The Trump administration is taking aim at ultra-processed foods while reversing long-held U.S. government stances on red meat and saturated fats.

‘The Trump administration is now updating federal nutrition standards and guidelines to ensure that Americans have the most accurate, data-driven information supported by science and hard facts, not special interests or partisan ideology,’ White House Press Secretary Karoline Leavitt told reporters.

Leavitt said that the guidelines would impact what is served in public schools, what American servicemembers eat and what food is distributed through government programs.

‘Faulty dietary guidelines of the past stack the deck against healthy eating and food options for everyday American families, which has fueled the chronic disease epidemic and jacked up the health care costs of households across the country,’ Leavitt added. ‘When these guidelines are followed, Americans will be saving themselves thousands of dollars. If we want to cut health care costs in our country, we must become a healthier country… A healthier America will lead to a more affordable America.’

The Department of Health and Human Services (HHS) announced the new guidelines with an updated, inverted food pyramid. The top of the pyramid, which is now the wider part of the structure, is built on meat, fats, fruits and vegetables, while whole grains are at the narrow bottom.

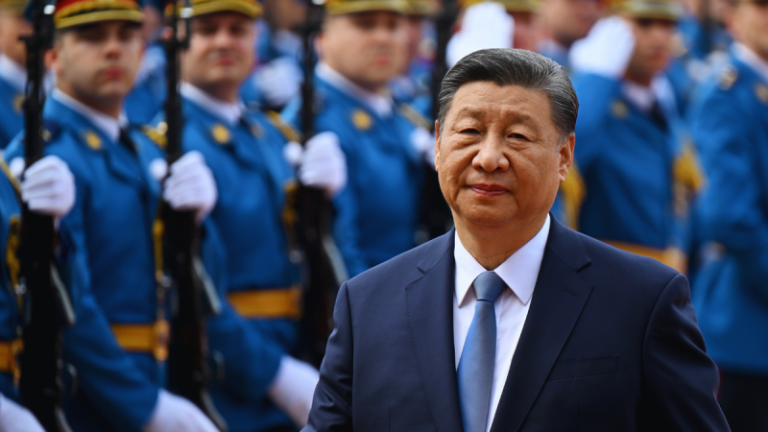

HHS Secretary Robert F. Kennedy Jr. has made overhauling the U.S. food supply a crucial focus of his ‘Make America Healthy Again’ (MAHA) agenda, which is aimed at addressing chronic disease and childhood illnesses. The secretary has argued that the nation’s food practices have harmed Americans and led to skyrocketing healthcare costs.

‘The new guidelines recognize that whole, nutrient-dense food is the most effective path to better health and lower health care costs,’ Kennedy said. ‘Protein and healthy fats are essential, and were wrongly discouraged in prior dietary guidelines. We are ending the war on saturated fats.’

The HHS secretary railed against refined carbohydrates, food additives and added sugar, highlighting the health risks associated with sugar-sweetened beverages. Kennedy’s main message to Americans was to ‘eat real food.’

Kennedy framed the issue as not only one about health, but also one of national security.

‘If a foreign adversary sought to destroy the health of our children, cripple our economy, to weaken our national security, there would be no better strategy than to addict us to ultra-processed foods,’ he said.

Agriculture Secretary Brooke Rollins also joined the briefing. She praised Secretary Kennedy’s work and highlighted the role that farmers would play in making America healthy again.

‘We are finally putting real food back at the center of the American diet. Real food that nourishes the body, restores health, fuels energy and builds strength,’ Rollins said. ‘This pivot also leans into the abundant, affordable and healthy food supply already available from America’s incredible farmers and ranchers. By making milk, raising cattle, and growing wholesome fruits, vegetables, and grains, they hold the key to solving our national health crisis.’

FDA Commissioner Dr. Marty Makary emphasized the harm that old guidelines did to the health of everyday Americans. He noted that protein guidelines in particular were far too low for America’s children.

‘We have 40% of our kids now with a chronic disease. It is not their fault. This is something that is the result of bad advice from the government and a medical establishment that for decades peddled research from a flawed 1960s model,’ Makary said. ‘This is not a willpower problem for our nation’s kids. This is something adults have done to kids, and we’re going to fix it.’

Makary agreed with Centers for Medicare & Medicaid Services Administrator Dr. Mehmet Oz that the best way for the U.S. to reduce drug spending is for Americans to focus on diet and health with the goal of not taking medications that they do not need.

The new guidance comes in stark contrast to the Dietary Guidelines Advisory Committee’s report released in the final days of President Joe Biden’s term, which garnered criticism over a lack of directives on ultra-processed foods.

This is a developing story. Please check back for updates.