Zeus Resources Limited (ZEU:AU) has announced Outstanding Antimony Results at Casablanca

Zeus Resources Limited (ZEU:AU) has announced Outstanding Antimony Results at Casablanca

Download the PDF here.

Zeus Resources Limited (ZEU:AU) has announced Outstanding Antimony Results at Casablanca

Zeus Resources Limited (ZEU:AU) has announced Outstanding Antimony Results at Casablanca

Download the PDF here.

Secretary of War Pete Hegseth warned that some traditional U.S. allies are ‘hemming and hawing about the use of force’ as Washington presses forward with its campaign against Iran, raising fresh questions about NATO cohesion at a moment of escalation.

Spain has refused U.S. permission to use certain bases for strikes on Iran, calling for de-escalation and adherence to international law. Turkey has criticized the operation and warned of broader regional destabilization, while President Recep Tayyip Erdoğan said he was ‘saddened’ by Ayatollah Ali Khamenei’s death and denied that Turkish territory was used in the campaign.

In a statement released on Saturday, French President Emmanuel Macron said that, ‘The outbreak of war between the United States, Israel and Iran carries grave consequences for international peace and security.’ He added, ‘The ongoing escalation is dangerous for all. It must stop.’

During Monday’s media briefing, Hegseth drew a sharp contrast between Israel and what he described as hesitant allies. ‘Israel has clear missions as well, for which we are grateful. Capable partners, as we’ve said since the beginning. Capable partners are good partners, unlike so many of our traditional allies, who wring their hands and clutch their pearls, hemming and hawing about the use of force.’

The criticism reflects growing frustration inside the administration that while some European capitals have issued statements of support, operational backing has not matched the rhetoric.

President Donald Trump also voiced dissatisfaction with allied hesitation. In an interview with The Daily Telegraph, Trump said he was ‘very disappointed’ in British Prime Minister Keir Starmer for initially blocking U.S. use of British bases and that Starmer took ‘far too much time’ to reverse course.

The United Kingdom later authorized U.S. use of key facilities, including Diego Garcia, after raising initial legal objections and following a drone strike on RAF Akrotiri in Cyprus.

Justin Fulcher, former senior adviser to Hegseth, told Fox News Digital the moment represents ‘an absolutely critical inflection point where NATO should act in a unified way in support of what the United States is doing.’

He framed the issue as larger than the current campaign. ‘Symbolically, the U.S.-NATO alliance is critical when looking at actually restoring deterrence globally,’ Fulcher said, arguing that visible unity would send a message not only to Tehran but to other geopolitical rivals watching how the alliance responds under pressure.

NATO Secretary General Mark Rutte has sought to downplay suggestions of division.

‘I spoke with all the key European leaders over the weekend,’ Rutte said on Fox News. ‘There is widespread support for what the president is doing.’

He added, ‘Europe is stepping up, is doing what is necessary to make sure this operation can go ahead and deliver all the enablement necessary.’

Germany has struck a more cautious tone. Chancellor Friedrich Merz warned in Sunday that strikes risk an Iraq- or Afghanistan-style quagmire and that Europe would bear the consequences.

At the same time, he said Berlin would not ‘lecture’ the U.S. ‘We recognize the dilemma,’ he said, explaining that repeated attempts over past decades had not put Iran off trying to acquire nuclear weapons or oppressing its own people. ‘So we’re not going to be lecturing our partners on their military strikes against Iran.’

‘Despite all the doubts, we share many of their aims,’ he said.

Fulcher contrasted the current hesitation with the strong reactions from some NATO capitals during past alliance disputes, including tensions surrounding Greenland.

‘When you look at Greenland, that was obviously a very touchy subject for some countries in the Alliance,’ Fulcher said. ‘Iran for decades has been a huge promoter and funder of terrorism all across the globe — attacks that have happened in Europe, in many NATO and European countries,’ he said. ‘For me, it is quite shocking that we’re seeing a difficult time for many NATO members to fully unify and step up in support of the United States and what the U.S. and Israel is doing in Iran.’

He argued that Europe has a significant strategic incentive to see Iranian capabilities degraded.

‘I think actually Europe and NATO have the most to gain from neutralizing the threat that emanates from Iran,’ Fulcher said. ‘When you look at whether the ballistic missile threat or some of the state-sponsored terrorism threats, Europe has been on the receiving end of much more of these threats than the United States has in some cases.’

He stressed that support should extend beyond public endorsements.

‘Some of our European allies can do a lot more to not just support with words, which should be the bare minimum here, but also support with actual tangible action,’ Fulcher concluded.

Reuters contributed to this report.

As Democrats line up to denounce President Donald Trump and Israeli Prime Minister Benjamin Netanyahu’s joint strikes on Iran’s ruling regime, Sen. John Fetterman, D-Pa., is doing the opposite, forcefully defending the operation and rebuking members of his own party who call it reckless.

The Pennsylvania Democrat, who has increasingly staked out unapologetic pro-Israel positions, has openly questioned why critics from both the far-right and far-left are making hay over the strikes, arguing the operation was necessary to counter Tehran’s aggression. His stance is widening a visible fracture inside the party over how far to back Israel amid escalating regional tensions.

On Monday, Fetterman wrote that he’s ‘not sure why it’s controversial to anyone to appreciate and celebrate wiping out 49 leaders of one of the most evil regimes in recorded history,’ after Trump announced the potentially four-week mission was ahead of schedule after discovering several top Iranian officials being targeted were reportedly in the same area and could be taken out at once.

After the initial strike on Saturday, Fetterman reposted an image from the ‘Israel War Room’ that showed a Wanted-style poster of Ayatollah Ali Hosseini Khamenei with the word ‘Eliminated’ burned across it.

‘Let’s see who grieves for that garbage,’ Fetterman captioned.

The former Pennsylvania lieutenant governor later credited Trump, saying in a statement that he ‘has been willing to do what’s right and necessary to produce real peace in the region.’

‘God bless the United States, our great military, and Israel.’

He also openly questioned members of his own caucus, who have otherwise agreed that Iran cannot be permitted to nuclearize.

‘Every member in the U.S. Senate agrees we cannot allow Iran to acquire a nuclear weapon,’ he wrote on X.

‘I’m baffled why so many are unwilling to support the only action to achieve that. Empty sloganeering vs. commitment to global security — which is it?’

He said Saturday he would be a ‘hard no’ if Democrats forced a war powers resolution vote to claw back Trump’s authority.

Sen. Tim Kaine, D-Va., told Richmond press on Monday that he intends to press for a vote on a War Powers Resolution he filed in January focused on Iran.

Kaine wondered aloud in a separate public statement whether Trump is ‘too mentally incapacitated to realize we had a diplomatic agreement with Iran…’

‘The Senate should immediately return to session and vote on my War Powers Resolution to block the use of U.S. forces in hostilities against Iran. Every single Senator needs to go on the record about this dangerous, unnecessary, and idiotic action,’ Kaine said.

Fetterman was not the only Democrat to sound off on critics of the Iran strike. Former New York Mayor Eric Adams, who is also a former NYPD officer, lambasted what he called the political fringes for ignoring the human rights abuses, mass murder and attacks on Americans committed by Khamenei, 86, and his predecessor, Ayatollah Ruhollah Khomeini.

Rep. Gregory Landsman, D-Ohio, also praised the operation against Iran and compared the killing of Khamenei to taking out Usama bin Laden, but stopped short of endorsing Trump’s broader plans.

‘There’s a lot of folks in Congress who don’t trust this president and I’m one of those people. In the end I trust the generals and I trust our military,’ he told the Cincinnati Enquirer.

The Islamic Republic’s opaque and fractured governing system following the killing of its supreme leader, Ayatollah Ali Khamenei, selected radical cleric Ayatollah Alireza Arafi to its interim leadership council on Saturday.

Ben Sabti, an Iran expert at the Institute of National Security Studies in Israel, said, ‘His name was brought up in the last two or three years. He is not a kind of politician but is part of exporting the revolution from the propaganda side.’ A foundational pillar of the birth of the 1979 Islamic Republic was to export its violent Shiite ideology and foster radical Islamist revolutions across the globe.

‘He’s been marinating in Khomeinist ideology his entire career. Khomeinism is a threat to U.S. interests,’ Jason Brodsky, policy director of United Against Nuclear Iran, told Fox News Digital.

The founder of the Islamic Republic of Iran in 1979, Ayatollah Ruhollah Khomeini’s ‘Death to America’ pledge is a core feature of Khomeinism, according to experts.

According to a UANI report, Arafi has long been agitating against the U.S. and Israel. ‘America will take its wish for Iran to abandon production of military hardware to the grave,’ he is quoted as saying, and in a 2019 Friday prayer sermon he announced, ‘We will stay with our imam and leader to the end, when we humiliate [global] arrogance. Together with the Sayyed of the resistance, we say: Oh great leader of the world of Islam, we will be with you until the end, when the arrogant people in the world are defeated, and Israel is erased.’

Brodsky continued, ‘The fact that Iran’s system elevated Alireza Arafi to membership on the interim leadership council is a signal that he could be a leading candidate to replace Ali Khamenei as supreme leader.

Arafi is also being watched in Washington. In an interview with Fox News Digital on Sunday, Rep. Brian Mast, R-Fla., chairman of the House Foreign Affairs Committee, described Arafi as ”a very hard-line cleric.’

He noted, ‘Arafi has been promoted through the ranks — heading Iran’s seminary, leading Al-Mustafa University, and serving as a member of the Guardian Council and Assembly of Experts. Additionally, he has been Friday prayer leader of Qom, which is the center of the Iranian clergy. This provides him with religious, educational and government experience to replace Khamenei as supreme leader.’

According to UANI, Arafi promised ‘death’ to protesters who knock over the turbans of Iranian Islamic clerics. ‘Those who attack the turbans of the clergy should know that the turban will become their shroud,’ Arafi said.

Brodsky added, ‘Arafi helped make Al-Mustafa University into a training ground and recruiting center for the IRGC [Islamic Revolutionary Guard Corps]. Al-Mustafa University was later sanctioned by the U.S. government under counterterrorism authorities. A weakness in his candidacy to replace Khamenei is that he has never been a core member of the military-security establishment in Iran and has never led a branch of the Islamic Republic’s government apparatus.

‘He is also not a Sayyid. [sign of high respect for people of lineage from the Islamic prophet Muhammad in the Shiite tradition.] But his serving on an interim leadership council will expose him to foreign policy and security issues to a greater extent, and position him as a formidable contender. Alireza Arafi is an indoctrinated follower of Khomeinism and spearheaded an effort to further Islamize Iran’s university and seminary system,’ he said.

According to Iran Wire, an independent Iranian diaspora news outlet, ‘Alireza Arafi is a prominent hardline cleric, a member of the Guardian Council and the head of Iran’s seminaries, positions that place him at the center of the country’s religious establishment. His selection matters because the third member of the Temporary Leadership Council must be a theologian chosen by the Expediency Discernment Council — and Arafi is widely seen as a staunch loyalist to the core ideology of the Islamic Republic.’

Mardo Soghom, a veteran journalist and Iran expert, told Fox News Digital, ‘What I can say at this point is that there is no unified government with sufficient control over the country. The foreign minister admits the IRGC is on its own. Arafi would never have the authority or the control Khamenei had. It is a compromise candidate whom the IRGC can control and is not a threat to two factions.’

Mariam Memarsadeghi, senior fellow at the Macdonald-Laurier Institute and founder and director of the Cyrus Forum for Iran’s Future, told Fox News Digital, ‘The regime or what remains of it is no different from a terrorist group. Now that the U.S. and Israel are bombing the U.S. and Israel, every leader the terror group chooses will be rightly eliminated. The Iranian people are elated. All decent human beings who believe in freedom should be elated.’

First lady Melania Trump presided over the United Nations Security Council meeting Monday, declaring that the United States ‘stands with all of the children throughout the world,’ in a historic speech calling for ‘peace through education,’ amid the U.S. military involvement in Iran.

The speech marked the first time a first lady from any country — and the first time a sitting U.S. first lady — presided over the Security Council as its members consider education, technology, peace and security.

The United States assumed the United Nations Security Council presidency Monday, just days after the U.S. and Israel launched a massive joint military operation against Iran over the weekend known as ‘Operation Epic Fury.’

The attacks left major leaders dead, including Iranian Supreme Leader Ayatollah Ali Khamenei.

The joint military operation is expected to carry on for days, as the U.S. military continues to target military and ballistic missile sites that pose an ‘imminent threat.’

President Donald Trump warned over the weekend against Iranian retaliation, saying that if Iran were to ‘hit very hard,’ they would be met with ‘a force that has never been seen before.’

But the first lady’s appearance at the United Nations was scheduled before Operation Epic Fury began.

‘The U.S. stands with all of the children throughout the world,’ the first lady said Monday. ‘I hope soon — peace will be yours.’

The U.N. Security Council consists of 15 member states, with five permanent members: the United States, China, France, the Russian Federation, the United Kingdom, and 10 nonpermanent members elected for two-year terms, including Bahrain, Colombia, Democratic Republic of the Congo, Denmark, Greece, Latvia, Liberia, Pakistan, Panama and Somalia.

‘Collectively, your mission to maintain security while upholding the responsibility of preventing conflict during times of both war and peace is significant, must be applied evenly, and should never be carried out lightly,’ she said. ‘Peace does not need to be fragile.’

The first lady’s speech focused on education, saying that it ‘shapes the core of their country’s belief system.’

‘A nation that makes learning sacred protects its books, its language, its science, and its mathematics — it protects its future,’ she said. ‘This leads to something powerful — to greater understanding, moral reasoning, and tolerance of others. Peace.’

The first lady stressed that children raised in cultures rooted in intelligence ‘develop confidence, innovate, build, compete, and maintain a deep value system.’

‘Their knowledge fosters empathy for others, transcending geography, religion, race, gender, and even local norms,’ she said. ‘They become caring people.’

On the contrary, the first lady said that children raised in a culture ‘rooted in ignorance are surrounded by disorder, and sometimes even conflict.’

‘These societies are filled with rigid thinkers who embrace prejudice and shun human dignity,’ she said. ‘When a nation restricts thought, it restricts its own future.’

The first lady said education is a ‘fundamental human right,’ but added that ‘so many children and young adults are banned from attending secondary schools and universities.’

‘The cost is not abstract,’ she said. ‘A society that excludes vast segments of its population can realize only a fraction of its potential. Societies rules by knowledge and wisdom are, therefore, more peaceful.’

The first lady declared that ‘knowledge is power,’ and said, ‘We must capture this positive energy and ignite it across continents to transform our world — throughout our digitally connected human race.’

‘Intellect blossoms humanity’s fundamental needs: shelter, food security, clean water and healthcare.’

‘The global community must facilitate complete access to technology so that every individual can reach their full potential through education,’ she said. ‘We must strive to achieve connectivity in the most remote locations and the furthest distances from our cities.’

The first lady said the objective ‘is entirely feasible and is already on the way.’

‘Today, roughly 6 billion individuals, about 70% of people on planet Earth, have a mobile device and use the internet,’ she said. ‘If our nations band together, we can close the technological divide, empowering all to reach their full potential.’

‘From a solitary farmer on a remote Greek island to a quiet genius in Somalia or a dreamer in uptown Manhattan, anyone can read the vast treasury of human knowledge, created over centuries, which is now codified and accessible through artificial intelligence,’ she continued.

The first lady went on to question whether a ‘single digital nation-state’ could be inevitable.

‘Perhaps this idea isn’t so farfetched, since digital currency and payment systems via blockchain, plus AI’s massive factual database is already revolutionizing media and financial markets,’ she said. ‘We are in the age of imagination — a period when technology can be free and unrestricted by land borders.’

She added: ‘Now is the time for our generation to elevate our children above ideology through access to wisdom.’

The first lady said artificial intelligence is ‘democratizing knowledge’ and creating a ‘new reality for our children by disrupting the traditional academic path to information.’

‘Let’s connect everyone to knowledge through AI, including those in the most remote geographic regions of our world,’ she said. ‘AI can provide us with an understanding of each other’s needs and the needs for your children.’

The first lady said artificial intelligence is ‘redefining who gets to participate in the global economy of ideas.’

‘I believe our shared intellectual future will prove to be a more secure, harmonious, advanced civilization,’ she said. ‘The path to peace depends on us taking responsibility to empower our children through education and technology.’

The first lady stressed that ‘conflict arises from ignorance, but knowledge creates understanding, replacing fear with peace and unity.’

‘Security Council members, I encourage you to pledge to safeguard learning in our communities and promote access to heightened education for all,’ she said. ‘I implore you to build a future generation of leaders who embrace peace through education.’

The speech comes as the first lady continues her push as a champion of online protection of children and youth through her ‘Be Best’ initiative launched during the first Trump administration.

In 2025, the first lady garnered support on Capitol Hill for the passage of the Take it Down Act, which was signed into law by the president in May 2025. The law punishes internet abuse involving nonconsensual, explicit imagery.

The first lady also launched a nationwide Presidential Artificial Intelligence Challenge, which invited every student and educator across the nation to ‘unleash their imagination and showcase the spirit of American innovation’ by visiting AI.gov to sign up.

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.

Brent crude, the global oil benchmark, jumped as much as 10 percent to trade above US$82 per barrel before easing back toward US$79. US crude rose more than 6.5 percent, climbing nearly US$5 per barrel to around US$72.

Natural gas markets saw even sharper moves. European gas futures rocketed higher after QatarEnergy said it had suspended liquefied natural gas (LNG) production following what it described as “military attacks” on its facilities.

The company halted production after a drone targeted a facility in Ras Laffan Industrial City, according to Qatar’s Ministry of Defence. A separate drone reportedly struck a water tank at a power plant in Mesaieed. In Saudi Arabia, Aramco temporarily shut its Ras Tanura refinery after it was hit by a drone.

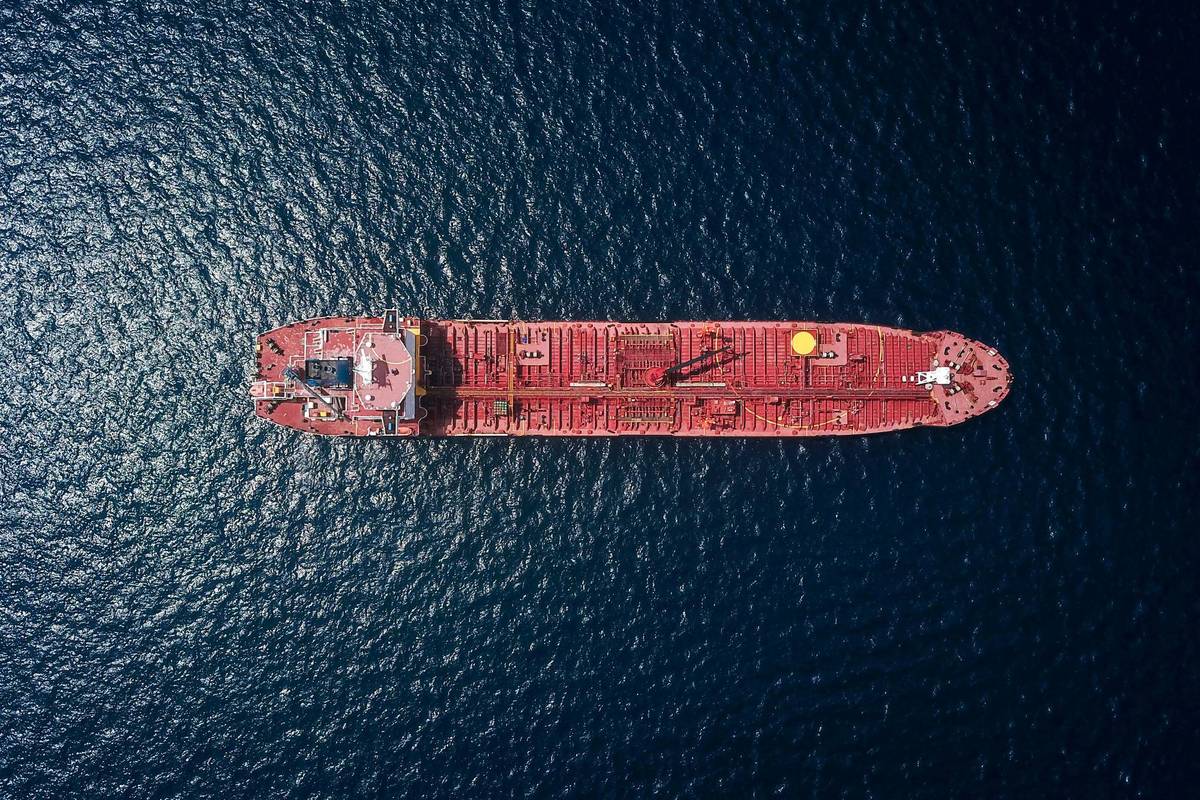

Tensions have centred on the Strait of Hormuz, the narrow waterway through which roughly 20 percent of the world’s oil and significant LNG volumes pass.

Shipping traffic through the strait has slowed dramatically.

The UK Maritime Trade Operations Centre reported that two vessels had been struck and that an “unknown projectile” exploded “in very close proximity” to a third. At least 150 tankers have reportedly dropped anchor beyond the strait, while major shipping companies paused or rerouted sailings.

‘Meanwhile, no LNG vessels have transited the Strait of Hormuz since Saturday, effectively cutting off around 20 percent of global LNG supply. Although there is no formal blockade, tankers remain anchored due to heightened security and insurance risks, intensifying supply concerns,’ an email from the Independent Commodity Intelligence Services (ICIS) noted.

Analysts say the disruption threatens around 120 billion cubic meters per year of LNG supply from Qatar and the UAE, volumes that are comparable to the gas Europe has lost from Russia since 2021.

Others warned that prices could climb much higher if the standoff persists. Some estimates suggest Brent could approach or exceed US$100 per barrel in the event of a prolonged closure.

OPEC+ spare capacity is largely located in the Gulf and would be difficult to access if shipping remains constrained. On Sunday (March 1), OPEC+ agreed to increase output by 206,000 barrels per day starting next month in an effort to cushion price rises.

However, any additional barrels would still need to transit through the region.

Gold, often viewed as a safe-haven asset during geopolitical turmoil, also rose by around 2 percent to US$5,378 per ounce.

Much now depends on whether energy infrastructure continues to be targeted and how long shipping disruptions persist.

“The jump in prices will feed through almost immediately because the oil traders are very much following the news too,” Robin Mills, chief executive of consultancy Qamar Energy, told BBC.

“At the moment, oil prices are not particularly high, they are still below where they were even two years ago so we’re not in full-blown oil crisis mode yet.”

The trajectory of prices, analysts say, will hinge on how much supply is ultimately disrupted, how long any other form of disruption lasts, and whether traffic through one of the world’s most critical energy chokepoints resumes in the coming days.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Israeli racecar driver Alon Day was in Florida getting ready to compete in the CUBE 3 Architecture Trans Am 2 Series when the U.S. and Israel launched airstrikes in Iran in a joint offensive on Saturday.

The former NASCAR driver had a lot on his mind, thinking of his family back home as Iran launched retaliatory action against countries that have U.S. military bases in them.

‘It’s kind of a tricky situation. I’m here racing in the United States and at the same moment, my wife, my kid and everybody is in Israel,’ he told Fox News Digital. ‘It’s so complicated to think about everything. And now, when I’m a fresh dad, I want to be there. I want to be there with my family and everything. It’s extremely nervous to be here. My phone is always ringing with alarms of the ballistic missiles coming in Israel.

‘It’s a bit tough. I’m here on a mission and I’m very happy that I have the opportunity to actually race here in the United States.’

The joint airstrikes were launched on Saturday, hitting several military and nuclear facilities. The Israel Defense Forces said Sunday morning it has launched strikes in the ‘heart of Tehran,’ hitting targets that belong to the Iranian terror regime. One of the strikes left Ali Khamenei dead.

Day expressed hope that the military operations will be able to bring stability to the Middle East.

‘Probably, yeah,’ he told Fox News Digital when asked about whether he thought the region would be more peaceful. ‘I’m getting so many messages from random Iranian people, saying ‘Thank you Israel, thank you United States. We are going through a different kind of era right now.’ Something is changing. We cannot even think about what the implication of losing the war will be. If the Iranian people lose this war, they’re going to have a really bad time with the Iranian regime.

‘I feel like this is a good opportunity. But I’m not a politician. I’m not a military guy. I’m just a racecar driver. I’m on a mission and the mission is to win races as much as possible for JSSI and to bring the Israel flag here and to show how great allies Israel and the United States are together.’

Day, who has spent time on NASCAR’s Cup Series and O’Reilly Auto Parts Series circuits, said he had no plans to scrap his 2026 season.

‘Listen, I was born in 1991 – the Gulf War. I’ve been through the Intifada, Hamas, Hezbollah, everything,’ he explained. ‘Every person in Israel grew up into this, those kind of war situations. It’s very sad to say that, but we’re kind of used to that and we need to live with that.

‘And it is what it is. I think now, specifically now, it’s for a good reason.’

Day praised the U.S. and Israeli militaries for their actions.

‘I want to take this opportunity also to thank the U.S. military forces and the Israel military forces for what they’re doing to keep us safe and for a better future fighting against evilness.

‘I think everything is for a bright future in front of us. I really want to take the opportunity and thank everybody, every person who is fighting against the Iranian regime. It is for a good reason, so I want to really thank them.’

Follow Fox News Digital’s sports coverage on X and subscribe to the Fox News Sports Huddle newsletter.

The U.S. Embassy in Baghdad on Monday urged Americans in Iraq to shelter in place until further notice, citing heightened security threats across the country.

In an alert, the embassy advised U.S. citizens to exercise increased caution, avoid crowds and keep a low profile amid ongoing riots and demonstrations against the United States following the death of Supreme Leader Ayatollah Ali Khamenei.

It said protests, particularly near the July 14th Bridge in Baghdad, have turned violent, prompting Iraqi authorities to close the International Zone in central Baghdad with limited exceptions.

The U.S. Mission in Iraq also directed all staff to shelter in place and suspended consular operations, including routine services.

Iraqi airspace is currently closed, officials said, and travelers were advised to contact airlines directly for updates.

The State Department maintains a Level 4 ‘Do Not Travel’ advisory for Iraq, urging Americans not to travel to the country for any reason and advising those already there to review personal security plans and consider departing when conditions allow.

‘Iran-aligned terrorist militias continue to pose a significant threat to public safety,’ the U.S. embassy said in a post on X. ‘Reports of missiles, drones, and rockets in Iraqi airspace continue.’

The U.S. military presence in Iraq has shifted in recent years, with Iraqi officials announcing in January the formal handover of Al-Asad Air Base from U.S. forces to Iraqi control.

The country’s defense ministry described the move as part of a broader transition toward long-term security cooperation with the United States, Britain, France, Italy, Spain and other countries, focused on training and advisory support.

Iraqi officials said international coalition forces are scheduled to withdraw from their headquarters in Erbil by the end of September 2026 under agreed-upon timelines.

iPhone 17e delivers incredible value with faster performance, an advanced camera system, enhanced durability, the magic of MagSafe, and double the starting storage at 256GB

Apple® today announced iPhone® 17e, a powerful and more affordable addition to the iPhone 17 lineup. At the heart of iPhone 17e is the latest-generation A19, which delivers exceptional performance for everything users do. iPhone 17e also features C1X, the latest-generation cellular modem designed by Apple, which is up to 2x faster than C1 in iPhone 16e. The 48MP Fusion camera captures stunning photos, including next-generation portraits, and 4K Dolby Vision video. It also enables an optical-quality 2x Telephoto — like having two cameras in one. The 6.1-inch Super Retina XDR® display features Ceramic Shield® 2, offering 3x better scratch resistance than the previous generation and reduced glare. 1 With MagSafe®, users can enjoy fast wireless charging and access to a vast ecosystem of accessories like chargers and cases. And when iPhone 17e users are outside of cellular and Wi-Fi coverage, Apple’s groundbreaking satellite features — including Emergency SOS, Roadside Assistance, Messages, and Find My® via satellite — help them stay connected when it matters most. 2

Available in three elegant colors with a premium matte finish — black, white, and a beautiful new soft pink — iPhone 17e will be available for pre-order beginning Wednesday, March 4, with availability starting Wednesday, March 11. iPhone 17e will start at 256GB of storage for $599 — 2x the entry storage from the previous generation at the same starting price, and 4x more than iPhone 12 — giving users more space for high-resolution photos, 4K videos, apps, games, and more.

‘iPhone 17e combines powerful performance and features our users love at an exceptional value, making it a compelling option for customers looking to upgrade to the iPhone 17 family,’ said Kaiann Drance, Apple’s vice president of Worldwide iPhone Product Marketing. ‘We know our customers want a product that will last, and iPhone 17e delivers just that. With A19 for incredible performance, double the entry storage, a smarter camera system, and enhanced durability, iPhone 17e is designed to stay fast, secure, and valuable for years to come.’

A Beautiful Design with Enhanced Durability

iPhone holds its value longer than other smartphones, 3 and iPhone 17e is built to last. It features a strong yet lightweight aerospace-grade aluminum design, and is splash, water, and dust resistant with an IP68 rating. 4 The Ceramic Shield 2 front cover — featured across the iPhone 17 family — is tougher than any smartphone glass, and an Apple-designed coating provides 3x better scratch resistance than the previous generation as well as improved anti-reflection to reduce glare.

The Super Retina XDR display with OLED technology delivers a fantastic viewing experience whether a user is streaming videos in Dolby Vision or playing games, and with up to 1200 nits peak HDR brightness, it is easy to view content on brighter days. Face ID® provides a seamless and secure way to unlock iPhone 17e, authenticate purchases, sign in to apps, and more. With the Action button, users can access their favorite features — like the flashlight, visual intelligence, and more — with just a press.

Powerful Performance and Exceptional Efficiency

iPhone 17e features the latest-generation A19 built with advanced 3-nanometer technology, delivering powerful performance. The faster, more efficient 6-core CPU — up to 2x faster than iPhone 11 — handles everything from simple tasks like scrolling through photos to advanced Apple Intelligence capabilities like Clean Up. The 4-core GPU with Neural Accelerators unlocks console-level gaming on the go, supporting demanding AAA titles and hardware-accelerated ray tracing for more realistic lighting and reflections. The upgraded 16-core Neural Engine is optimized for large generative models and, combined with Neural Accelerators built into each GPU, enables Apple Intelligence and other AI models to run faster than on the previous generation.

capabilities like Clean Up. The 4-core GPU with Neural Accelerators unlocks console-level gaming on the go, supporting demanding AAA titles and hardware-accelerated ray tracing for more realistic lighting and reflections. The upgraded 16-core Neural Engine is optimized for large generative models and, combined with Neural Accelerators built into each GPU, enables Apple Intelligence and other AI models to run faster than on the previous generation.

iPhone 17e also features C1X, the latest-generation cellular modem designed by Apple. C1X is up to 2x faster than C1 in iPhone 16e and matches the speed of iPhone Air . C1X uses 30 percent less energy than the modem in iPhone 16 Pro, contributing to the exceptional all-day battery life.

. C1X uses 30 percent less energy than the modem in iPhone 16 Pro, contributing to the exceptional all-day battery life.

Excellent Battery Life, Fast Charging, and MagSafe

iPhone 17e delivers exceptional all-day battery life, enabled by the efficiencies of Apple silicon, including the C1X cellular modem, and the advanced power management of iOS 26. With fast wired charging using USB-C, iPhone 17e can charge up to 50 percent in around 30 minutes. 5 iPhone 17e also supports MagSafe and Qi2 for fast wireless charging up to 15W compared to 7.5W Qi wireless charging on iPhone 16e. MagSafe chargers, stands, cases, wallets, camera accessories, and more snap easily to the back of iPhone 17e, providing seamless alignment with a wide ecosystem of accessories.

An Advanced Camera System to Capture Everyday Moments

iPhone 17e takes gorgeous photos with excellent detail, including in low light with Night mode. The 48MP Fusion camera enables an optical-quality 2x Telephoto, giving users two cameras in one so they can get closer to the subject and easily frame their shot. Users can shoot sharp photos at up to 48MP resolution, or capture in the 24MP default for incredible image quality at a file size perfect for storing and sharing. Portrait mode improves thanks to an advanced image pipeline, delivering remarkably natural depth and smooth bokeh that gracefully blurs the background while keeping subjects sharp. The advanced pipeline also enables next-generation portraits, so iPhone 17e recognizes people, dogs, and cats, and automatically saves depth information, allowing users to turn photos into beautiful portraits with background blur after capture and to adjust the focus point in the Photos app. The latest generation of HDR captures subjects with true-to-life renderings of skin tones and ensures bright highlights, rich midtones, and deep shadows across the image — all while preserving fine details.

iPhone 17e takes stunning videos with the ability to record in 4K with Dolby Vision up to 60 fps. iPhone 17e also records video in Spatial Audio for immersive listening with AirPods® or Apple Vision Pro®, and enables more ways to edit video sound with Audio Mix. With wind noise reduction, powerful machine learning algorithms automatically reduce unwanted noise for better audio quality.

Groundbreaking Safety and Communication Capabilities

iPhone 17e helps users stay connected and get assistance when it matters most. When outside of cellular and Wi-Fi coverage, users can text friends and family with Messages via satellite; connect with emergency services using Emergency SOS via satellite; and reach roadside assistance providers with Roadside Assistance via satellite. The Find My app lets users share their location via satellite, reassuring friends and family of their whereabouts while traveling off the grid. Crash Detection can detect a severe car accident and automatically dial emergency services if a user is unconscious or unable to reach their iPhone. 6

iOS 26 and Apple Intelligence

iPhone 17e comes with iOS 26 , delivering a beautiful new design, powerful Apple Intelligence capabilities, and meaningful improvements to the apps users rely on every day. 7 The new design with Liquid Glass makes apps and system experiences more expressive and delightful, bringing greater focus to content while keeping iOS instantly familiar and introducing even more ways to personalize iPhone. Apple Intelligence allows users to communicate across languages with Live Translation in Messages, FaceTime®, Phone, and with AirPods. 8 Visual intelligence now extends to a user’s iPhone screen, letting them search, ask questions, and take action on the content they’re viewing. 9 To help users eliminate distractions, Call Screening can screen calls from unknown numbers and automatically ask the reason for calling, while Hold Assist can hold on the line until a live agent is available. 10 In Messages, users can now choose to screen messages from unknown senders by filtering them to a dedicated folder so they don’t clutter up the conversation list.

iPhone 17e and the Environment

Apple 2030 is the company’s ambitious plan to be carbon neutral across its entire footprint by the end of this decade by reducing product emissions from their three biggest sources: materials, electricity, and transportation. iPhone 17e is made with 30 percent recycled content, 11 including 85 percent recycled aluminum in the enclosure and 100 percent recycled cobalt in the battery. It is manufactured with 55 percent renewable electricity, like wind and solar, across the supply chain. iPhone 17e is designed to be durable, repairable, and also offers industry-leading software support, while meeting Apple’s high standards for energy efficiency and safe chemistry. The paper packaging is 100 percent fiber-based and can be easily recycled. 12

Pricing and Availability

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today, Apple leads the world in innovation with iPhone, iPad, Mac, AirPods, Apple Watch, and Apple Vision Pro. Apple’s six software platforms — iOS, iPadOS, macOS, watchOS, visionOS, and tvOS — provide seamless experiences across all Apple devices and empower people with breakthrough services including the App Store, Apple Music, Apple Pay, iCloud, and Apple TV. Apple’s more than 150,000 employees are dedicated to making the best products on earth and to leaving the world better than we found it.

1 The display has rounded corners that follow a beautiful curved design, and these corners are within a standard rectangle. When measured as a standard rectangular shape, the screen is 6.06 inches diagonally. The actual viewable area is smaller.

2 Apple’s satellite features are included for free for two years starting at the time of activation of a new iPhone 14 or later, and are not available in all markets. For Emergency SOS via satellite availability, visit support.apple.com/en-us/HT213426 . For Messages via satellite availability, visit support.apple.com/en-us/120930 . For Roadside Assistance via satellite availability, visit support.apple.com/en-us/105098 . Apple’s satellite features were designed for use in open spaces with a clear line of sight to the sky. Performance may be impacted by obstructions such as trees or surrounding buildings.

3 Based on data from FDM | CCS Insight from 2023 to mid-2025, comparing average trade-in price of working-condition smartphones from major brands in key markets.

4 iPhone 17e is splash-, water-, and dust-resistant. It was tested under controlled laboratory conditions and has a rating of IP68 under IEC standard 60529 (maximum depth of 6 meters for up to 30 minutes). Splash, water, and dust resistance are not permanent conditions. Resistance might decrease as a result of normal wear. Do not attempt to charge a wet iPhone; refer to the user guide for cleaning and drying instructions. Liquid damage is not covered under warranty.

5 A 20W or higher power adapter is required to fast-charge iPhone 17e.

6 Crash Detection is designed for four-wheel passenger vehicle crashes with certain mass, G-force, and speed profiles consistent with severe, life-threatening crashes. It was designed for severe, life-threatening, high-impact front and rear, side-swipe, T-bone, and rollover crashes. Crash Detection is available worldwide on iPhone 14 or later, Apple Watch® Series 8 or later, Apple Watch SE®, and Apple Watch Ultra® or later.

7 Features are subject to change. Some features, applications, and services may not be available in all regions or all languages. For more information on iOS 26, visit apple.com/os/ios .

8 Live Translation in Messages supports English (U.S., UK), Dutch, French (France), German, Italian, Japanese, Korean, Portuguese (Brazil), Spanish (Spain), Chinese (simplified), Chinese (traditional), Turkish, and Vietnamese. Live Translation in Phone, FaceTime, and with AirPods supports English (U.S., UK), French (France), German, Italian, Japanese, Korean, Portuguese (Brazil), Spanish (Spain), Chinese (Mandarin, simplified), and Chinese (Mandarin, traditional). Live Translation with AirPods works on AirPods 4 with Active Noise Cancellation or AirPods Pro 2 and later with the latest firmware when paired with an Apple Intelligence-enabled iPhone.

9 Visual intelligence is available on any Apple Intelligence-enabled iPhone. Some capabilities may not be available in all languages and regions. For more details, see support.apple.com/en-us/121115#visual-intelligence .

10 Call Screening supports Cantonese (China mainland, Hong Kong, Macao), English (U.S., Australia, Canada, India, Ireland, New Zealand, Puerto Rico, Singapore, South Africa, UK), French (Canada, France), German (Germany), Japanese (Japan), Korean (Korea), Mandarin Chinese (China mainland, Taiwan, Macao), Portuguese (Brazil), and Spanish (U.S., Mexico, Puerto Rico, Spain). Hold Assist supports English (U.S., Australia, Canada, India, Singapore, UK), French (France), Spanish (U.S., Mexico, Spain), German (Germany), Portuguese (Brazil), Japanese (Japan), and Mandarin Chinese (China mainland).

11 Product recycled or renewable content is the mass of certified recycled material relative to the overall mass of the device, not including packaging or in-box accessories.

12 Breakdown of U.S. retail packaging by weight. Adhesives, inks, and coatings are excluded from Apple’s calculations.

13 Customers in the U.S. who shop at Apple using Apple Card® can pay monthly at 0 percent APR when they choose to check out with Apple Card Monthly Installments, and they’ll get 3 percent Daily Cash® back — all up front. More information — including details on eligibility, exclusions, and Apple Card terms — is available at apple.com/apple-card/monthly-installments .

NOTE TO EDITORS: For additional information visit Apple Newsroom ( www.apple.com/newsroom ), or email Apple’s Media Helpline at media.help@apple.com .

© 2026 Apple Inc. All rights reserved. Apple, the Apple logo, iPhone, Super Retina XDR, Ceramic Shield, MagSafe, Find My, Face ID, Apple Intelligence, iPhone Air, AirPods, Apple Vision Pro, FaceTime, Apple Store, Apple Trade In, AppleCare, AppleCare+, AppleCare One, iCloud+, Apple Invites, HomeKit, Apple Arcade, Apple Fitness+, Apple Music, Apple News+, Apple TV, Apple Watch, Apple Watch SE, Apple Watch Ultra, Apple Card, and Daily Cash are trademarks of Apple. iOS is a trademark or registered trademark of Cisco and is used under license. Other company and product names may be trademarks of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260302227994/en/

Press Contacts:

Blair Ranger

Apple

blair_ranger@apple.com

Stephanie Ng

Apple

sng26@apple.com

News Provided by Business Wire via QuoteMedia

With blazing performance, more memory, enhanced connectivity, and game-changing iPadOS 26 features, iPad Air is a fantastic value

Apple® today announced the new iPad Air® featuring M4 and more memory, giving users a big jump in performance at the same starting price. With a faster CPU and GPU, iPad Air boosts tasks like editing and gaming, and is a powerful device for AI with a faster Neural Engine, higher memory bandwidth, and 50 percent more unified system memory than the previous generation. With M4, iPad Air is up to 30 percent faster than iPad Air with M3, 1 and up to 2.3x faster than iPad Air with M1. 2 The new iPad Air also features the latest in Apple silicon connectivity chips, N1 and C1X, delivering fast wireless and cellular connections — and support for Wi-Fi 7 — that empower users to work and be creative anywhere. 3 Available in two sizes and four gorgeous finishes that users love, the 11-inch iPad Air is super portable, and the 13-inch model provides an even larger display for those who want more space to multitask. With game-changing iPadOS® 26 capabilities, advanced cameras, all-day battery life, a powerful app ecosystem, and support for accessories like Apple Pencil Pro® and Magic Keyboard®, iPad Air delivers a remarkable and versatile experience for anyone who wants to do more on iPad®, from students and creators, to business users and gamers. 4

With the same starting price of just $599 for the 11-inch model and $799 for the 13-inch model, the new iPad Air is an incredible value. And for education, the 11-inch iPad Air starts at $549, and the 13-inch model starts at $749. Customers can pre-order iPad Air starting Wednesday, March 4, with availability beginning Wednesday, March 11.

‘iPad Air gives users more ways than ever to be creative and productive, offering powerful performance and incredible versatility to help them turn their ideas into reality,’ said Bob Borchers, Apple’s vice president of Worldwide Product Marketing. ‘With its blazing performance thanks to M4, incredible AI capabilities, and game-changing iPadOS 26 features, there’s never been a better time to choose or upgrade to iPad Air.’

Even More Performance with M4

M4 brings a significant boost in performance to the new iPad Air, empowering users to be productive and creative wherever they are — from aspiring creatives working with large files to travelers editing content on the go. Featuring an 8-core CPU and a 9-core GPU, iPad Air is up to 30 percent faster than iPad Air with M3 and up to 2.3x faster than iPad Air with M1. 5 Users will notice the blazing speed of M4 in everything they do — with Apple Creator Studio , compositing photos in Pixelmator Pro® or editing video in Final Cut Pro® is quicker than ever. With the 9-core GPU of M4, iPad Air supports second-generation hardware-accelerated mesh shading and ray tracing for incredible graphics performance. M4 delivers over 4x faster 3D pro rendering with ray tracing performance compared to iPad Air with M1, offering more accurate lighting, reflections, and shadows for extremely realistic gaming experiences. 2

, compositing photos in Pixelmator Pro® or editing video in Final Cut Pro® is quicker than ever. With the 9-core GPU of M4, iPad Air supports second-generation hardware-accelerated mesh shading and ray tracing for incredible graphics performance. M4 delivers over 4x faster 3D pro rendering with ray tracing performance compared to iPad Air with M1, offering more accurate lighting, reflections, and shadows for extremely realistic gaming experiences. 2

Next-Level Power for AI

M4 is also powerful for AI, with faster memory bandwidth and an incredibly fast Neural Engine — benefiting everyone from college students transcribing lecture notes, to creators storyboarding a new project, to business users polishing emails. With the new iPad Air, unified memory jumps 50 percent, to 12GB, and memory bandwidth increases to 120GB/s, helping users run AI models faster. The 16-core Neural Engine is 3x faster than that of M1 and is perfect for everyday tasks that use on-device AI, like searching for subjects and texts in photos, or leveraging powerful AI features in apps like Goodnotes and Onform: Video Analysis App. 2 The Neural Engine also powers capabilities in Apple Creator Studio apps, like removing the background of video footage with Scene Removal Mask in Final Cut Pro.

N1 and C1X Come to iPad Air for Faster Connectivity

iPad Air features N1, an Apple-designed wireless networking chip that enables Wi-Fi 7, Bluetooth 6, and Thread. 3 N1 brings better performance when connected to 5GHz Wi-Fi networks, and improves the overall performance and reliability of features like Personal Hotspot and AirDrop®. Cellular models of iPad Air also feature C1X, a cellular modem designed by Apple that offers up to 50 percent faster cellular data performance — and for active cellular users, C1X offers up to 30 percent less modem energy usage than iPad Air with M3. 1 Cellular models of iPad Air allow users to enjoy GPS capabilities, so they can navigate with even more confidence. Users can also enjoy 5G cellular support, helping them stay connected for work or leisure all around the world. 6 And with eSIM, users can quickly and securely add a new plan, connect and transfer existing cellular plans digitally, and stay in touch with family and friends regardless of Wi-Fi availability — ideal for business travelers, students on campus, and anyone working on the go.

iPadOS 26 Supercharges the iPad Experience

iPadOS 26 offers powerful features that help users handle creative and professional tasks with ease, pushing the capabilities of iPad even further.

Advanced Accessories for iPad Air

From sketching ideas to getting work done, Apple Pencil and Magic Keyboard unlock new levels of creativity and productivity on iPad Air. 4 Apple Pencil (USB-C) and Apple Pencil Pro offer users two incredible options. Apple Pencil (USB-C) is a great value for essential tasks like note taking and sketching, and Apple Pencil Pro delivers the ultimate experience, enabling users to take advantage of capabilities such as squeeze and barrel roll to bring their ideas to life in entirely new ways. Apple Pencil Pro also supports Find My®, helping users locate it if misplaced.

Magic Keyboard for iPad Air provides an amazing typing experience and expands what users can do, with a built-in trackpad ideal for precision tasks like selecting text, and a 14-key function row that allows easy access to features like screen brightness and volume controls. It attaches magnetically, and the Smart Connector® immediately connects power and data without the need for Bluetooth; a machined aluminum hinge also includes a USB-C connector for charging. Magic Keyboard for iPad Air has a magical floating design customers love, and comes in black and white.

Ideal for iPad and iPad Air Upgraders

With game-changing improvements over iPad and earlier iPad Air models, there’s never been a better time to upgrade.

Big performance gains: Upgraders will enjoy enhanced speed and responsiveness with 12GB of unified memory and 120GB/s of memory bandwidth, and will experience even more seamless windowing in iPadOS 26. Users coming from iPad Air with M1 will see up to 2.3x faster performance, with over 4x faster 3D pro rendering with ray tracing performance. 5

Advanced Center Stage® camera, mics, and speakers: Users coming from iPad Air with M1 will also enjoy a front 12MP Center Stage camera located along the landscape edge, as well as landscape stereo speakers. For upgraders coming from M1, the 13-inch model delivers even better sound quality, which is great for enjoying music and videos.

Powerful Apple Intelligence capabilities: Built seamlessly into iPadOS with groundbreaking privacy, Apple Intelligence provides upgraders and new iPad users with intuitive features that make their experience even more helpful and powerful. 7

capabilities: Built seamlessly into iPadOS with groundbreaking privacy, Apple Intelligence provides upgraders and new iPad users with intuitive features that make their experience even more helpful and powerful. 7

Even more value: Users coming from previous-generation iPad Air models will get faster connectivity with N1 and C1X, and M1 upgraders will also get 128GB of starting storage. iPad Air with M4 has the same starting price at just $599 for the 11-inch model, and $799 for the 13-inch model.

iPad Air and the Environment

Apple 2030 is the company’s ambitious plan to be carbon neutral across its entire footprint by the end of this decade by reducing product emissions from their three biggest sources: materials, electricity, and transportation. iPad Air is made with 30 percent recycled content, 8 including 100 percent recycled aluminum in the enclosure and 100 percent recycled cobalt in the battery. It is manufactured with 40 percent renewable electricity, like wind and solar, across the supply chain. iPad Air is designed to be durable and repairable, and also offers industry-leading software support, while meeting Apple’s high standards for energy efficiency and safe chemistry. The paper packaging is 100 percent fiber-based and can be easily recycled. 9

Pricing and Availability

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today, Apple leads the world in innovation with iPhone, iPad, Mac, AirPods, Apple Watch, and Apple Vision Pro. Apple’s six software platforms — iOS, iPadOS, macOS, watchOS, visionOS, and tvOS — provide seamless experiences across all Apple devices and empower people with breakthrough services including the App Store, Apple Music, Apple Pay, iCloud, and Apple TV. Apple’s more than 150,000 employees are dedicated to making the best products on earth and to leaving the world better than we found it.

1 Results are compared to 13-inch iPad Air (M3) units with 8-core CPU and 8GB of unified memory.

2 Results are compared to iPad Air (5th generation) units with 8-core CPU and 8GB of unified memory.

3 Wi-Fi 7 is available in countries and regions where supported.

4 Accessories sold separately.

5 Testing was conducted by Apple in January and February 2026. See apple.com/ipad-air for more information.

6 Data plan is required. 5G is available in select markets and through select carriers. Speeds vary based on site conditions and carrier. For details on 5G support, contact carrier and see apple.com/ipad/cellular .

7 Apple Intelligence is available in beta with support for these languages: English, Danish, Dutch, French, German, Italian, Norwegian, Portuguese, Spanish, Swedish, Turkish, Vietnamese, Chinese (simplified), Chinese (traditional), Japanese, and Korean. Some features may not be available in all regions or languages. For feature and language availability and system requirements, see support.apple.com/en-us/121115 .

8 Product recycled or renewable content is the mass of certified recycled material relative to the overall mass of the device, not including packaging or in-box accessories.

9 Breakdown of U.S. retail packaging by weight. Adhesives, inks, and coatings are excluded from Apple’s calculations.

NOTE TO EDITORS: For additional information visit Apple Newsroom ( www.apple.com/newsroom ), or email Apple’s Media Helpline at media.help@apple.com .

© 2026 Apple Inc. All rights reserved. Apple, the Apple logo, iPad Air, iPadOS, Apple Pencil Pro, Magic Keyboard, iPad, Apple Creator Studio, Pixelmator Pro, Final Cut Pro, AirDrop, Apple Pencil, Find My, Smart Connector, Apple Intelligence, Apple Store, AppleCare, AppleCare+, Apple Care One, Apple Card, and Daily Cash are trademarks of Apple. Other company and product names may be trademarks of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260302883514/en/

Press Contacts:

Skylar Eisenhart

Apple

s_eisenhart@apple.com

Tara Courtney

Apple

tcourtney@apple.com

News Provided by Business Wire via QuoteMedia