The Department of Justice on Tuesday released nearly 30,000 pages of documents related to disgraced late financier Jeffrey Epstein. This is the latest batch of documents to be released since the DOJ began publishing files on Dec. 19.

The files include a number of revelations, including a psychological assessments from Epstein’s time in prison, a fake passport and his cellmate’s testimony about witnessing the financier’s first apparent suicide attempt. The newly released pages also include a claim made by an unidentified Epstein accuser who said that former President Bill Clinton’s name was used as a way to deter her from coming forward.

Here are some of the top takeaways.

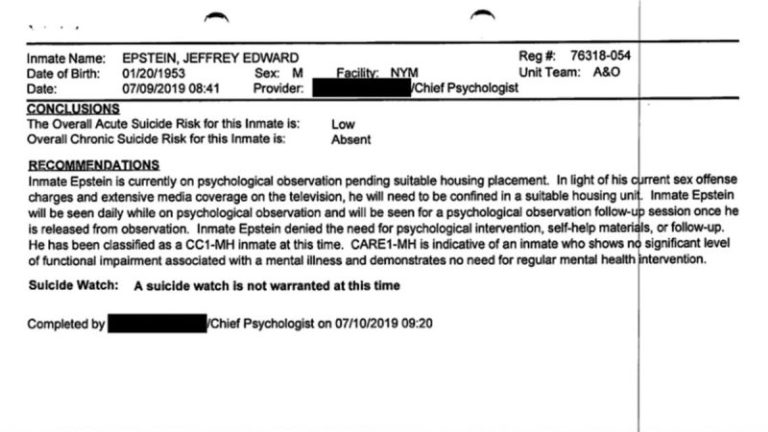

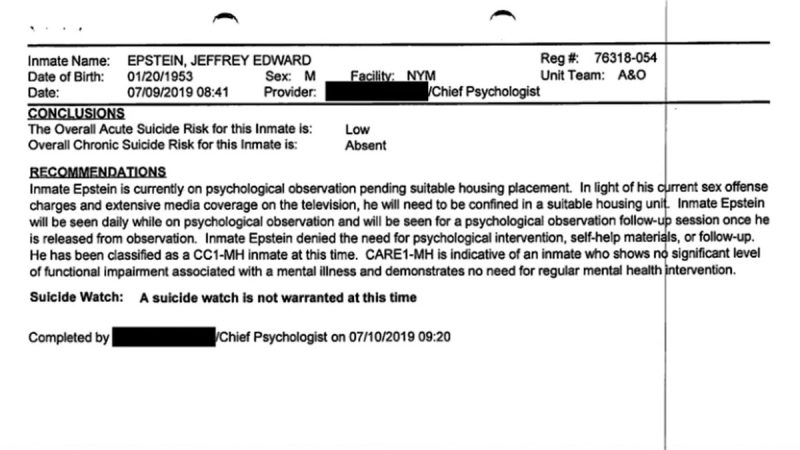

Prison psychology report shows Epstein was deemed ‘low risk’ for suicide days before his death

A Bureau of Prisons psychological assessment released Tuesday by the DOJ showed Epstein was considered to be at ‘low’ acute suicide risk and showed no signs of suicidal ideation just days before his death, according to internal prison records.

The suicide risk assessment, conducted on July 9, 2019, states Epstein was placed on precautionary psychological observation due to the high-profile nature of his case and not because he expressed intent to self-harm.

‘Inmate Epstein adamantly denied any suicidal ideation, intention or plan,’ the chief psychologist wrote in the assessment.

The psychologist noted Epstein appeared ‘polite, calm, and cooperative’ during the evaluation, with ‘organized and coherent’ thoughts and no signs of acute psychological distress. Additionally, the psychologist documented Epstein saying that ‘being alive is fun,’ describing himself as a banker with a ‘big business,’ and expressing confidence in his legal defense.

The report concluded that ‘the Overall Acute Suicide Risk for this Inmate is: Low,’ and, ‘A suicide watch is not warranted at this time.’

Newly shared Bureau of Prisons records shed fresh light on what Epstein’s cellmate, Nicholas Tartaglione, says he witnessed during the disgraced financier’s first apparent suicide attempt while in federal custody.

‘I was asleep with headphones on when I felt something hit my legs,’ Tartaglione said, according to the memo.

‘I turned on the light and saw Epstein on the floor with something around his neck,’ he told investigators, adding that Epstein appeared unresponsive.

The records state Tartaglione immediately called for help after discovering Epstein on the ground. Correctional officers responded, and Epstein was taken for medical evaluation. Officials later described the incident as an apparent suicide attempt.

The documents also note that Epstein later accused Tartaglione of trying to kill him, a claim Tartaglione flatly denied.

‘That allegation is completely false,’ Tartaglione told investigators. Additionally, Bureau of Prisons officials said there was no evidence to support Epstein’s claim.

Epstein was later removed from the cell and placed under closer observation before his death weeks later in what was ruled a suicide.

Tartaglione was sentenced to four consecutive life sentences in 2024 for killing four people, according to prior reporting from Fox News Digital.

Epstein accuser said Clinton’s name was used to deter her from coming forward

A woman who accused Epstein of sexual misconduct said she was warned that his ties to former President Bill Clinton could prevent her from working if she spoke out, according to a sworn attorney-released statement in Tuesday’s DOJ document dump.

In the statement, dated August 27, 2019, the woman identified as Jane Doe alleged that after fleeing an encounter with Epstein at his Manhattan mansion, another woman cautioned her that Epstein ‘knew a lot of powerful people, including Bill Clinton,’ and that refusing him could end her career in the modeling industry.

The accuser said she believed the reference to influential figures was meant to intimidate her and discourage her from coming forward.

The statement does not allege that Clinton participated in or had knowledge of the alleged encounter. Clinton has previously denied wrongdoing in connection with Epstein.

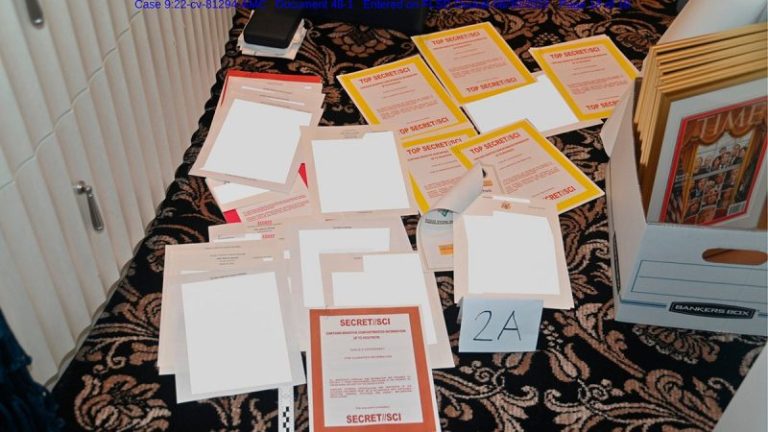

Jeffrey Epstein’s fake passport revealed

The latest documents also include a fake passport that Epstein apparently used in the 1980s. The passport appeared to be issued from Austria, with Epstein going by the name ‘Marius Robert Fortelni.’ It listed Saudi Arabia as his place of residence.

In a 2019 letter to a federal judge over his detention on sex trafficking charges, Epstein’s lawyers justified his use of a false identity.

‘Eighth, as for the Austrian passport the government trumpets, it expired 32 years ago,’ his attorneys said in the letter. ‘And the government offers nothing to suggest — and certainly no evidence — that Epstein ever used it.’

‘In any case, Epstein – an affluent member of the Jewish faith – acquired the passport in the 1980s, when hijackings were prevalent, in connection to Middle East travel,’ the letter continued. ‘The passport was for personal protection in the event of travel to dangerous areas, only to be presented to potential kidnappers, hijackers or terrorists should violent episodes occur.’

Epstein requested ‘razor to shave,’ complained of lack of water weeks before death, document shows

Documents indicate that Epstein requested a razor to shave while in federal custody just weeks before his death, while also raising a series of complaints about his detention conditions.

In a July 30, 2019 internal communication labeled ‘Inmate Epstein,’ Epstein asked for a razor and requested access to water during attorney conferences, saying the available machine ‘does not have water’ and that he was becoming dehydrated, according to the document.

The same email notes Epstein claimed he did not receive all of his prescribed medications after being placed on psychological observation, and said he had not slept well in 21 days due to the absence of his CPAP machine. Epstein also complained about noise in the Special Housing Unit, warning he could suffer ‘psychological trauma’ from the conditions.

Fox News’ Bill Mears contributed to this report.