Lahontan Gold Corp. (TSXV:LG)(OTCQB:LGCXF)(FSE:Y2F) (the ‘Company‘ or ‘Lahontan‘) is pleased to announce that the Federal Bureau of Land Management (‘BLM‘) has published its Decision Record (‘DR‘), Finding of No Significant Impact (‘FONSI‘), and approval of the Company’s Exploration Plan of Operations (‘EPOO‘) for the Santa Fe Mine project, on the BLM’s website: https://eplanning.blm.gov/eplanning-ui/home. This decision concludes the National Environmental Policy Act (‘NEPA‘) Environmental Assessment (‘EA‘) process and authorizes Lahontan to move forward with its greatly expanded exploration drilling and mine development program at Santa Fe.

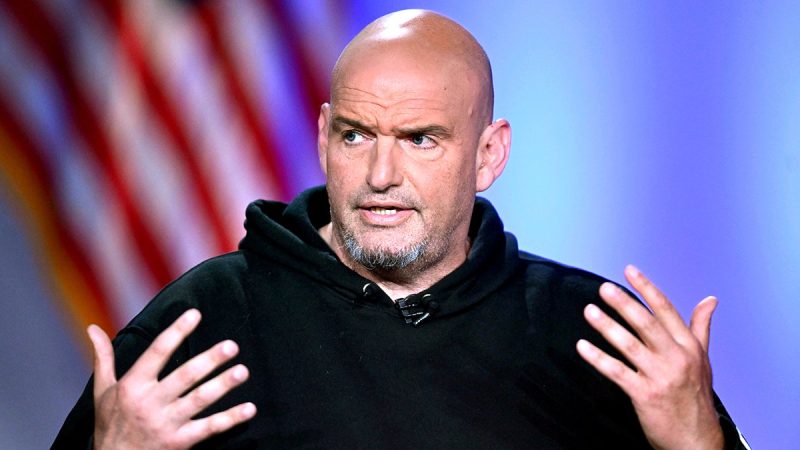

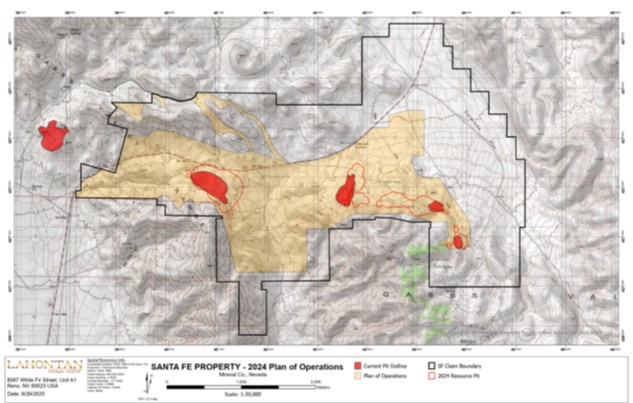

The recently approved Exploration Plan of Operations (‘EPOO’) allows Lahontan to conduct exploration drilling across a 12.2 km² area of the Santa Fe Mine project, enabling the Company to test multiple new targets, well beyond the currently defined gold and silver resources (see map below)*. Previous Lahontan drilling programs focused on validating historical drill results, defining and expanding resources adjacent to the past-producing open pits, and collecting data to support detailed mine planning and scheduling.

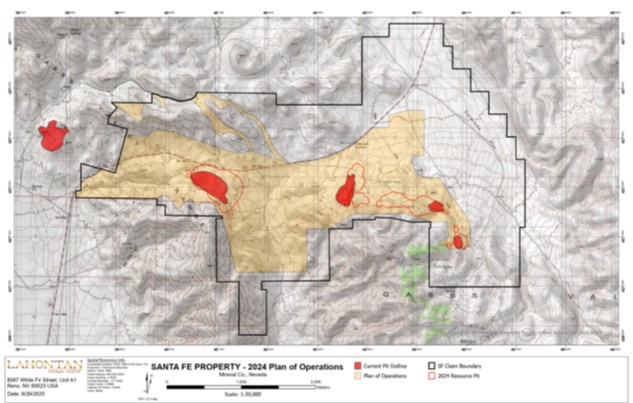

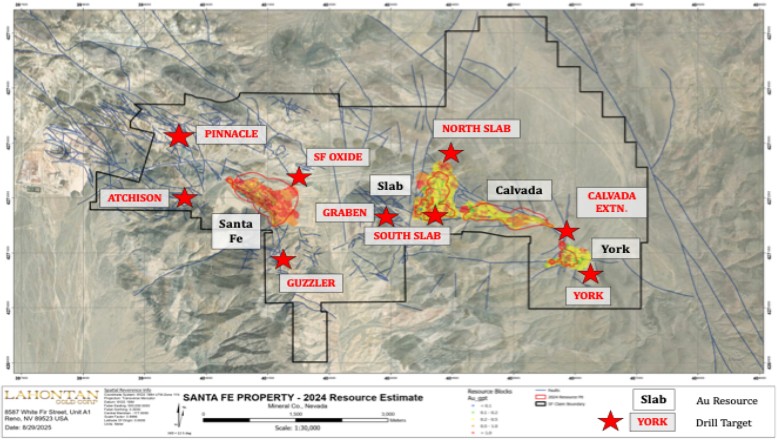

With the EPOO in place, Lahontan can now initiate true exploration programs across the broader project area. The EPOO encompasses over 700 permitted drill holes targeting well-defined geologic and geochemical anomalies, as well as previously drilled areas that returned significant gold and silver intercepts that require follow-up drilling. Priority targets include the Pinnacles area, hosted in a similar geologic setting to Fortitude Gold’s nearby Isabella Pearl Mine, as well as important historic drilling at the Guzzler target south of the Santa Fe open pit, along with multiple untested zones between the known resource areas at Santa Fe (see map below).

Map of the recently approved EPOO for Santa Fe. The yellow shading outlines the area included in the EPOO, dark red indicates the historic pits including the Isabella Pearl pit west of the project boundary, the red lines shows the surface projection of known gold and silver resources*.

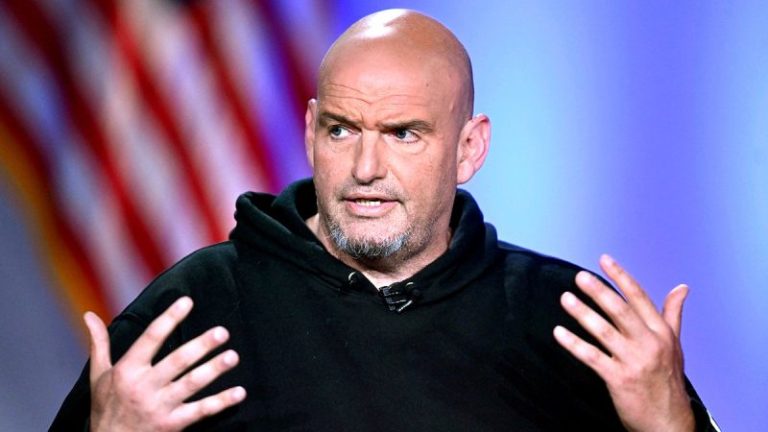

Kimberly Ann, Lahontan Gold Corp. Executive Chair, Founder, CEO, and President commented: ‘Receiving approval of the Santa Fe Mine project EPOO represents a landmark milestone for Lahontan. Until now, the Company’s exploration activities were limited to a five-acre disturbance area, significantly restricting its ability to step out from known resources and fully assess the exploration potential of the Santa Fe Mine Project. With the approval of the EPOO, Lahontan can now explore a 12.2 km² area encompassing multiple well-defined geological and geochemical targets located between and adjacent to existing gold and silver resources. The expanded permit area also allows for drill testing of the historical heap leach pads, which may contain remnant mineralization of potential economic interest. This approval positions the Company to evaluate the broader gold and silver endowment of the Santa Fe Mine project and to unlock the full potential of its strategic land position in Nevada’s Walker Lane. Lahontan would also like to thank the staff of the Carson City office of the BLM for their efficient and timely completion of the EPOO.’

Map of exploration targets at the Santa Fe Mine Project.

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan’s flagship property, the 28.3 km2 Santa Fe Mine project, had past production of 359,202 ounces of gold and 702,067 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing. The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq(48,393,000 tonnes grading 0.92 g/t Au and 7.18 g/t Ag, together grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (16,760,000 grading 0.74 g/t Au and 3.25 g/t Ag, together grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report and note below*). The Company plans to continue advancing the Santa Fe Mine project towards production, update the Santa Fe Preliminary Economic Assessment, and drill test its satellite West Santa Fe project during 2025. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the ‘Preliminary Economic Assessment, NI 43-101 Technical Report, Santa Fe Project’, Authors: Kenji Umeno, P. Eng., Thomas Dyer, PE, Kyle Murphy, PE, Trevor Rabb, P. Geo, Darcy Baker, PhD, P. Geo., and John M. Young, SME-RM; Effective Date: December 10, 2024, Report Date: January 24, 2025. The Technical Report is available on the Company’s website and SEDAR+. Mineral resources are reported using a cut-off grade of 0.15 g/t AuEq for oxide resources and 0.60 g/t AuEq for non-oxide resources. AuEq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and oxide gold recoveries ranging from 28% to 79%, oxide silver recoveries ranging from 8% to 30%, and non-oxide gold and silver recoveries of 71%.

Qualified Person

Brian J. Maher, M.Sc., CPG-12342, is a ‘Qualified Person’ as defined under Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has reviewed and approved the content of this news release in respect of all technical disclosure other than the Mineral Resource Estimate as noted above. Mr. Maher is Vice President-Exploration for Lahontan Gold and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the disclosure.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email:

Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain ‘forward-looking information’ within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as ‘plan’, ‘expect’, ‘project’, ‘intend’, ‘believe’, ‘anticipate’, ‘estimate’ and other similar words, or statements that certain events or conditions ‘may’ or ‘will’ occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedar.com

Source

Click here to connect with Lahontan Gold Corp. (TSXV:LG)(OTCQB:LGCXF)(FSE:Y2F) to receive an Investor Presentation

This post appeared first on investingnews.com