Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the ‘Company’ or ‘Nine Mile’) is pleased to announce Certified Assay results for volcanogenic massive sulphide (VMS) mineralization collected from the pre-drill area on the Wedge VMS Project, in the world-famous Bathurst Mining Camp (BMC), New Brunswick, Canada.

TABLE 1: ACTLABS CERTIFIED ASSAY RESULTS:

| Sample # | Cu | Pb | Zn | Au | Ag | Cu Eq |

| % | % | % | g/t | g/t | % | |

| 280447 | 10.90 | 0.02 | 0.04 | 0.17 | 6.00 | 11.22 |

| 280448 | 9.95 | 0.03 | 0.03 | 0.24 | 6.20 | 10.36 |

| 280449 | 9.11 | 0.04 | 0.49 | 0.31 | 6.90 | 9.73 |

| 280450 | 10.20 | 0.12 | 0.44 | 0.18 | 7.70 | 10.68 |

| 280451 | 10.60 | 0.05 | 0.24 | 0.19 | 7.60 | 11.02 |

| 280452 | 10.10 | 0.41 | 0.76 | 0.24 | 11.60 | 10.86 |

| 280453 | 0.48 | 0.01 | 0.01 | 0.12 | 1.20 | 0.65 |

| 280454 | 2.31 | 0.19 | 0.45 | 0.26 | 3.50 | 2.83 |

| 280455 | 0.10 | 0.01 | 0.01 | 0.09 | 0.80 | 0.23 |

| 280456 | 10.20 | 0.05 | 0.34 | 0.19 | 6.40 | 10.64 |

| 280457 | 10.10 | 0.04 | 0.39 | 0.17 | 5.70 | 10.51 |

| 280458 | 3.09 | 0.39 | 1.42 | 0.32 | 5.50 | 4.00 |

| 280459 | 2.40 | 1.76 | 2.17 | 0.29 | 22.70 | 4.00 |

| 280460 | 15.00 | 0.05 | 0.11 | 0.71 | 42.00 | 16.64 |

| 280461 | 13.30 | 0.07 | 0.09 | 0.58 | 25.70 | 14.49 |

| 280462 | 14.20 | 0.04 | 0.12 | 0.21 | 48.10 | 15.37 |

| 280463 | 13.30 | 0.07 | 0.10 | 0.52 | 29.50 | 14.49 |

| 280464 | 13.70 | 0.06 | 0.11 | 0.25 | 30.90 | 14.60 |

| 280465 | 0.33 | 0.01 | 0.02 | 0.12 | 1.70 | 0.51 |

| 280466 | 0.09 | 0.01 | 0.02 | 0.12 | 1.20 | 0.26 |

The assays were shipped to ActLabs in Fredericton, New Brunswick for preparation with final analysis of pulps conducted in Ancaster, Ontario. The primary analytical method for the Wedge samples is UT-7, multi-element Peroxide ‘Total’ Fusion (ICP-OES+MS). When overlimit results are returned, ore grade analysis is triggered and conducted utilizing Code 8-AR-ICP-OES. Gold analysis is treated separately by 30g Fire Assay and AA finish, method 1A2. Ag is also treated separately by method 1E Ag. QA /QC controls involve inserting standards in the samples stream at set intervals.

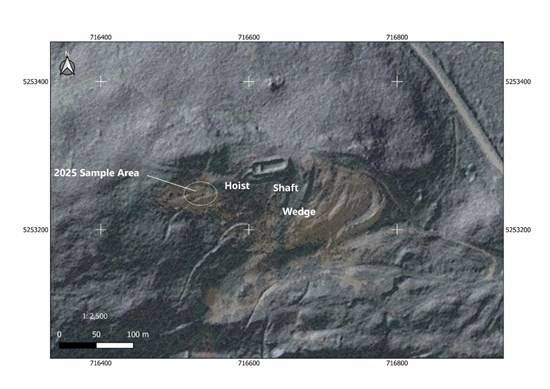

Samples 280461 through 280464 below (Figure 1) are examples of the massive Hi-Grade Copper sulphide mineralization (Chalcopyrite). Covellite is also clearly seen in sample #280461 and #280463, as a dark blue cast in colour. The samples were collected in the area highlighted in Figure 2, immediately to the west of the footings for the old hoist and the remains of the shaft. These are well-known landmarks.

FIGURE 1: HIGHLIGHTED SAMPLES

SAMPLE #280461 (14.49% CU-EQ)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7335/279109_463894d78493091f_002full.jpg

SAMPLE #280462 (15.37% CU-EQ)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7335/279109_463894d78493091f_003full.jpg

SAMPLE #280463 (14.49% CU-EQ)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7335/279109_463894d78493091f_004full.jpg

SAMPLE #280464 (14.60% CU-EQ)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7335/279109_463894d78493091f_005full.jpg

FIGURE 2: 2025 SAMPLE AREA

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7335/279109_463894d78493091f_006full.jpg

Gary Lohman, Director, P.Geo., VP Exploration, stated, ‘The mineralization is massive in character, fine grained, with basic Fe (Pyrite) and Cu sulphides (Chalcopyrite – Covellite), mineralogy as we have seen in recent drilling. Visible covellite (CuS) was locally present, adding a high grade component to the system. Again, these values explain what we are seeing in our drill core from our first 3 holes. (WD-25-01 & WD-25-02 & WD-25-02B). We are extremely encouraged and look forward to the WD-25-01 Certified Drill Core Assay Results.’

Patrick J. Cruickshank, MBA, CEO & Director, stated, ‘Our current Wedge Program continues to demonstrate the high-grade quality of the sampling of this deposit. These results are simply outstanding. Our current Drill Program was designed with this quality of mineralization below and I believe our 1st (3) announced drill holes clearly demonstrates this success. This is definitely a special copper rich deposit. We look forward to sharing our summary of our next drill hole in our program.’

Qualified Person

The technical content of this news release pertaining to the Wedge Project was reviewed and approved by Gary Lohman, P.Geo., a non-independent qualified person as defined by National Instrument 43-101.

Copper Equivalent (Cu-Eq) for these surface grab samples is calculated based on December 16, 2025, pricing: US$ 5.35/lb Cu, US$ 0.88/lb Pb, US$ 1.37/lb Zn, US$ 67.10/oz Ag, and US$ 4337.70/oz Au, with 80% metallurgical recoveries assumed for all metals. Since it is unclear which metals will be the principal products, assuming different recoveries is premature at this stage. Therefore, an 80% recovery rate is justified.

About Nine Mile Metals Ltd.:

Nine Mile Metals Ltd. is a Canadian public mineral exploration company focused on VMS (Cu, Pb, Zn, Ag and Au) exploration in the world-famous Bathurst Mining Camp, New Brunswick, Canada. The Company’s primary business objective is to explore its four VMS Projects: Nine Mile Brook VMS Project; California Lake VMS Project; and the Canoe Landing Lake (East – West) Project and the Wedge VMS Project. The Company is focused on exploration of Minerals for Technology (MFT), positioning for the boom in EV and green technologies requiring Copper, Silver, Lead and Zinc with a hedge with Gold.

ON BEHALF OF Nine Mile Metals LTD.,

‘Patrick J. Cruickshank, MBA’

CEO and Director

T: 506-804-6117

E: patrick@ninemilemetals.com

Forward-Looking Information:

This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of Nine Mile. Forward-looking information is based on certain key expectations and assumptions made by the management of Nine Mile. In some cases, you can identify forward-looking statements by the use of words such as ‘will,’ ‘may,’ ‘would,’ ‘expect,’ ‘intend,’ ‘plan,’ ‘seek,’ ‘anticipate,’ ‘believe,’ ‘estimate,’ ‘predict,’ ‘potential,’ ‘continue,’ ‘likely,’ ‘could’ and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Forward-looking statements in this press release include that (a) prior to commencing the 2023 exploration drill program, the ground will be mapped at surface and representative samples analyzed to determine the base and precious metal assay values , (b) the Ag and Au values will be reported upon receipt of the certified assay results from ALS Global, and (c) our current financial raise will enable us to drill the Wedge Project (along with our Canoe Landing VMS Project and follow up exploration work on our California Lake VMS Project) this season as opposed to next year. Although Nine Mile believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Nine Mile can give no assurance that they will prove to be correct.

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

The Canadian Venture Building, 82 Richmond Street East, Toronto, ON M5C 1P1 (T) 506-804-6117

www.ninemilemetals.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279109

News Provided by Newsfile via QuoteMedia

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board Changes