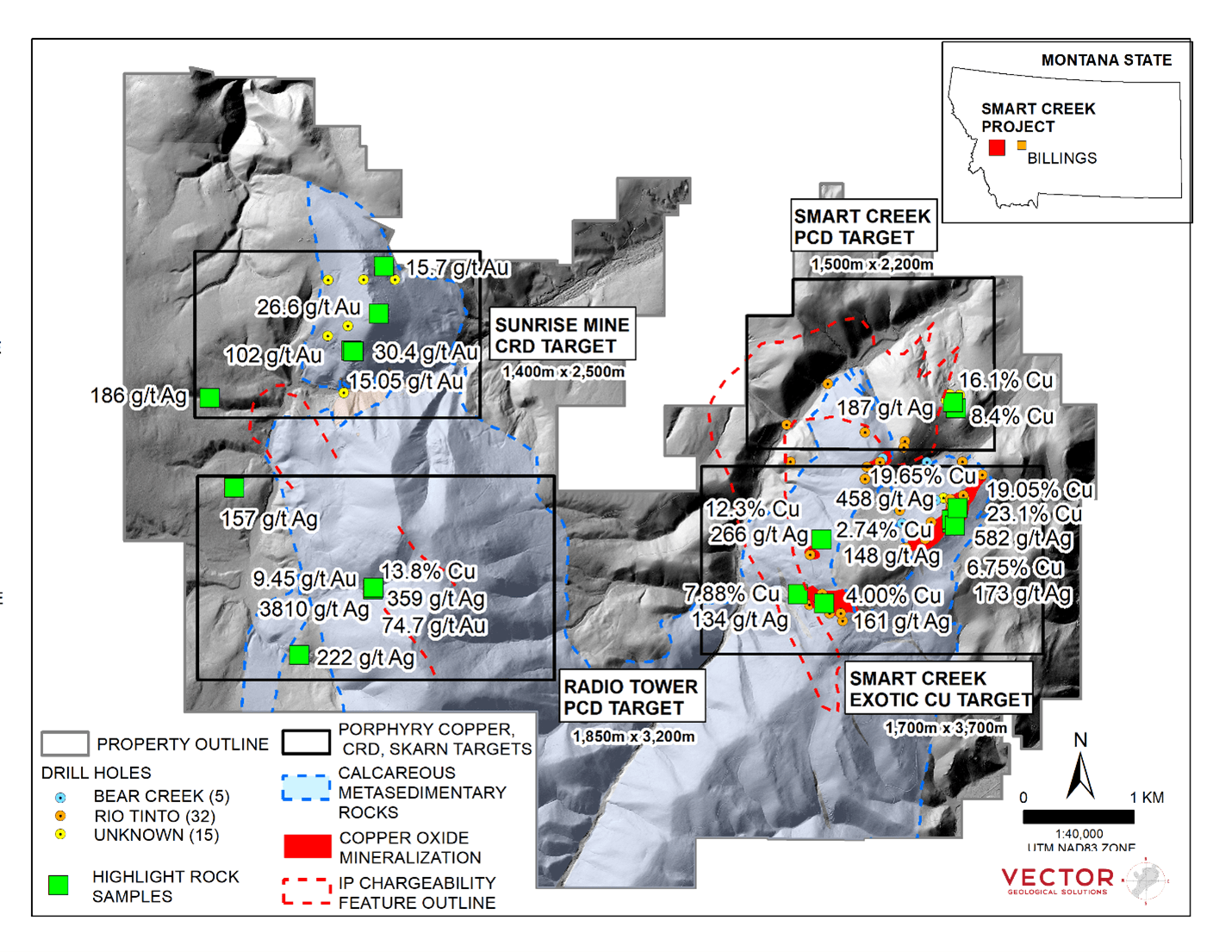

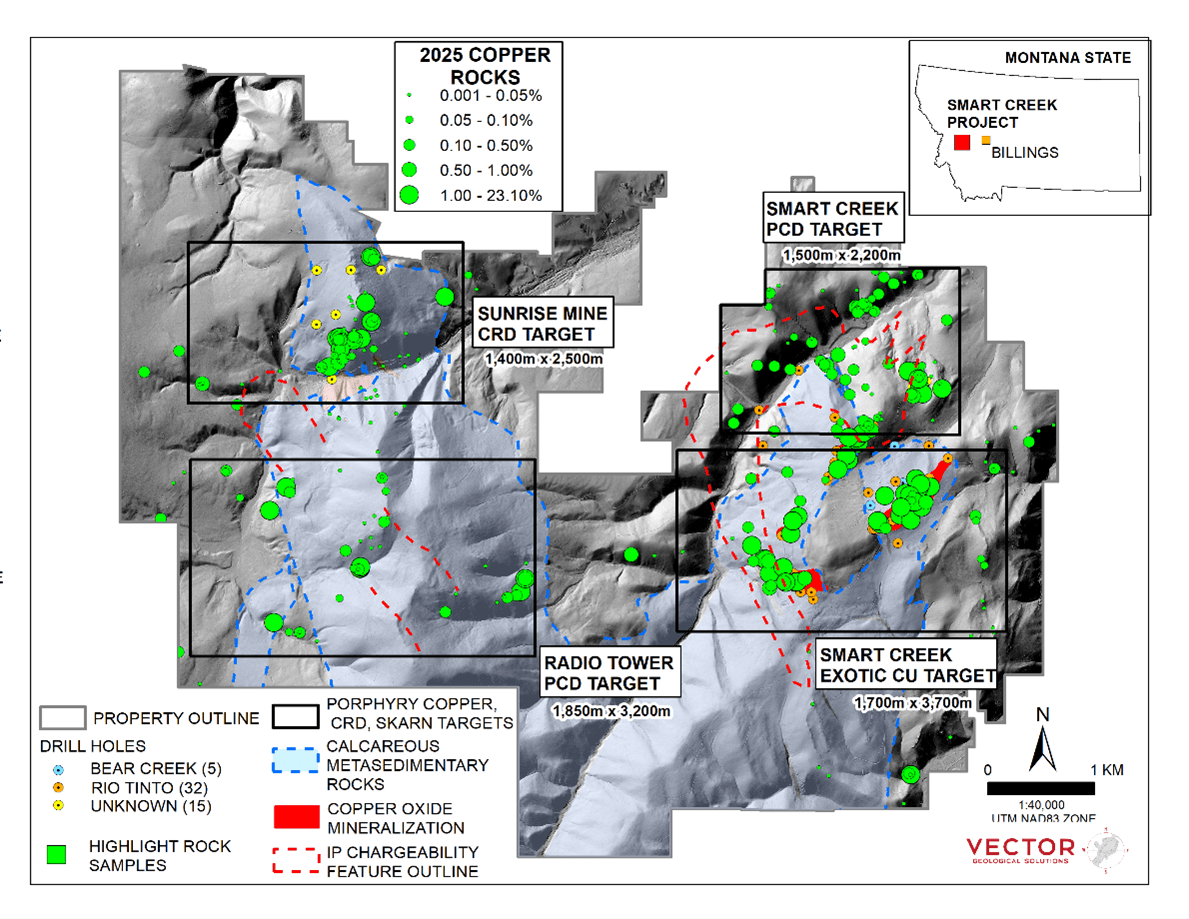

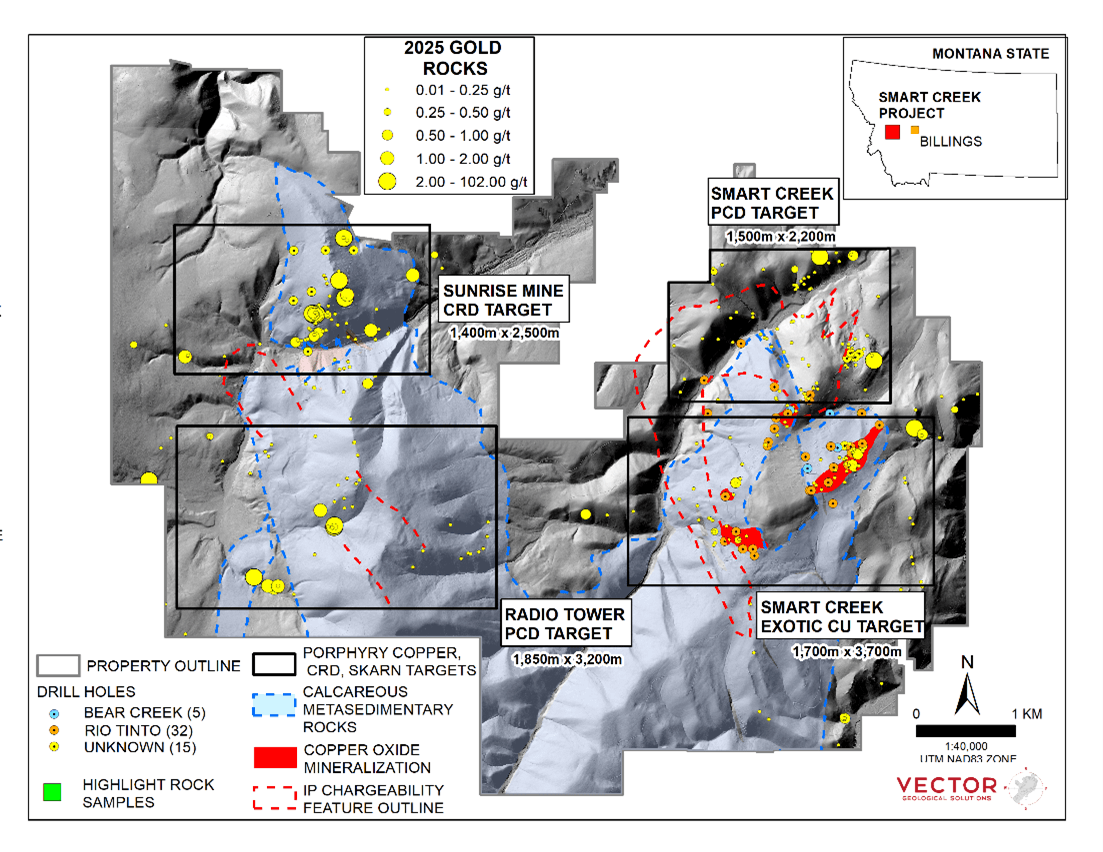

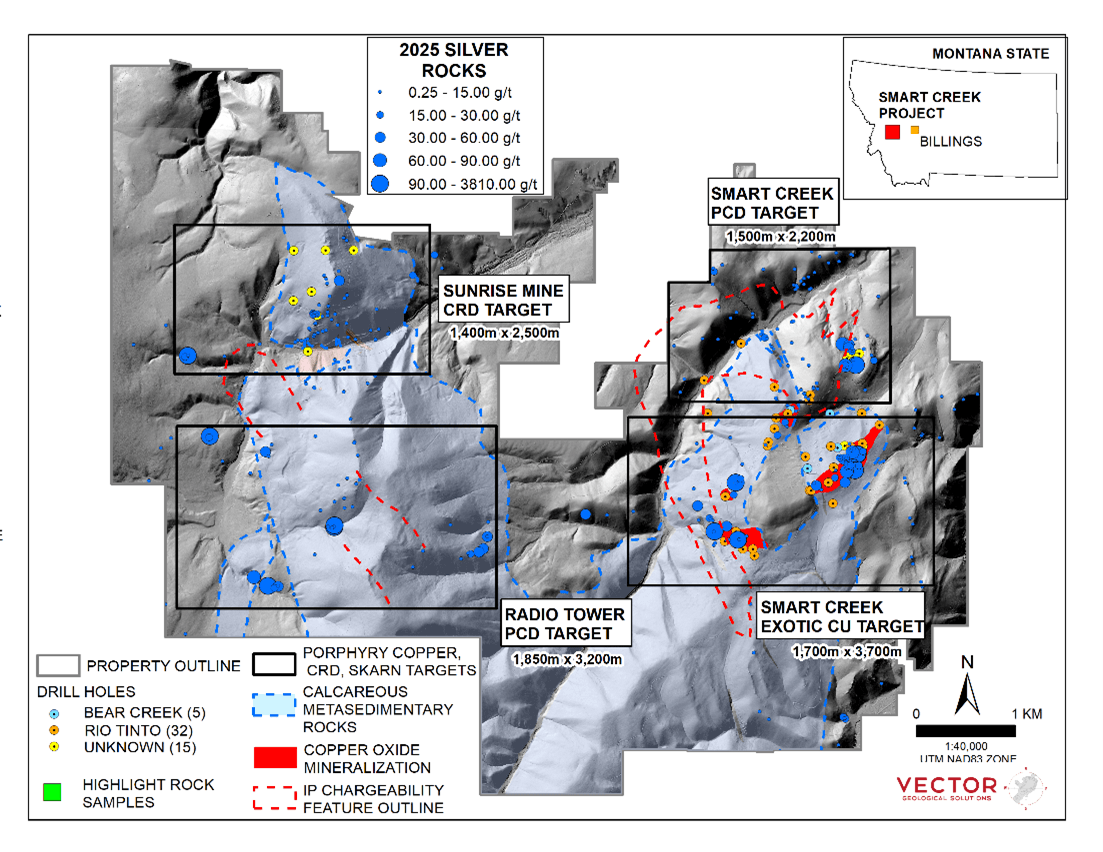

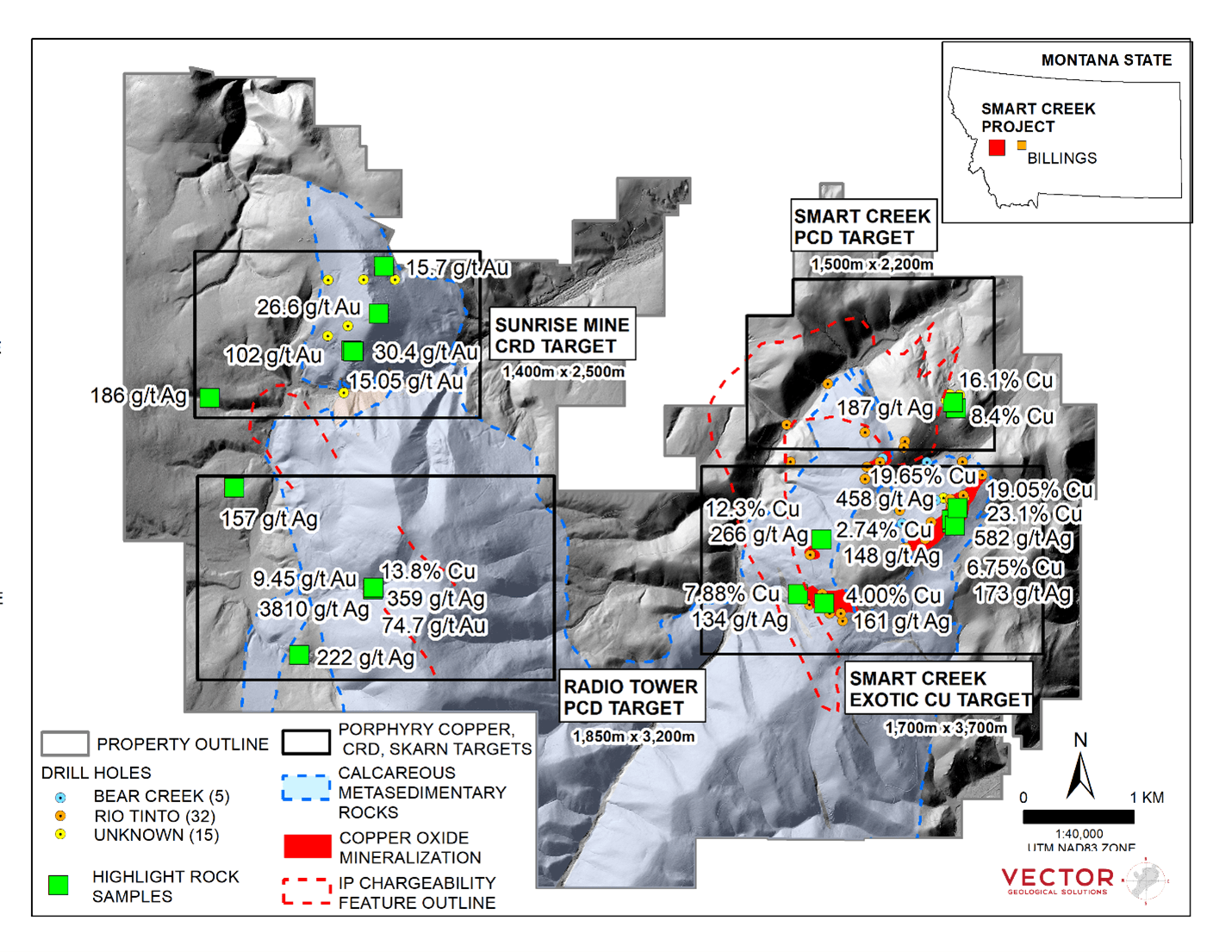

TSXV: DMCU; OTCQB: DMCUF; FSE: 03E) provides an exploration update. The company has received analytical results for 310 surface samples from the summerFall field campaign at the Smart Creek Project (‘Project’) in Montana. The program was designed to characterize known mineralized zones, refine drill target locations and identify new areas for follow-up exploration. The program has successfully identified high-grade gold, copper, and silver at the Smart Creek Project and has expanded all known targets and identified new high-grade copper, gold and copper mineralization across the property (Figures 1-4).

Gord Neal, CEO of Domestic Metals Corp. commented: ‘The 2025 field campaign was a success. These are the highest-grade field samples results I have ever been presented with in my career. In my experience these kinds of returns are harbingers of major economic discoveries. High grade mineralization has been identified in several locations, including new discovery areas. We look forward to firming up drill targets, deploying a targeted geophysics program followed by a diamond drill program in Q1, 2026’

Highlight High-Grade Assay Results

- 102 g/t Au (Sample G019007)

- 74.7 g/t Au, 13.8% Cu, 3810 g/t Ag (Sample G019235)

- 30.4 g/t Au (Sample G019001)

- 26.6 g/t Au (Sample G019353)

- 23.1% Cu, 424 g/t Ag (Sample G019225)

- 19.65% Cu, 458 g/t Ag (Sample G019031)

- 19.05% Cu, 582 g/t Ag (Sample G019038)

Highlight, high-grade surface samples are provided in the table below:

| Sample |

Easting |

Northing |

Sample |

Sample |

Copper |

Gold |

Silver |

| ID |

(m) |

(m) |

Lithology |

Type |

(%) |

(g/t) |

(g/t) |

| G019001 |

321345 |

5150400 |

Quartzite |

Outcrop |

0.549 |

30.4 |

12 |

| G019007 |

321365 |

5150392 |

Limestone |

Outcrop |

0.377 |

102 |

20.7 |

| G019029 |

326795 |

5148835 |

Siltstone |

Outcrop |

6.75 |

0.313 |

173 |

| G019031 |

326790 |

5148864 |

Siltstone |

Outcrop |

19.65 |

0.877 |

458 |

| G019038 |

326847 |

5148970 |

Siltstone |

Subcrop |

19.05 |

0.763 |

582 |

| G019082 |

321640 |

5151163 |

Marble |

Mine Dump |

1.835 |

15.7 |

6.5 |

| G019093 |

320056 |

5149968 |

Quartz Vein |

Prospect Pit |

0.875 |

0.226 |

186 |

| G019094 |

320870 |

5147635 |

Sandstone |

Mine Dump |

0.073 |

1.5 |

222 |

| G019151 |

321361 |

5150388 |

Dolostone |

Outcrop |

0.787 |

15.05 |

15 |

| G019219 |

326817 |

5148809 |

Limestone |

Subcrop |

2.72 |

0.167 |

148 |

| G019225 |

326843 |

5148971 |

Siltstone |

Outcrop |

23.1 |

0.814 |

424 |

| G019235 |

321541 |

5148233 |

Limestone |

Mine Dump |

13.8 |

74.7 |

3810 |

| G019238 |

321545 |

5148248 |

Limestone |

Mine Dump |

2.19 |

9.45 |

359 |

| G019298 |

325631 |

5148102 |

Limestone |

Mine Dump |

4.00 |

0.259 |

161 |

| G019353 |

321592 |

5150732 |

Breccia |

Trench/Float |

2.63 |

26.6 |

55.2 |

| G019378 |

320281 |

5149152 |

Breccia |

Mine Dump |

0.329 |

0.487 |

157 |

| G019379 |

326830 |

5149873 |

Siltstone |

Mine Dump |

8.42 |

0.137 |

187 |

| G019422 |

325394 |

5148187 |

Siltstone |

Mine Dump |

7.88 |

0.301 |

134 |

| G019427 |

325610 |

5148683 |

Siltstone |

Float |

12.35 |

0.747 |

266 |

| G019447 |

323588 |

5150514 |

quartz vein |

Test Pit |

0.177 |

0.426 |

105 |

| G019465 |

326802 |

5149930 |

Siltstone |

Mine Dump |

16.1 |

0.007 |

9.5 |

Table 1. Highlight rock sample assay results for the 2025 exploration program

Summary

- Domestic completed successful mapping, sampling and prospecting at the Smart Creek Project. The new data will be coupled with a geophysical (MT/IP) program in advance of drilling scheduled for Q1/2026.

- Rock sample assays from outcrops, historic trenching, mines and workings demonstrate high-grade gold, copper, silver and zinc and confirms the project is prospective for porphyry copper deposits, carbonate replacement deposits (‘CRD’), skarn and exotic copper deposits.

- 39 samples (out of 310) exceed 0.5 g/t Au, 43 samples (out of 310) exceed 1 % Cu, 35 samples (out of 310) exceed 30 g/t Ag, 31 samples (out of 310) exceed 0.1% Zn.

- All targets (Sunrise Mine, Smart Creek, Radio Tower, Exotic Cu) are significantly expanded based on the results of the 2025 exploration program at the Project.

Figure 1. Project location, key targets, favourable geology, airborne magnetics, IP targets and highlight, selected high-grade rock samples from the 2025 surface sampling program at the Smart Creek Project

Figure 1. Project location, key targets, favourable geology, airborne magnetics, IP targets and highlight, selected high-grade rock samples from the 2025 surface sampling program at the Smart Creek Project

Domestic Metals 2025 Exploration Program Review

Domestic Metals completed a 40-day field campaign in August-September 2025 focused on geological mapping as well as several novel rock sampling techniques including: prospecting grab/composite grab samples and limestone sampling for trace metal vectoring. Sample subsets were also evaluated for alteration (slab and stain for potassic alteration related to porphyry mineralization), UV light evaluation (seeking metal contaminated calcite veins that can assist with vectoring toward CRD and porphyry mineralization), short-wave infrared evaluation (clay alteration vectoring) and portable XRF evaluation of iron oxide fracture fill (geochemical leakage vectoring technique to identify mineralization). Data from techniques other than the prospecting samples is currently being reviewed by Domestic Metals and will be the subject of future news release.

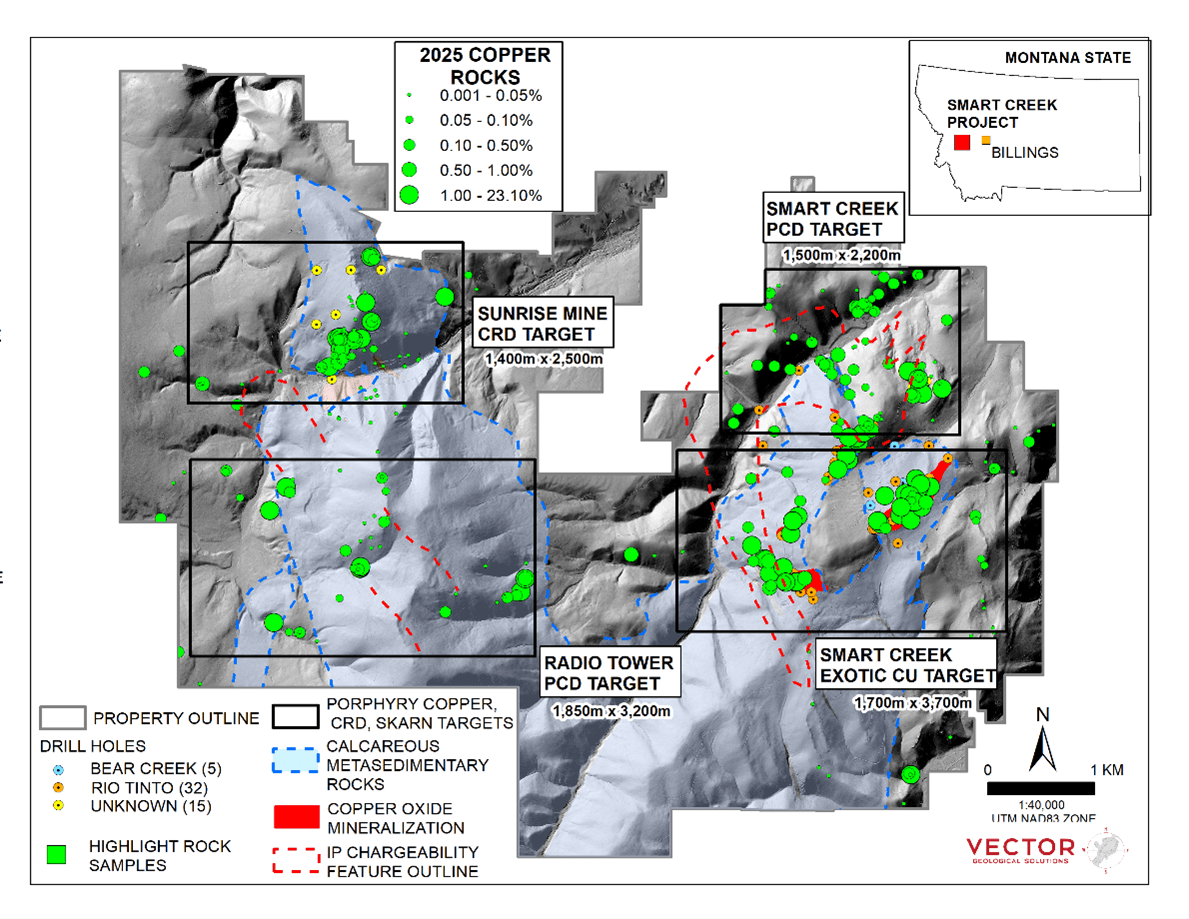

Figure 2. Property location, drill hole collars, favourable host rocks, IP targets, magnetic features and Surface rock sampling results (grab and composite grab samples) from the 2025 surface rock sampling program at the Smart Creek Project including copper geochemistry3

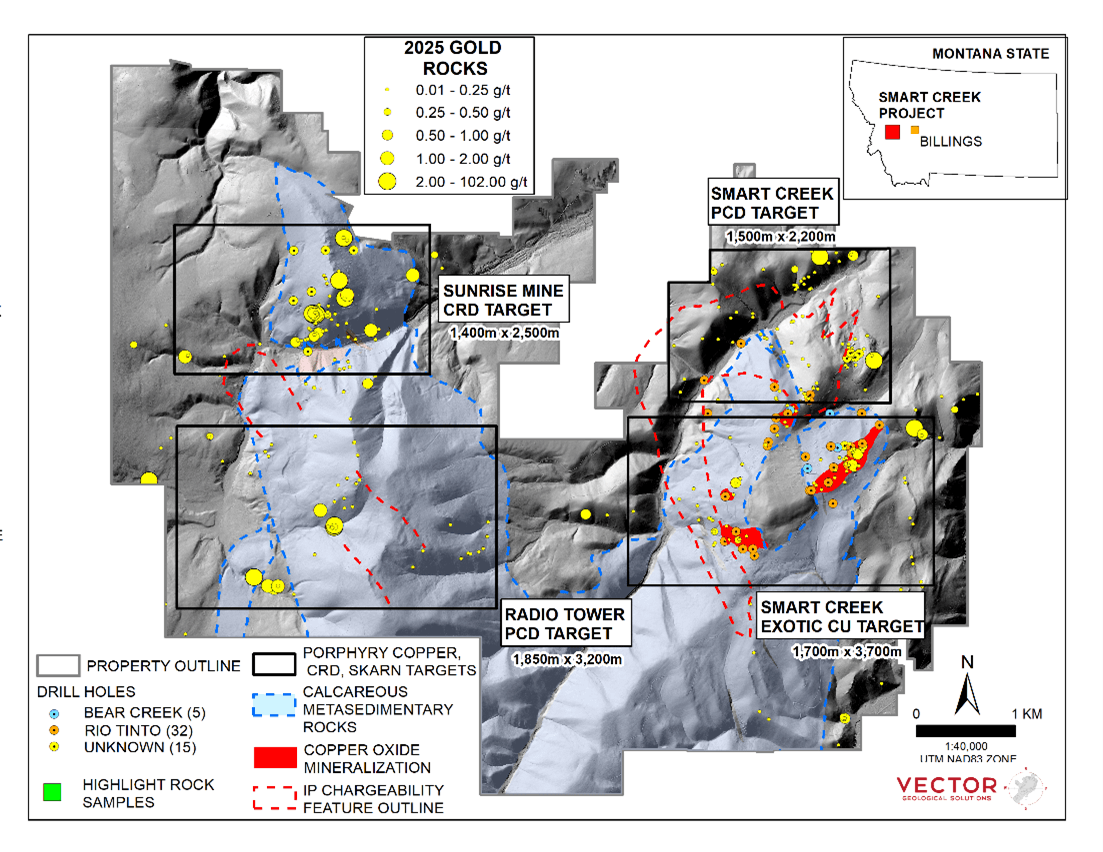

Figure 3. Property location, favourable host rocks, IP targets, magnetic features and Surface rock sampling results (grab and composite grab samples) from the 2025 surface rock sampling program at the Smart Creek Project including gold geochemistry3

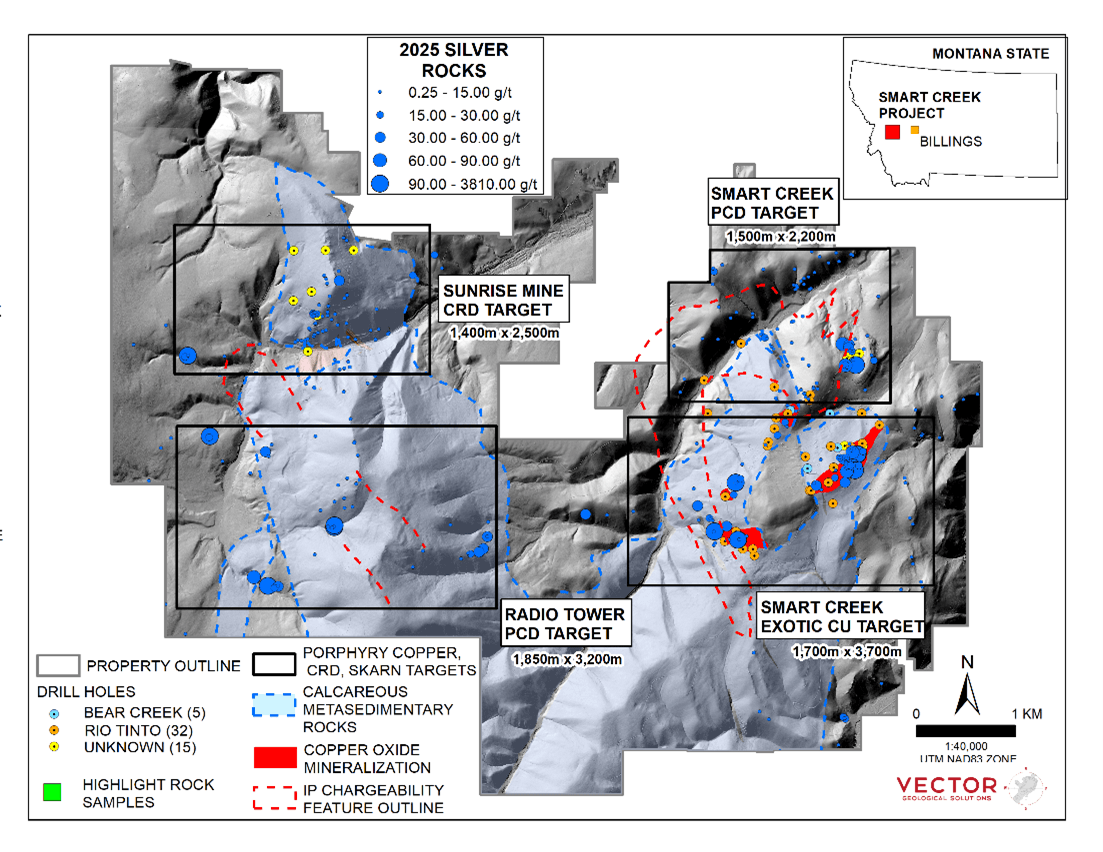

Figure 4. Property location, favourable host rocks, IP targets, magnetic features and Surface rock sampling results (grab and composite grab samples) from the 2025 surface rock sampling program at the Project including silver geochemistry3

Smart Creek Porphyry Copper Project

The Smart Creek Copper Porphyry Project is a joint venture with Rio Tinto, where Rio will retain 40% of the asset. Rio drilled around 26 of the 40 permitted sites over 2.5 years as they vector toward the centre of the porphyry and at the Smart Creek Target returned 109.73 meter @ 0.75% Cu, which included 89 metres of 0.97% Copper (SMCR0022; see NR dated August 20, 2024)3

Exceptional rock sample results have been received from the 2025 field work, which highlights several opportunities including porphyry, skarn, CRD and structurally-controlled gold.

Of particular interest, the Smart Creek project area is underlain by geology that is highly prospective for CRD style deposits:

- The Helena Fm silty limestones are superb reactive trap rocks.

- Heat and fluid sources are abundant in this prolific western Montana porphyry belt.

- The CRD signature alteration footprints are widespread at Smart creek (marble and manganese oxides).

- Massive to semi-massive sulfides with excellent metal tenor have been sampled and mapped on the property.

Major deposits in the carbonate-hosted clan can yield high unit-value deposits with an excellent pedigree in the western unit states. Examples include the Copper Queen CRD deposit in the Bisbee Arizona District which yielded historic production of 53 Mt @ 6% Cu1,2. The Domestic Metals technical team has extensive experience with this style of mineralization and will systematically explore for the CRD deposit style at the Project using modern toolkits.

The geochemical data is enhancing known target areas and is allowing Domestic Metals to identify targets for follow up diamond drilling scheduled for late Q1, 2026. New target areas have also been identified for target work-up.

Technical Information

All scientific and technical information in this news release has been reviewed and approved by Daniel MacNeil, P.Geo. Mr. MacNeil is a Technical Advisor to the Company and is a qualified person for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Mr. MacNeil has verified the data disclosed in this news release, including the assay and test data underlying the information or opinions contained in this news release. Mr. MacNeil verified the data disclosed (including previously released Domestic data underlying the information disclosed) in this news release by reviewing imported and sorted assay data; checking the performance of blank samples and certified reference materials; reviewing the variance in field duplicate results; and reviewing grade calculation formulas. Mr. MacNeil detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to in this news release.

Samples were coarse crushed, fine crushed to 70% <2mm, split using a Boyd rotary splitter, pulverized up to 250g 85% <75micrometers. Analysis was conducted following 4-acid digestion (34 elements ICP-AES; ME-ICP61). Gold was analysed by 30g fire assay – AA finish (Au-AA23). Overlimits were evaluated by Au-GRA21, Ag-OG62, Cu-OG62, Zn-OG62 and Ag-GRA21. The company used ALS Labs in Reno, Nevada.

Samples with certified reference materials were inserted at intervals for ~5% of the submitted samples (15 standards total). QAQC results are satisfactory for the standards.

Disclosure Notes

1 Briggs, D.F., 2015, History of the Warren (Bisbee) Mining District. Arizona Geological Survey Contributed Report CR-15-b, 8 p.

2 Past producing deposits and development projects shown outside of the Smart Creek land position provide geologic context for the Property, but this is not necessarily indicative that the Property hosts similar grades or tonnages of mineralization.

3 Data disclosed in this news release includes historical drilling results and information derived from historic drill results, Domestic Metals has not undertaken any independent investigation of the sampling, nor has it independently analyzed the results of the historical exploration work to verify the results. Domestic considers these historical data relevant as the Company is using this data as a guide to plan exploration programs. The Company’s current and future exploration work includes verification of the historical data through drilling.

About Domestic Metals Corp.

Domestic Metals Corp. is a mineral exploration company focused on the discovery of large-scale, copper and gold deposits in exceptional, historical mining project areas in the Americas.

The Company aims to discover new economic mineral deposits in historical mining districts that have seen exploration in geologically attractive mining jurisdictions, where economically favorable grades have been indicated by historic drilling and outcrop sampling.

The Smart Creek Project is strategically located in the mining-friendly state of Montana, containing widespread copper mineralization at surface and hosts 4 attractive porphyry copper, epithermal gold, replacement and exotic copper exploration targets with excellent host rocks for mineral deposition.

Domestic Metals Corp. is led by an experienced management team and an accomplished technical team, with successful track records in mine discovery, mining development and financing.

On behalf of Domestic Metals Corp.

Gord Neal, CEO and Director

(604) 657 7813

Follow us on:

X, LinkedIn, Facebook and Instagram

For more information on Domestic Metals, please contact:

Gord Neal, Phone: 604 657-7813 or Michael Pound, Phone: 604 363-2885

Please visit the Company website at www.domesticmetals.com or contact us at info@domesticmetals.com.

For all investor relations inquiries, please contact:

John Liviakis, Liviakis Financial Communications Inc., Phone: 415-389-4670

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain statements that may be deemed ‘forward-looking statements’. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words ‘expects’, ‘plans’, ‘anticipates’, ‘believes’, ‘intends’, ‘estimates’, ‘projects’, ‘potential’ and similar expressions, or that events or conditions ‘will’, ‘would’, ‘may’, ‘could’ or ‘should’ occur. Forward-looking statements may include, without limitation, statements relating to the Company’s continued stock exchange listings and the planned exploration activities on properties. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to: competition within the industry; actual results of current exploration activities; environmental risks; changes in project parameters as plans continue to be refined; future price of commodities; failure of equipment or processes to operate as anticipated; accidents, and other risks of the mining industry; delays in obtaining approvals or financing; risks related to indebtedness and the service of such indebtedness; as well as those factors, risks and uncertainties identified and reported in the Company’s public filings under the Company’s SEDAR+ profile at www.sedarplus.ca. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/a41d6bcd-69fe-4f0b-85af-76aaa957307a

https://www.globenewswire.com/NewsRoom/AttachmentNg/1c35f7df-07e5-4ae2-82ae-67c722ab5dda

https://www.globenewswire.com/NewsRoom/AttachmentNg/9bed90eb-3138-42ab-aada-5b9ae17c08f7

https://www.globenewswire.com/NewsRoom/AttachmentNg/347ace2f-f035-47dc-9be9-865cf8d9fd06

Figure 1. Project location, key targets, favourable geology, airborne magnetics, IP targets and highlight, selected high-grade rock samples from the 2025 surface sampling program at the Smart Creek Project

Figure 1. Project location, key targets, favourable geology, airborne magnetics, IP targets and highlight, selected high-grade rock samples from the 2025 surface sampling program at the Smart Creek Project