Radisson Mining Resources Inc. (TSXV: RDS,OTC:RMRDF) (OTCQX: RMRDF) (‘Radisson’ or the ‘Company’) is pleased to announce assay results from six new drill holes completed at its 100%-owned O’Brien Gold Project (‘O’Brien’ or the ‘Project’) located in the Abitibi region of Québec. The six holes are the latest completed as part of the Company’s ongoing 140,000-metre step-out drill program designed to test the overall scope of gold mineralization at the Project (see Radisson news release dated October 16, 2025). Two of the holes represent the twelfth and thirteenth directional wedges completed from pilot hole OB-24-337 and serve to expand the broad area of new high-grade mineralization being delineated across multiple veins beneath the historic O’Brien Gold Mine. All six of the holes released today intersected gold mineralization, and five of the holes returned intercepts with grades and thicknesses consistent with the Project’s existing mineral resources, continuing the very high success rate of the current drill program. Highlights include:

-

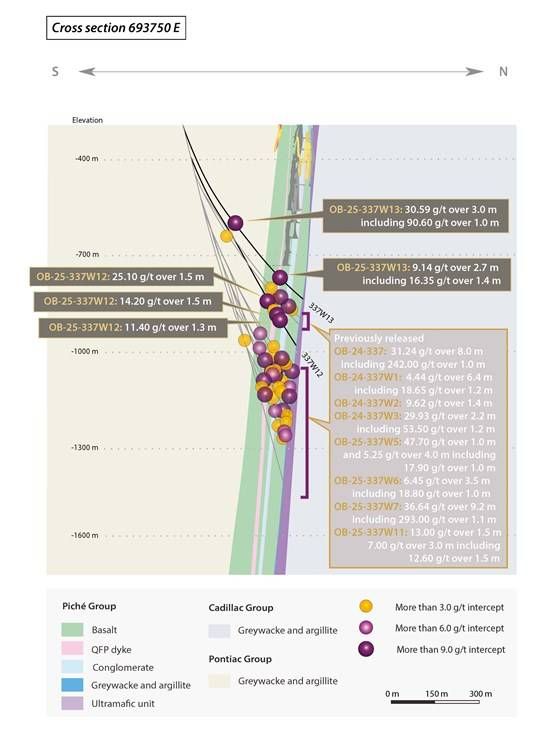

OB-25-337W13 intersected 90.60 grams per tonne (‘g/t’) gold (‘Au’) over 1.0 metre within a mineralized interval averaging 30.59 g/t Au over 3.0 metres and 9.14 g/t Au over 2.7 metres, including 16.35 g/t Au over 1.4 metres;

-

OB-25-337W12 intersected 25.10 g/t Au over 1.5 metres and 14.20 g/t Au over 1.5 metres and 11.40 g/t Au over 1.3 metres;

-

OB-25-322W2 intersected 3.11 g/t Au over 8.0 metres including 5.93 g/t Au over 1.5 metres and 3.62 g/t Au over 4.0 metres including 6.33 g/t Au over 1.5 metres;

-

OB-25-322W1 intersected 4.02 g/t Au over 4.5 metres, including 8.29 g/t Au over 1.5 metres;

Matt Manson, President and CEO: ‘Today we are releasing six new drill holes from our ongoing deep step-out drill program at O’Brien. These continue to illustrate the extension of the Project’s system of gold mineralization below the historic O’Brien mine and the current mineral resources. Of particular note are the two new wedges completed from pilot hole OB-24-337 located beneath the former mine’s final stope. These are the twelfth and thirteenth such wedges completed. Once again, we are seeing multiple high-grade intercepts of quartz-sulphide veins within broader alteration envelopes. This represents a system of gold mineralization that we have modelled as up to six veins delineated over a 250-metre (east-west) by 500-metre (vertical) area that remains open. With this step-out drill program we are steadily pushing the limits of known mineralization at O’Brien outwards and downwards. Overall, we have now completed 74 drill holes in the 140,000 metres program, 61 of which have intersected mineralization with grades and thicknesses consistent with the Project’s current mineral resources, an 82% success rate. As we start 2026, we will be operating seven drill rigs at site and ramping up to our eighth rig presently. Twelve additional step-out drill holes, including the final OB-24-337 wedges, have been completed and are awaiting assays.’

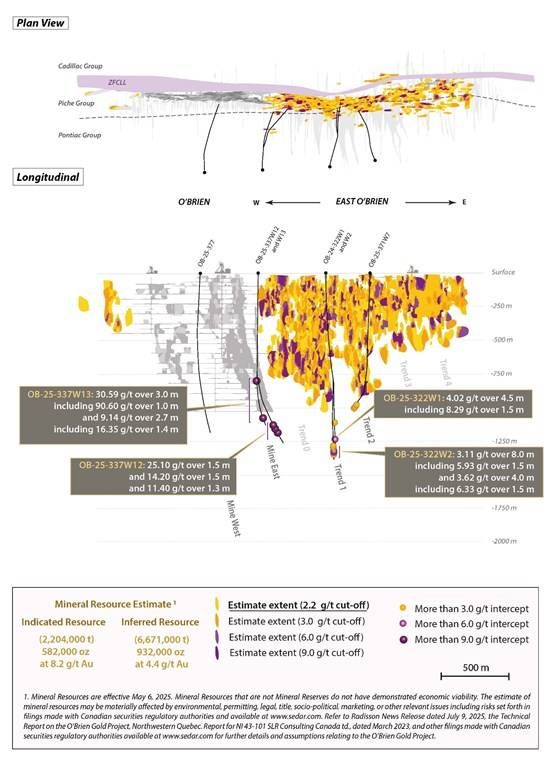

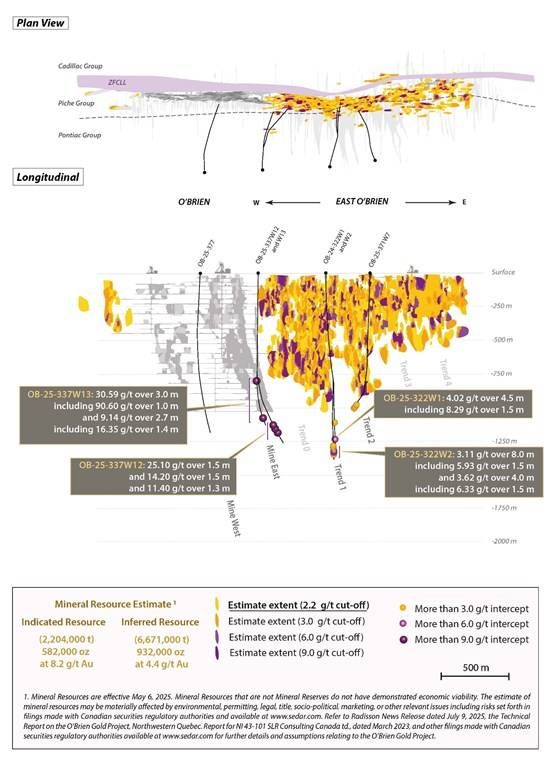

Figure 1: Longitudinal Vertical Section and Plan View of Gold Vein Mineralization and Mineral Resources at the O’Brien Gold Project, with Today’s Drill Holes Illustrated

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/279548_fc1f5b478496fb3e_001full.jpg

Table 1: Assay Results from Select Drill Holes

| DDH |

Zone |

|

From (m) |

To (m) |

Core Length (m) |

Au g/t – Uncut |

Host Lithology |

| OB-25-322W1 |

Trend #1 |

|

1,226.0 |

1,227.5 |

1.50 |

3.88 |

V3-S |

| |

1,359.5 |

1,364.0 |

4.50 |

4.02 |

S1p |

| Including |

1,362.5 |

1,364.0 |

1.50 |

8.29 |

S1p |

| OB-25-322W2 |

Trend #1 |

|

1,401.0 |

1,402.0 |

1.00 |

2.82 |

POR-S |

| |

1,409.0 |

1,410.5 |

1.50 |

3.61 |

S1p |

| |

1,421.0 |

1,429.0 |

8.00 |

3.11 |

S1p |

| Including |

1,424.5 |

1,426.0 |

1.50 |

5.93 |

S1p |

| |

1,434.5 |

1,438.5 |

4.00 |

3.62 |

S1p |

| Including |

1,435.5 |

1,437.0 |

1.50 |

6.33 |

S1p |

| |

1,465.0 |

1,466.5 |

1.50 |

3.67 |

POR-N |

| OB-25-337W12 |

O’Brien Mine

East |

|

1,274.5 |

1,276.0 |

1.50 |

25.10 |

V3-S |

| |

1,293.5 |

1,295.0 |

1.50 |

3.50 |

POR-S |

| |

1,306.5 |

1,308.0 |

1.50 |

14.20 |

POR-S |

| |

1,318.7 |

1,320.0 |

1.30 |

11.40 |

V3-CEN |

| OB-25-337W13 |

O’Brien Mine

East |

|

862.0 |

865.0 |

3.00 |

30.59 |

PON-S3 |

| Including |

864.0 |

865.0 |

1.00 |

90.60 |

PON-S3 |

| |

1,211.5 |

1,214.2 |

2.70 |

9.14 |

POR-S |

| Including |

1,212.8 |

1,214.2 |

1.40 |

16.35 |

POR-S |

| OB-25-371W7 |

Trend #2 |

|

1,143.2 |

1,144.7 |

1.50 |

3.94 |

S1p |

| |

1,152.5 |

1,154.0 |

1.50 |

4.61 |

POR-N |

| |

1,169.9 |

1,171.4 |

1.50 |

3.51 |

V3-N |

Notes on Calculation of Drill Intercepts:

The O’Brien Gold Project Mineral Resource Estimate effective May 6, 2025 (‘MRE’) utilizes a 2.20 g/t Au bottom cut-off, a US$2,000 gold price, a minimum mining width of 1.2 metres, and a 40 g/t Au upper cap on composites. Intercepts presented in Table 1 are calculated with a 3.00 g/t Au bottom cut-off. True widths, based on depth of intercept and drill hole inclination, are estimated to be 30-80% of core length. Table 2 presents additional drill intercepts calculated with a 1.00 g/t bottom cut-off over a minimum 1.0 metre core length so as to illustrate the frequency and continuity of mineralized intervals within which high-grade gold veins at O’Brien are developed. Lithology Codes: PON-S3: Pontiac Sediments; V3-S, V3-N, V3-CEN: Basalt-South, North, Central; S1P, S3P: Conglomerate; POR-S, POR-N: Porphyry South, North; TX: Crystal Tuff; ZFLLC: Larder Lake-Cadillac Fault Zone.

Gold Mineralization at O’Brien

Gold mineralizing quartz-sulphide veins at O’Brien occur within a thin band of interlayered mafic volcanic rocks, conglomerates, and porphyritic andesitic sills of the Piché Group occurring in contact with the east-west oriented Larder Lake-Cadillac Break (‘LLCB’). Gold, along with pyrite and arsenopyrite, is typically associated with shearing and a pervasive biotite alteration, and developed within multiple Piché Group lithologies and, occasionally, the hanging-wall Pontiac and footwall Cadillac meta-sedimentary rocks.

As mapped at the historic O’Brien mine, and now replicated in the modern drilling, individual veins are generally narrow, ranging from several centimetres up to several metres in thickness. Multiple veins occur sub-parallel to each other, as well as sub-parallel to the Piché lithologies and the LLCB. Individual veins have well-established lateral continuity, with near-vertical, high-grade shoots developed over significant lengths. Based on the historic data available, it is clear that the former mine was ‘high-graded’, with mining focussed on a main central stope and parallel veins identified but left undeveloped.

The historic O’Brien mine produced over half a million ounces of gold from such veins and shoots at an average grade exceeding 15 g/t Au and over a vertical extent of at least 1,000 metres. Modern exploration has focussed on delineating well developed vein mineralization to the east of the historic mine, with additional high-grade shoots becoming evident in the exploration data over what has been described as a series of repeating trends (‘Trend #s 0 to 5’).

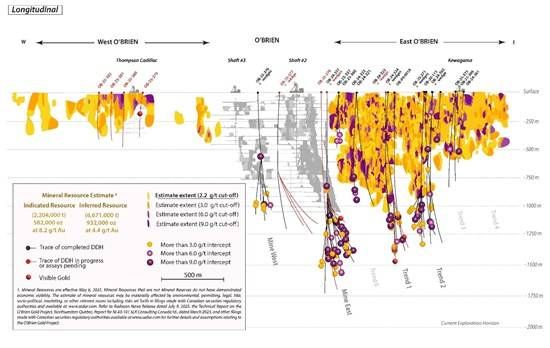

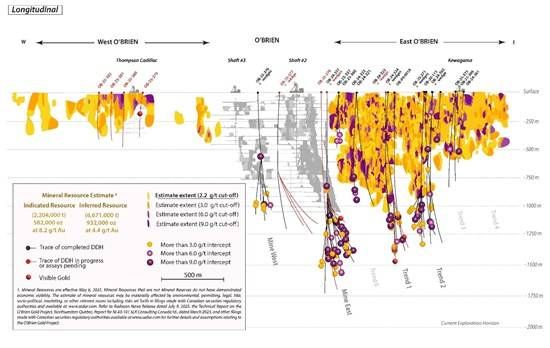

Figure 2: Deep Step-Out Drill Holes Completed and/or Published by the Company since December 2024

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/279548_fc1f5b478496fb3e_003full.jpg

Step-Out Drilling at O’Brien

Since the end of 2024, Radisson has been pursuing a program of broad step-outs beneath the historic O’Brien Gold mine and the existing mineral resources designed to test the extent of mineralization at the Project. This drilling is accomplished with pilot holes followed by wedges and directional drilling to maximize drill efficiency. On October 16, 2025, Radisson announced the expansion of the step-out drill program to 140,000 metres employing an eventual eight drill rigs.

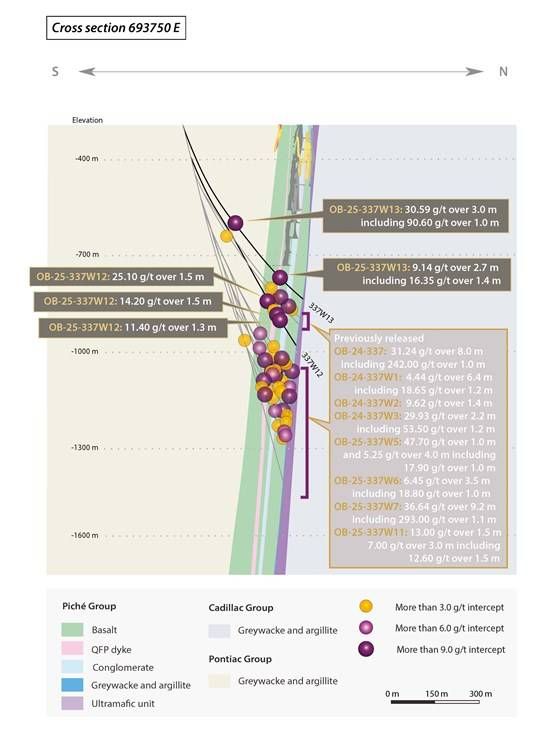

The origin of the step-out drill program was the deep pilot hole OB-24-337, which was the first exploration drill hole located below the former mine workings since mining ended in 1957. This hole intersected 31.24 g/t Au over 8.0 metres, including 242.0 g/t Au over 1.0 metre at approximately 1,500 metres vertical depth (see Radisson news release dated December 16, 2024). With today’s results, assay results from a total of thirteen wedges from OB-24-337 have now been reported and up to six gold-bearing veins have been delineated over an area of approximately 250 metres (east-west) by 500 metres (vertical). The thirteenth wedge, released today, intersected 9.14 g/t Au over 2.7 metres including 16.35 g/t Au over 1.4 metres within Piché rocks just 40 metres below the final historic mining stope (Figures 1 and 3). The final two wedges, the fourteenth and fifteenth, have been completed and assay results are expected shortly. Future drilling in this area will utilize new pilot holes and wedge extensions to test the full scope of mineralization down to 2 kilometres depth.

Figure 3: Vertical Cross Section through the Historic O’Brien Mine with Deep Pilot Hole OB-24-337 and Wedges OB-25-337W1 to W13

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10977/279548_fc1f5b478496fb3e_004full.jpg

Table 2: Detailed Assay Results (see ‘Notes on Calculation of Drill Intercepts’)

| DDH |

Zone |

|

From (m) |

To (m) |

Core Length (m) |

Au g/t – Uncut |

Host Lithology |

| OB-25-322W1 |

Trend #1 |

|

1,226.0 |

1,227.5 |

1.50 |

3.88 |

V3-S |

| |

1,285.5 |

1,287.0 |

1.50 |

1.05 |

V3-S |

| |

1,315.2 |

1,322.5 |

7.30 |

1.14 |

POR-S |

| |

1,331.5 |

1,337.5 |

6.00 |

1.42 |

POR-S |

| |

1,349.0 |

1,353.5 |

4.50 |

1.77 |

S1p |

| |

1,359.5 |

1,364.0 |

4.50 |

4.02 |

S1p |

| Including |

1,362.5 |

1,364.0 |

1.50 |

8.29 |

S1p |

| |

1,371.5 |

1,373.0 |

1.50 |

1.80 |

S1p |

| |

1,390.0 |

1,391.0 |

1.00 |

2.22 |

V3-N |

| OB-25-322W2 |

Trend #1 |

|

1,401.0 |

1,402.0 |

1.00 |

2.82 |

POR-S |

| |

1,409.0 |

1,410.5 |

1.50 |

3.61 |

S1p |

| |

1,415.0 |

1,416.5 |

1.50 |

2.37 |

S1p |

| |

1,421.0 |

1,429.0 |

8.00 |

3.11 |

S1p |

| Including |

1,424.5 |

1,426.0 |

1.50 |

5.93 |

S1p |

| |

1,434.5 |

1,438.5 |

4.00 |

3.62 |

S1p |

| Including |

1,435.5 |

1,437.0 |

1.50 |

6.33 |

S1p |

| |

1,450.5 |

1,451.6 |

1.10 |

2.36 |

S1p |

| |

1,465.0 |

1,468.0 |

3.00 |

2.93 |

POR-N/V3-N |

| |

1,465.0 |

1,466.5 |

1.50 |

3.67 |

POR-N |

| OB-25-337W12 |

O’Brien Mine

East |

|

1,262.5 |

1,264.0 |

1.50 |

1.78 |

V3-S |

| |

1,267.0 |

1,268.5 |

1.50 |

1.39 |

V3-S |

| |

1,274.5 |

1,276.0 |

1.50 |

25.10 |

V3-S |

| |

1,281.8 |

1,283.3 |

1.50 |

1.17 |

V3-S |

| |

1,293.5 |

1,299.0 |

5.50 |

1.53 |

POR-S |

| Including |

1,293.5 |

1,295.0 |

1.50 |

3.50 |

POR-S |

| |

1,306.5 |

1,308.0 |

1.50 |

14.20 |

POR-S |

| |

1,313.2 |

1,317.7 |

4.50 |

1.01 |

V3-CEN |

| |

1,318.7 |

1,320.0 |

1.30 |

11.40 |

V3-CEN |

| |

1,378.5 |

1,379.9 |

1.40 |

1.04 |

POR-N |

| |

1,388.5 |

1,391.5 |

3.00 |

1.34 |

V3-N |

| OB-25-337W13 |

O’Brien Mine

East |

|

862.0 |

865.0 |

3.00 |

30.59 |

PON-S3 |

| Including |

864.0 |

865.0 |

1.00 |

90.60 |

PON-S3 |

| |

1,211.5 |

1,214.2 |

2.70 |

9.14 |

POR-S |

| Including |

1,212.8 |

1,214.2 |

1.40 |

16.35 |

POR-S |

| |

1,263.1 |

1,265.5 |

2.40 |

1.25 |

V3-N |

| |

1,279.0 |

1,280.5 |

1.50 |

1.03 |

V3-N |

| OB-25-371W7 |

Trend #2 |

|

1,092.5 |

1,095.5 |

3.00 |

1.25 |

V3-S |

| |

1,120.0 |

1,121.5 |

1.50 |

1.60 |

V3-S |

| |

1,141.8 |

1,147.0 |

5.20 |

2.36 |

V3-CEN/S1p |

| Including |

1,143.2 |

1,144.7 |

1.50 |

3.94 |

S1p |

| |

1,152.5 |

1,154.0 |

1.50 |

4.61 |

POR-N |

| |

1,168.4 |

1,171.4 |

3.00 |

2.90 |

V3-N |

| Including |

1,169.9 |

1,171.4 |

1.50 |

3.51 |

V3-N |

| OB-25-377 |

O’Brien Mine

West |

|

767.0 |

768.0 |

1.00 |

1.46 |

PON-S3 |

| |

791.0 |

792.0 |

1.00 |

1.08 |

PON-S3 |

| |

1,151.5 |

1,153.0 |

1.50 |

1.71 |

V3-S |

| |

1,191.0 |

1,192.1 |

1.10 |

1.63 |

V3-CEN |

| |

1,230.9 |

1,232.4 |

1.50 |

1.01 |

S1p |

| |

1,248.8 |

1,250.1 |

1.30 |

1.58 |

S1p |

| |

1,262.2 |

1,263.3 |

1.10 |

1.52 |

POR-N |

| |

1,310.0 |

1,311.0 |

1.00 |

1.46 |

V3-N |

Table 3: Drill Hole Collar Information for Holes contained in this News Release

| DDH |

Zone |

Easting |

Northing |

Azimuth |

Dip |

Hole Length (m) |

| OB-25-322W1 |

Trend #1 |

694199 |

5345098 |

1 |

-85.0 |

627.0 |

| OB-25-322W2 |

Trend #1 |

694199 |

5345098 |

1 |

-85.0 |

687.0 |

| OB-25-337W12 |

O’Brien Mine East |

693700 |

5345070 |

346 |

-79.5 |

651.5 |

| OB-25-337W13 |

O’Brien Mine East |

693700 |

5345070 |

346 |

-79.5 |

710.0 |

| OB-25-371W7 |

Trend #2 |

694531 |

5345147 |

334 |

-82.0 |

347.0 |

| OB-25-377 |

O’Brien Mine West |

693272 |

5345054 |

345 |

-79.5 |

1337.0 |

Notes:

Hole lengths for wedges represent meterage from point of wedge. Drill hole OB-24-337 was completed in 2024 while its wedge branches were drilled in 2025.

Today’s results also include the first and second wedges completed from pilot drill hole OB-24-322, which intersected high-grade mineralization on the downwards extension of Trend #1 at 1,280 metres and 1,360 metres vertical depth, respectively. These two wedges appear to have intersected the same mineralized zone over a vertical separation of 80 metres, returning similar intercepts of 4.02 g/t Au over 4.5 metres, including 8.29 g/t Au over 1.5 metres (OB-25-322W1) and 3.11 g/t Au over 8.0 metres including 5.93 g/t Au over 1.5 metres and 3.62 g/t Au over 4.0 metres including 6.33 g/t Au over 1.5 metres (OB-25-322W2). Additional drill wedges from OB-24-322 have been completed and assays are pending.

Drill hole OB-25-371W7 is the seventh wedge from a pilot hole centered on the deep extension of Trend #2. It returned three separate intercepts of gold mineralization that were short, but with grades and thicknesses consistent with the Project’s mineral resources, in an untested area on the western side of Trend #2 towards the deep extension of Trend #1 (Figure 1). The Company considers the apparent ‘gap’ between the deep extensions of these two mineralizing trends to be a function of drill coverage rather than mineralization (Figure 2). This area offers a significant opportunity to delineate future mineral resources at relatively shallow depths and within the scope of the mine design contained in the Project’s 2025 Preliminary Economic Assessment. Further drill testing here will be an important part of the upcoming 2026 work program. The sixth drill hole release today, OB-25-377, was located in a gap area between the western and eastern portions of the former mine and intersected three narrow zones of minor mineralization.

QA/QC

All drill cores in this campaign are NQ in size. Assays were completed on sawn half-cores, with the second half kept for future reference. The samples were analyzed using standard fire assay procedures with Atomic Absorption (AA) finish at ALS Laboratory Ltd, in Val-d’Or, Quebec. Samples yielding a grade higher than 10 g/t Au were analyzed a second time by fire assay with gravimetric finish at the same laboratory. Mineralized zones containing visible gold were analyzed with metallic sieve procedure. Standard reference materials, blank samples and duplicates were inserted prior to shipment for quality assurance and quality control (QA/QC) program.

QP Disclosure

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Mr. Richard Nieminen, P.Geo, (QC), a geological consultant for Radisson and a Qualified Person for purposes of NI 43-101. Mr. Luke Evans, M.Sc., P.Eng., ing, of SLR Consulting (Canada) Ltd., is the Qualified Person responsible for the preparation of the MRE at O’Brien. Each of Mr. Nieminen and Mr. Evans is independent of Radisson and the O’Brien Gold Project.

About Radisson Mining

Radisson is a gold exploration company focused on its 100% owned O’Brien Gold Project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Québec. A July 2025 Preliminary Economic Assessment described a low cost and high value project with an 11-year mine life and significant upside potential based on the use of existing regional infrastructure. Indicated Mineral Resources are estimated at 0.58 million ounces (2.20 million tonnes at 8.2 g/t Au), with additional Inferred Mineral Resources estimated at 0.93 million ounces (6.67 million tonnes at 4.4 g/t Au). Please see the NI 43-101 ‘O’Brien Gold Project Technical Report and Preliminary Economic Assessment, Québec, Canada’ effective June 27, 2025, and other filings made with Canadian securities regulatory authorities available at www.sedarplus.ca for further details and assumptions relating to the O’Brien Gold Project. For more information on Radisson, visit our website at www.radissonmining.com or contact:

Matt Manson

President and CEO

416.618.5885

mmanson@radissonmining.com

Kristina Pillon

Manager, Investor Relations

604.908.1695

kpillon@radissonmining.com

Forward-Looking Statements

This news release contains ‘forward-looking information’ within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. Forward-looking statements including, but are not limited to, statements with respect to the ability to execute the Company’s plans relating to the O’Brien Gold Project as set out in the Preliminary Economic Assessment; the Company’s ability to complete its planned exploration and development programs; the absence of adverse conditions at the O’Brien Gold Project; the absence of unforeseen operational delays; the absence of material delays in obtaining necessary permits; the price of gold remaining at levels that render the O’Brien Gold Project profitable; the Company’s ability to continue raising necessary capital to finance its operations; the ability to realize on the mineral resource and mineral reserve estimates; assumptions regarding present and future business strategies; local and global geopolitical and economic conditions and the environment in which the Company operates and will operate in the future; planned and ongoing drilling; the significance of drill results; the ability to continue drilling; the impact of drilling on the definition of any resource; and the ability to incorporate new drilling in an updated technical report and resource modelling; the Company’s ability to grow the O’Brien Gold Project; and the ability to convert inferred mineral resources to indicated mineral resources.

Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as ‘expects’, or ‘does not expect’, ‘is expected’, ‘interpreted’, ‘management’s view’, ‘anticipates’ or ‘does not anticipate’, ‘plans’, ‘budget’, ‘scheduled’, ‘forecasts’, ‘estimates’, ‘believes’ or ‘intends’ or variations of such words and phrases or stating that certain actions, events or results ‘may’ or ‘could’, ‘would’, ‘might’ or ‘will’ be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements Forward-looking information is based on estimates of management of the Company, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others; the risk that the O’Brien Gold Project will never reach the production stage (including due to a lack of financing); the Company’s capital requirements and access to funding; changes in legislation, regulations and accounting standards to which the Company is subject, including environmental, health and safety standards, and the impact of such legislation, regulations and standards on the Company’s activities; price volatility and availability of commodities; instability in the global financial system; the effects of high inflation, such as higher commodity prices; the risk of any future litigation against the Company; changes in project parameters and/or economic assessments as plans continue to be refined; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; risks relating to the drill results at O’Brien; the significance of drill results; and the ability of drill results to accurately predict mineralization. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Company believes that this forward-looking information is based on reasonable assumptions, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied upon. The Company does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law. These statements speak only as of the date of this news release.

Please refer to the ‘Risks and Uncertainties Related to Exploration’ and the ‘Risks Related to Financing and Development’ sections of the Company’s Management’s Discussion and Analysis dated April 29, 2025 for the year ended December 31, 2024, and the Company’s Management’s Discussion and Analysis dated November 26, 2025 for the three month period ended September 30, 2025, all of which are available electronically on SEDAR+ at www.sedarplus.ca. All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279548