Nobel Resources Corp. (TSX V: NBLC) (the ‘Company’ or ‘Nobel’) is pleased to announce commencement of mobilization by the Company’s diamond drill contractor to the Cuprita copper project (‘Cuprita’ or the ‘Project’) and drilling will commence during the week of January 12th. All necessary permits for this initial drilling at Cuprita have been received from the local authorities.

Larry Guy, Chairman and CEO of Nobel, states: ‘During 2025, our technical team identified highly prospective near surface copper targets at the Cuprita project. We are excited to commence drilling this large-scale, mineralized alteration system characterized by widespread copper minerals in outcrop. Nobel is the first company to drill test Cuprita, a copper project with exciting potential, in a prolific copper mining region of Chile. This is a fabulous start to 2026 for the Company.’

About Cuprita

Cuprita is a highly prospective copper porphyry project in the Atacama region of northern Chile. Cuprita is part of the Metallogenic Paleocene Porphyry Copper Belt that hosts several major porphyry copper deposits such as El Salvador, Cerro Colorado, Spence, Sierra Gorda, Fortuna, as well as several gold deposits. The Project sits on a very important north-northeast trending major structural corridor crosscut by a Northwest trending secondary structure. This structural setting is almost identical to the structural setting of the world class Spence, Sierra Gorda and El Salvador porphyry deposits to the north. Nobel geologists have identified multiple key geologic characteristics consistent with a potentially buried porphyry.

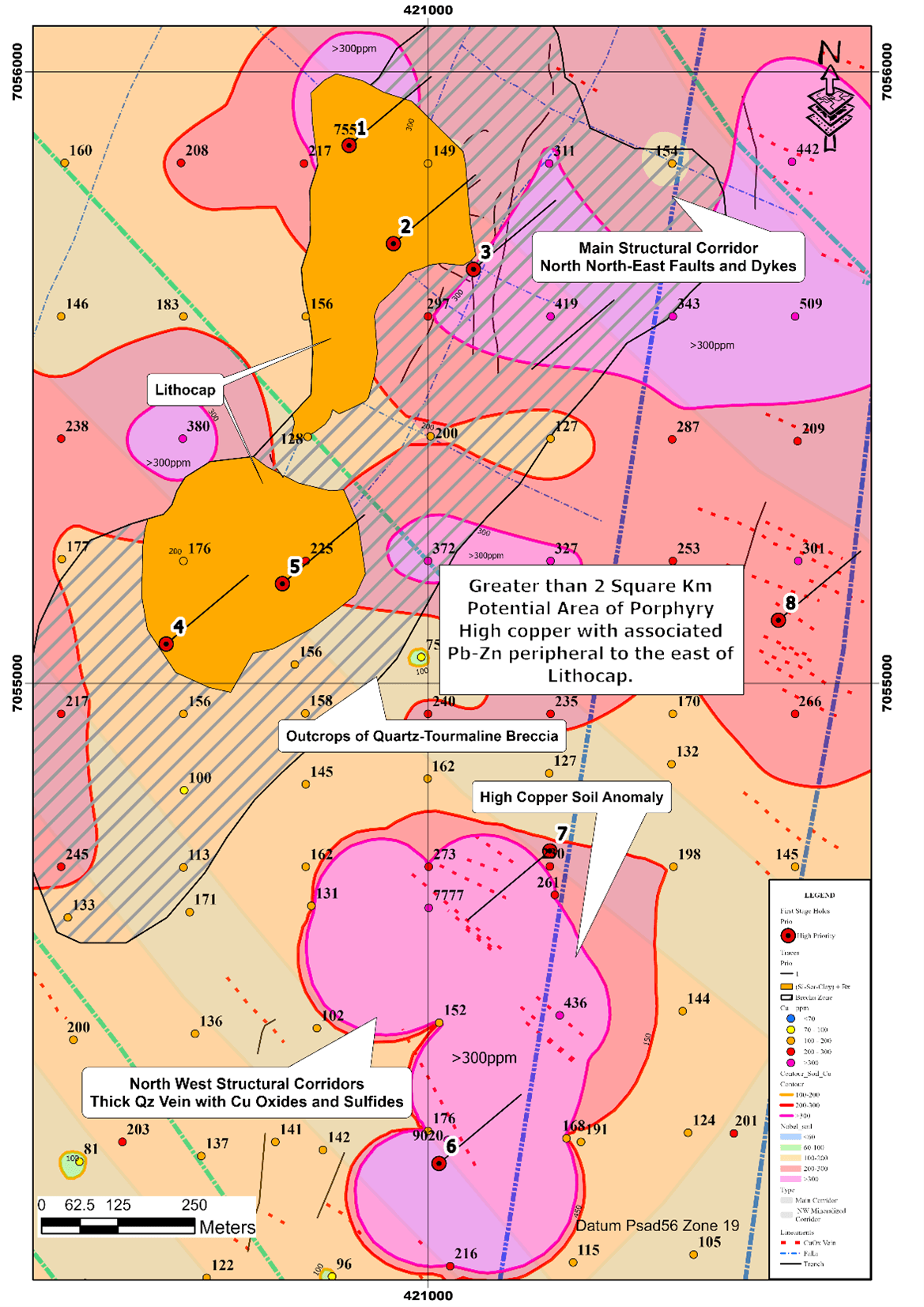

During the 2025 field campaigns, Nobel geologists identified a leach cap at Cuprita with an associated copper, lead and zinc anomaly in soils. The leach cap and soil anomaly are located adjacent to a ground magnetic low and are situated near the intersection of a major north-northeast striking fault structure with numerous northwest striking quartz veins with copper oxides. Intersecting major faults is a common, if not essential, structural control for the emplacement of copper-gold porphyries in the region (Figure 1).

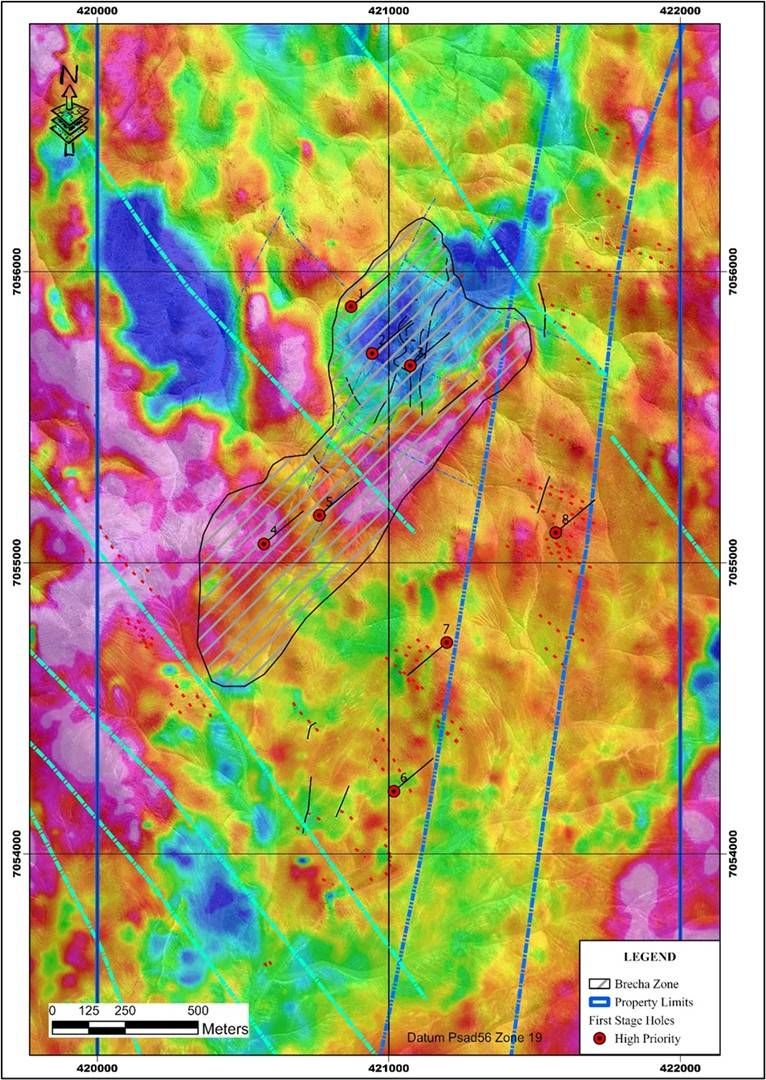

The presence of strongly anomalous copper in soil on the flanks of the leach cap is an important positive indicator supporting the potential for a buried mineralized porphyry deposit at the Cuprita project. The highest copper in soils values identified to date occur southeast of the outcropping leach cap (Figure 1). Much of the soil anomaly exhibits soil values more than 300% above the expected background levels of the area. In addition, the leach cap and soils anomaly are coincidental with a ground magnetic low (figure 2) which is a common indicator associated with mineralized systems in the region, where hydrothermal processes have replaced the magnetic minerals.

The presence of a leach cap at Cuprita is exceptionally encouraging in a regional context. Leach caps are a key feature of intact porphyry systems in this region (Figure 3, Conceptual Model). Recirculation of acidic fluids from the buried porphyry below often leave a bleached or iron oxide ‘rusty’ appearance on surface. The leach cap identified by Nobel geologists exhibits classic hydrothermal alteration similar to that found above a buried porphyry. The presence of copper oxides, quartz veins and remanent sulfides indicates potential for mineralization under the leach cap, which fits the classic geological model for the region.

Geological mapping has also identified a large area of tourmaline breccias covering much of the target, also considered an additional favorable pathfinder, characteristic of productive porphyry systems.

Figure 1: Compilation map showing the drill hole collars in relation to the extensive leached cap (lithocap) and associated structures, quartz-copper veins, soil geochemical anomalies, tourmaline breccias associated with a magnetic low, that comprise the key criteria for a mineralized porphyry target.

Figure 2: Location of the proposed prioritized drill holes in the most prospectives identified zones showing geophysical mag anomaly and outcropping mineralized veins.

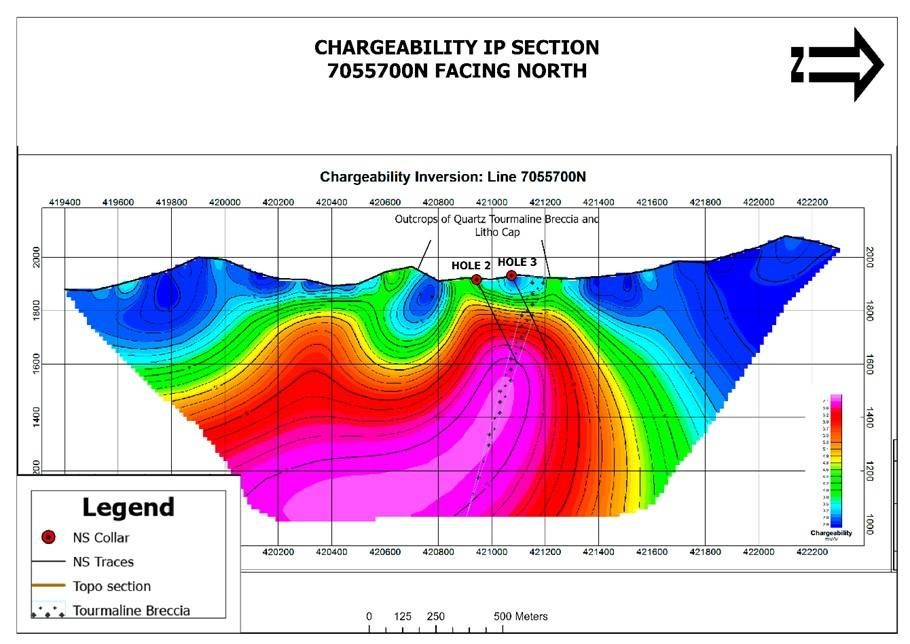

Figure 3: Section View IP 7055700N Chargeability Inversion. Projected proposed drill holes 2 and 3.

Grant of Stock Options and Restricted Share Units

Nobel has issued a total of 3,900,000 stock options (‘Options’) to purchase common shares of the Company to certain officers and directors pursuant to the Company’s Stock Option Plan. Such Options are exercisable into common shares of the Company at an exercise price of $0.05 per common share for a period of three years from the date of grant.

In addition, the Company has issued a total of 3,600,000 restricted share units (‘RSUs’) to certain directors and officers of the Company in accordance with the Company’s Restricted Share Unit and Deferred Unit Plan. The RSUs will vest annually in equal installments over a three-year period beginning on the one-year anniversary of the grant date.

The grant of the Options and the RSUs is subject to the approval of the TSX Venture Exchange.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. David Gower, P.Geo., as defined by National Instrument 43-101 of the Canadian Securities Administrators. Mr. Gower is a consultant of Nobel and is not considered independent of the Company.

About Nobel

Nobel Resources is a Canadian resource company focused on identifying and developing prospective mineral projects. The Company has a team with a strong background of exploration success.

For further information, please contact:

Lawrence Guy

Chairman and Chief Executive Officer

+1 647-276-0533

Vincent Chen

Investor Relations

vchen@nobel-resources.com

www.nobel-resources.com

Cautionary Note Regarding Forward-Looking Information

This press release contains ‘forward-looking information’ within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, the mineralization and prospectivity of the Project, the Company’s ability to explore and develop the Project, the Company’s exploration program, the granting of compensation securities, the Company’s ability to obtain adequate financing and the Company’s future plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as ‘plans’, ‘expects’ or ‘does not expect’, ‘is expected’, ‘budget’, ‘scheduled’, ‘estimates’, ‘forecasts’, ‘intends’, ‘anticipates’ or ‘does not anticipate’, or ‘believes’, or variations of such words and phrases or state that certain actions, events or results ‘may’, ‘could’, ‘would’, ‘might’ or ‘will be taken’, ‘occur’ or ‘be achieved’. Forward- looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nobel, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: general business, economic, competitive, geopolitical and social uncertainties; the actual results of current exploration activities; risks associated with operation in foreign jurisdictions; ability to successfully integrate the purchased properties; foreign operations risks; and other risks inherent in the mining industry. Although Nobel has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Nobel does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e2e2f879-a393-486f-b72a-fb122a1a50b7

https://www.globenewswire.com/NewsRoom/AttachmentNg/89a960f8-26b5-4399-8ed7-b11223425754

https://www.globenewswire.com/NewsRoom/AttachmentNg/15cf79bc-e3ab-49b8-8b54-fe06f4685844

News Provided by GlobeNewswire via QuoteMedia